With The Fed now on 24 hours a day jawboning expectations up for a rate-hike in December (which has suddenly spooked assets) and Fireworks Day (Guy Fawkes may have been on to something after all) across the pond, stocks, bonds, and commodities all leaked lower ahead of tomorrow’s “most important ever” payrolls…

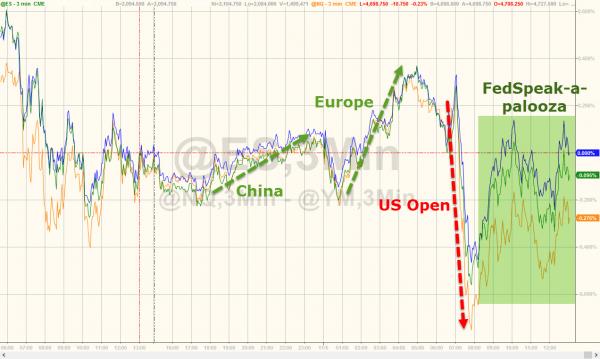

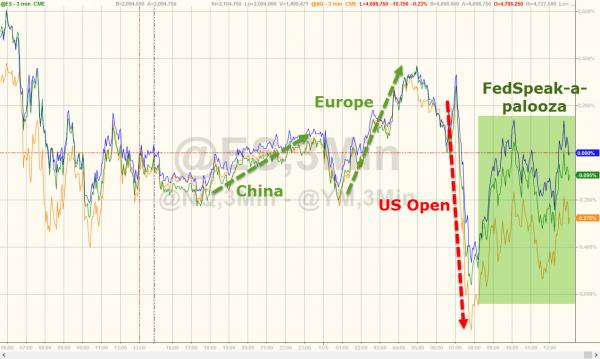

Stocks started the day off with the usual pre-open ramp.

With Trannies somehow outperforming today…

In spite of the collapse in crude…

S&P 2100 was once again all important… driven sending VXX to the low of the day…

Stocks were glued to USDJPY all day – especially after crude decoupled…

But there are 3 stocks worth noting before we leave the casino…

Valeant collapsed…

Herbalife ripped..

And Straight Path Communications…

Stocks started to catch down to credit…

And catching down to VIX (hedgers ahead of payrolls)…

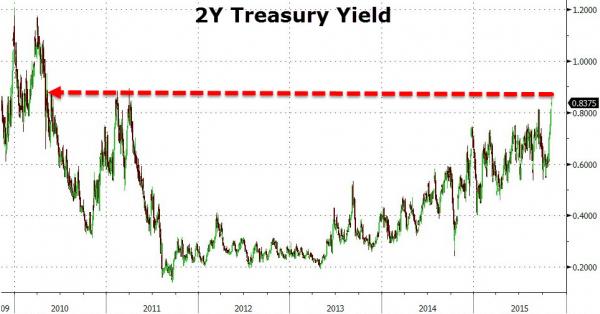

Treasury yields continued to rise today (with the short-end underperforming)…the buy-sell-buy pattern continues

Leaving 2Y Yields at their highest since May 2010…

The US Dollar was almost perfectly unchanged today against the majors (with modest strength in EUR offset by weakness in Cable)…

Commodities contonued to slide despite the lack of movement in the dollar…

With crude giving up all the post-FOMC gains…

Charts: Bloomberg

Bonus Chart: A Gentle Reminder from earlier of the rollover in payrolls ahead of tomorrow…

Leave A Comment