Bank of America Merrill Lynch is predicting an equity-rate convergence trade because of what it calls a trifecta of increasing U.S. treasury supply, declining demand and the need for pension and mutual funds to step up.

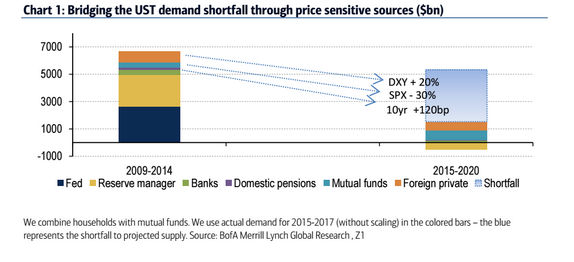

At the heart of the bank’s call is increased Treasury supply over the next five years – anywhere between $3 trillion and $4.5 trillion. “There are few things more certain right now than increased Treasury supply,” it asserted in its U.S. Rates Viewpoint newsletter.

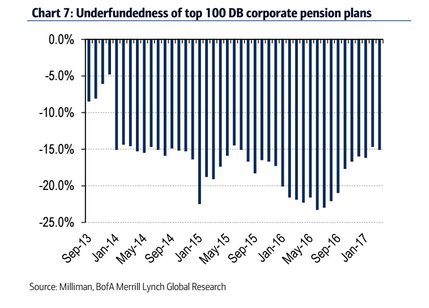

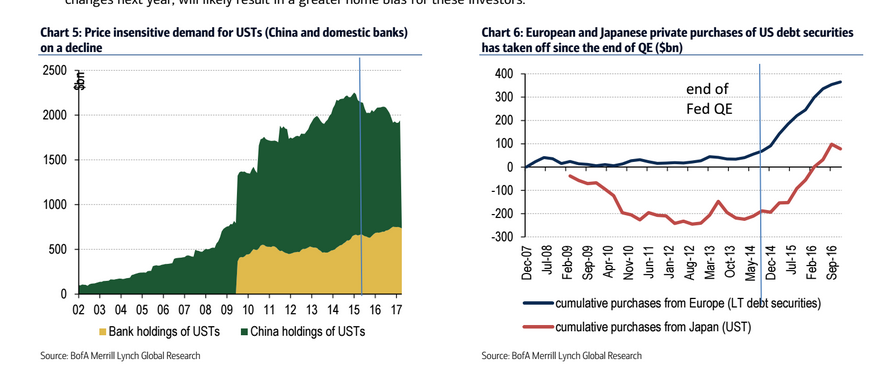

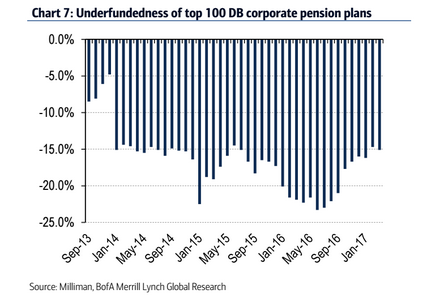

But unlike prior cycles, traditional and price insensitive sources of demand – reserves, domestic banks and Federal Reserve – cannot absorb the substantial increase in supply of UST. This means the duty of absorbing the increased supply will rest on value buyers such as foreign private investors, domestic pensions and fixed income mutual funds. In this equation, the foreign private community has faded on account of the end of quantitative easing by the European Central Bank and Bank of Japan, leaving an estimated $1trillion shortfall to be met by domestic pensions and mutual funds.

This trillion dollar mismatch in Treasury supply/demand dynamics over the next five years will likely trigger an equity-rate disconnect correction, Shyam S. Rajan, the bank’s rates strategist, asserted.

BAML factored baseline deficit projections, maturing debt, Fed run-offs, projected tax cuts and a likely recession to quantify the projected increase in Treasury supply. While current coupon auction sizes are just enough to cover baseline maturing debt and deficit projections for 2018, they begin to steeply fall starting 2019. Potential Fed portfolio run-offs and tax reform package in Congress could raise the shortfall to $800billion-$1 trillion a year starting as early as next year. Consequently, the U.S. Treasury will be underfinanced by a cumulative $3 trillion-$4.5 trillion over the next five years.

To fully fill this gap, the clearing level for rates would need to be nearly 120bp higher; and for mutual funds to have enough inflows to justify this demand, equities would have to be nearly 30% lower, the bank estimated.

Leave A Comment