The stock market turbulence in recent days has rattled investors, but the Federal Reserve remains on track to lift interest rates at the March policy meeting, according to this morning’s implied forecast via Fed fund futures.

The probability of a rate hike is 69%, according to CME data in early trading on Wednesday (Feb. 7). That’s down from the 77% estimate a week ago, which indicates that the crowd’s confidence that another round of policy tightening is near has declined, but only modestly.

The surge in stock market volatility has raised new questions about the economic outlook, but the general view that the Fed is committed to raise rates remains intact, according to some analysts.

“I don’t think what we have seen would change their view on their path of rate hikes,” says Daragh Maher, US head of FX strategy at HSBC Securities USA in New York.

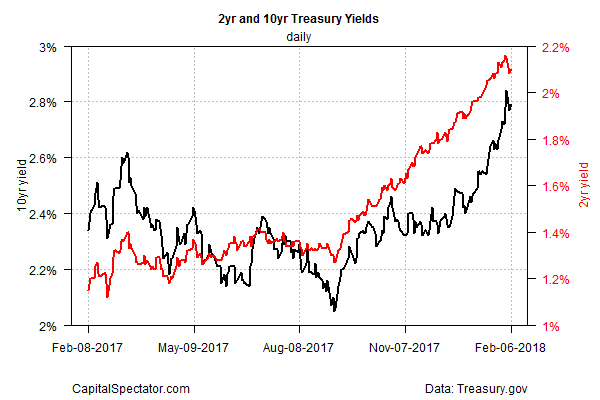

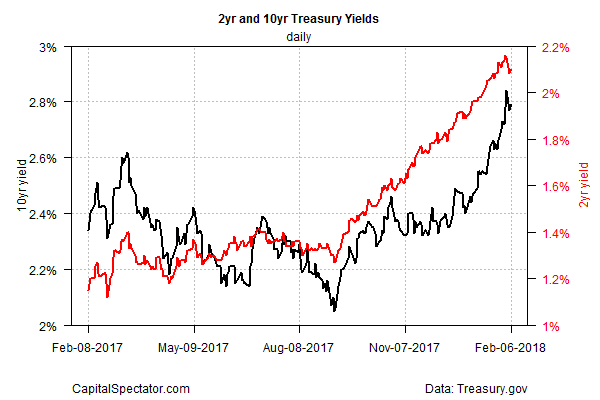

The policy sensitive 2-year Treasury yield, which is widely followed as a proxy for rate expectations, has pulled back slightly this week to 2.10% on Tuesday (Feb. 6) after reaching 2.16% last week, the highest level since 2008, based on data published at Treasury.gov.

The Treasury market’s implied inflation forecasts have also dipped in recent trading sessions after a lengthy stretch of trending higher. The yield spread for the nominal 10-year yield less its inflation-indexed counterpart dipped to 2.10% yesterday. But that’s still close to last week’s 2.14%, the highest since mid-2014.

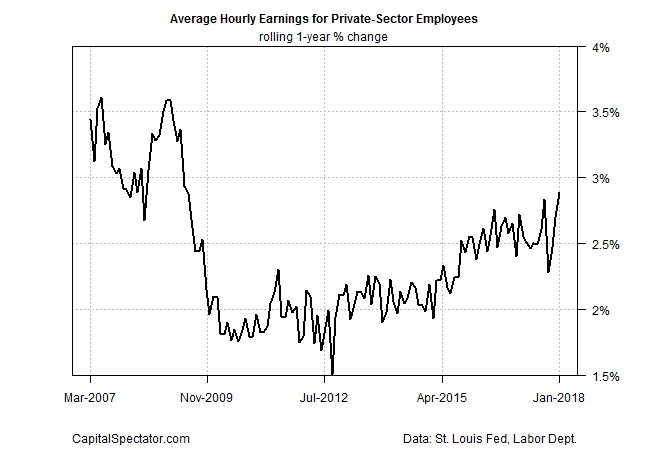

Last week’s employment report, which revealed a surprisingly strong uptick in wage growth, sparked concerns that inflation was finally heating up after remaining tepid for years following the Great Recession in 2008-2009. Average hourly earnings for private-sector employees increased 2.9% in January – the fastest pace since the recession ended.

The firmer trend in wage growth has been widely interpreted as a sign that inflation will heat up in the months ahead, although St. Louis Fed President James Bullard downplayed that outlook in a speech yesterday. “I caution against interpreting good news from labor markets as translating directly into higher inflation,” he said in excerpts of prepared remarks. “The empirical relationship between these variables has broken down in recent years and may be close to zero.”

Leave A Comment