With volatility oddly low, Goldman Sachs strikes a pose that is not too dissimilar to that of Bridgewater’s Ray Dalio, who said the dance with central banks and their negative interest rates and free market antics won’t end until cracks become apparent. In a July 5 portfolio strategy report, Goldman’s European-based analysts Ian Wright, Christian Mueller-Glissmann and Alessio Rizzi say ignore the crowds. In today’s low volatility market environment Europe in the summer is a great place… to invest.

The music for the low-volatility market environment might not stop for another year

The music for this low volatility dance has not yet stopped and could, in the estimation of Goldman Sachs, warrant a one-year time horizon on an investment that benefits from such a market environment.

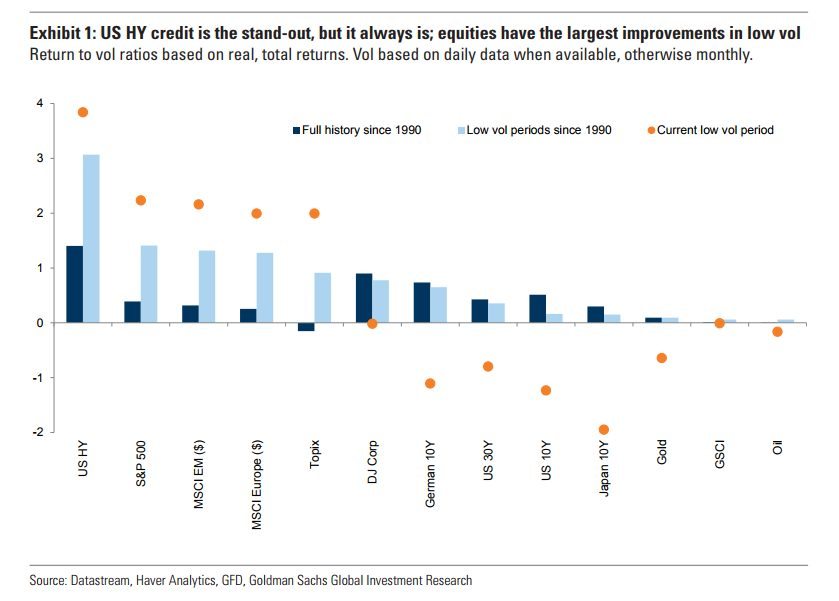

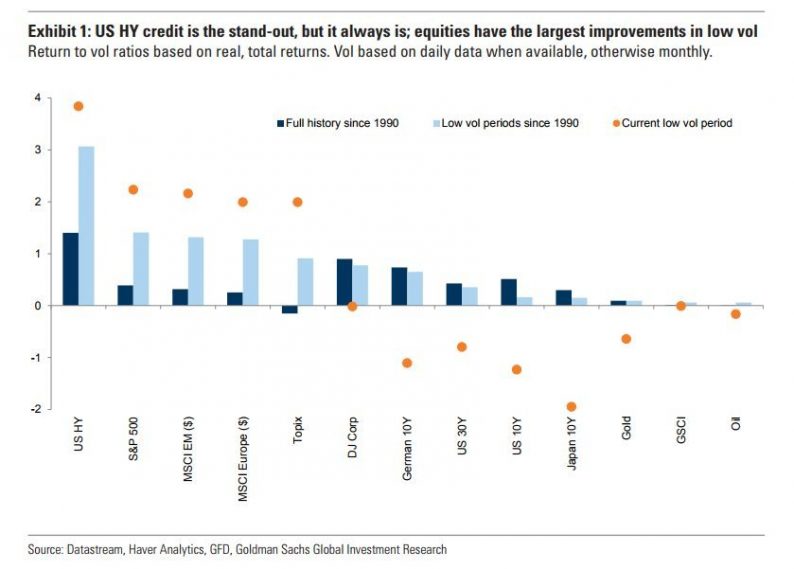

Typically, in a low-volatility market environment, both stocks and credit have been the assets to hold. This isn’t just on an absolute returns basis, but also when considering risk, which is most often measured by volatility of standard deviation to some degree.

But something is a little different during this volatility regime, Goldman’s analysts observe. Credit spreads have significantly tightened relative to the past. Separately, some algorithmic analysts point to low-volatility market environment post-2010 as being driven in large part by aggressive central bank bond buying that has brought interest to negative in some regions. For investments, the reach for high yield has most pointedly occurred during periods of low volatility.

High-yield US credit has typically been a favorite investment during low volatility, the report noted, pointing to statistical evidence dating back to 1990. During the current low-volatility market environment, high yield investments performed almost 1% higher than during the report’s near 27-year sample size look back. In fact, high yield has been on a relative performance sprint in 2017 year to date, outperforming the past average, but this strong early start is likely to mean revert, Goldman predicts.

Leave A Comment