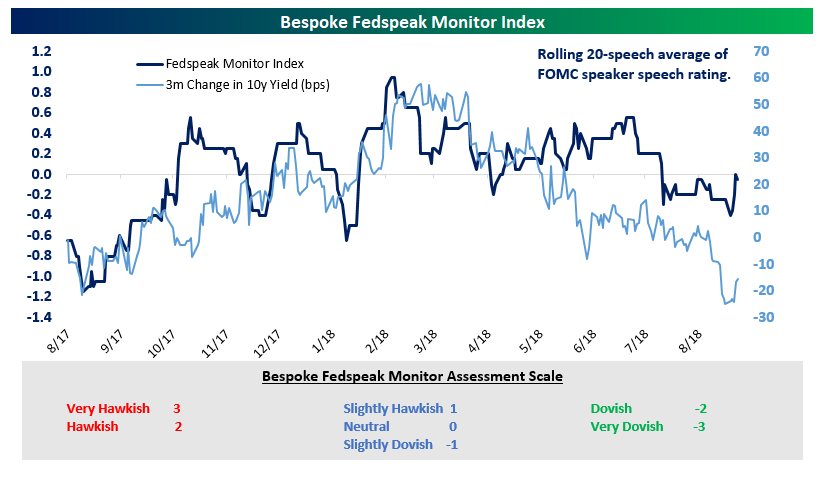

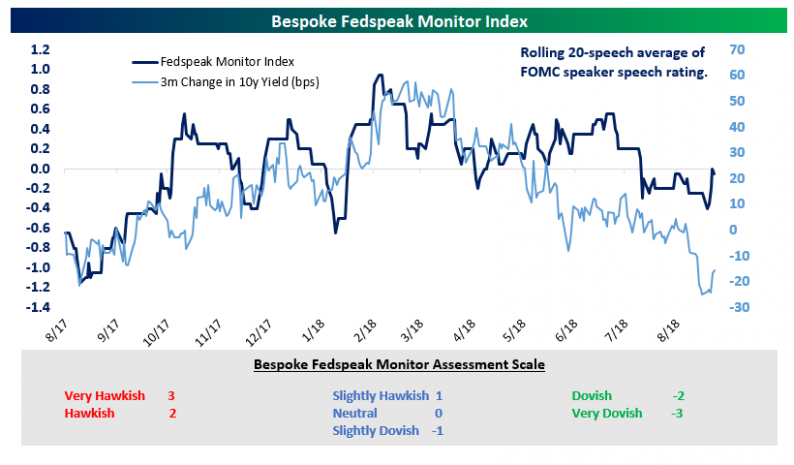

The Fed is currently engaged in an internal discussion about what to do once interest rates reach “neutral”; that is, the rate at which the economy is neither accelerated nor braked by the overnight interest rate. Where that “neutral” rate lies is part of the debate, but the market has basically priced an end to the current hiking cycle and the start of a cutting cycle in about 18 months to 2 years. As that conversation has evolved, the FOMC has shifted into more dovish territory after speaking relatively hawkishly from late April to late June.

We keep track of what the Fed is saying with regular updates to our Fedspeak Monitor, a running summary of what FOMC members say publicly. This is a qualitative assessment, so of course, it might differ somewhat from others’ views on how hawkish or dovish a given speech is. Using each speech’s rating, we can keep track over time how hawkish or dovish the FOMC is. The result is shown in the chart below, which tends to track the 3-month change in the 10-year yield pretty well over time.

Leave A Comment