Ysterday I covered the HYG/JNK proxy and the late fade post-FOMC. Same thing happened Thursday, as HYG plumed back below 80. Often times late day fades like this are caused by margin calls and fund outflows. The Genie seems out of the bottle.

In the latest week we saw $5.3bn in outflows from junk (HY) bond funds. This spread to IG funds as well with $3.3bn in outflows. $2.2bn outflows from EM debt funds (largest in 15 weeks) (outflows in 20 of 21 weeks). A $1.8bn outflows was seen from bank loan funds (largest in 12 months) (outflows in 19 of past 20 weeks).

The stock market gave up post-FOMC gains and then some. The following chart shows on-balance-volume (OBV). In layman terms this is a measure of true underlying demand. In the first half of this chart you can see OBV tracking prices in a relatively normal fashion. The main driver of this was corporate stock buybacks using cash flow and Ponzi priced debt.

Then prior to the market break last summer, OBV became unhinged from price. This was in effect a thin ice scenario and I think the result of the initial correction in HY.

Then we see the Hail Mary rallies of the last several months. OBV was overall poor. To me this suggests extreme manipulation and unnatural demand, most likely via futures from highly questionable sources (stooges (like the Fed and BoJ) of the Cabal). This is why “Black Mondays” are averted and hail Mary’s materialize “out of nowhere”. The healthier OBV seen earlier is dissipated because the funding debt is getting more expensive.

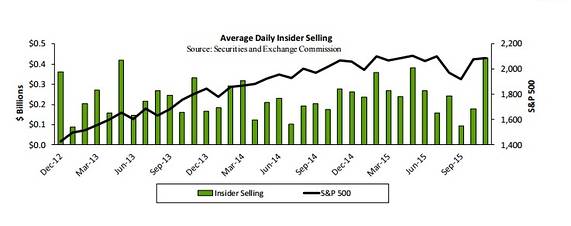

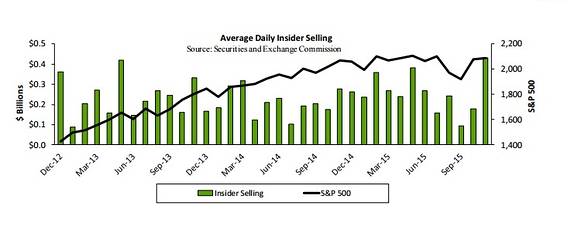

In addition corporate insiders are unloading their ill-got-gains at a fast clip. This reflects daily averages.

In a Ponzi based market and economy cheap fictitious capital for the worst kinds of credit is the key. Without that, all that’s left is leveraged manipulation and thin ice.

Is it my wild imagination or does that divergence look like a – – WTF!

Leave A Comment