TM editors’ note: This article discusses a penny stock and/or microcap. Such stocks are easily manipulated; do your own careful due diligence.

When a leading Swiss bank recommended its clients sell all their gold, AgaNola Asset Manager Florian Siegfried knew the precious metal was preparing for an upswing. In this interview with The Gold Report, he shares five junior mining names that have made smart moves during the down time and are well positioned for an upswing.

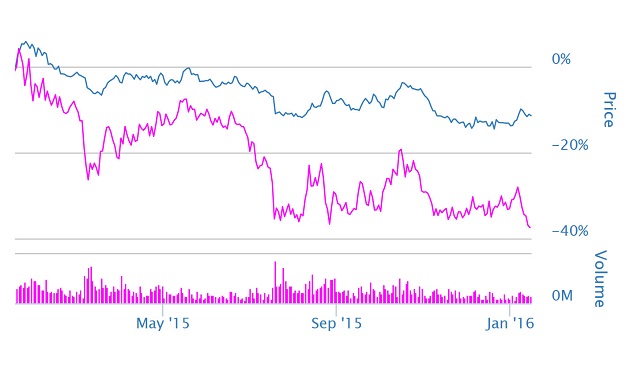

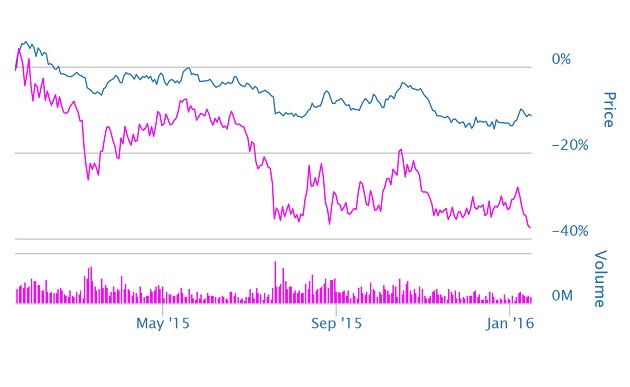

Market Vectors Junior Gold Miners ETF (magenta) and Gold Futures (blue) 1-Year Chart

The Gold Report: The year started off with quite a lot of volatility. From your perspective in Switzerland, what was the root cause of the stock decline? China, the Middle East, the United States?

Florian Siegfried: In our November 2014 interview, we outlined the notion that the cycling credit markets were undergoing a profound change where typically we see spreads going into widening. That climaxed in December of last year when we experienced a dramatic spike in spreads.

China and the Middle East are more of a catalyst than a cause for the volatility. The root cause is, in my opinion, from the credit side. This is why probably people are nervous. They see yields going up in the high-yield market. It’s still a very leveraged market with a lot of marching yields that have to be served now with lower prices, which creates a downside momentum. I think we have been answering the cyclical bear in equities. This should be good for gold on the other side, which is probably forming a bottom here. We are most likely at the late stages.

TGR: What are the indicators you watch to understand these cycles?

FS: In addition to the high-yield bond markets, the other indicator is action in the reverse repo market whereby the Federal Reserve is somehow sucking up liquidity by selling treasury bonds to the banks. Interestingly, the oil price falling so dramatically goes vis-à-vis with quite an explosive volume in the reverse repo market. This is probably related to underlying oil derivatives of hedges being unbound, and with WTI crude oil now trading below $30 per barrel the situation could get serious for the exposed big banks. In my opinion, that’s all related and a cause for concern because it’s created this liquidity now.

TGR: At the same time, gold is flirting with $1,100/ounce ($1,100/oz) levels. Is that related as well?

FS: As the economic conditions are deteriorating, oil prices continue to fall, credit defaults are set to rise and currencies are tumbling, I think we are building a floor in the gold price. Nevertheless, the sentiment is still extremely negative in gold and precious metals, which is probably an indicator that we could be at the turning point. A few weeks ago, a leading Swiss private bank was recommending its clients sell all gold. That was days before the equity market started to tank and gold took off. I consider this kind of capitulation by big institutions as a reliable contrarian indicator that the precious metals sector is about to turn around.

TGR: Is $1,100/oz a high enough price that some mining companies can be profitable?

FS: It depends on the company. What is driving earnings for many producers is not the U.S. dollar price but the Canadian gold price or the Australian dollar gold price, which are currently trading at $1,580/oz, up another 8% to 9% alone this year. This is a two- to three-year high price, and it’s a good price. The smaller Australian or Canadian producers get the whole benefit from currency depreciation.

Last year Australian miners enjoyed an extremely good market. A basket of six Australian midtier gold producers would have returned between 50% and 70% in the year. I think a $1,100/oz gold price, when you transfer it to local currencies, is a good price. The U.S. producers, which are not getting the same benefit because they have a high dollar, are clearly underperforming in this market. So each company has to be evaluated independently.

Leave A Comment