Photo Credit: Charis Tsevis

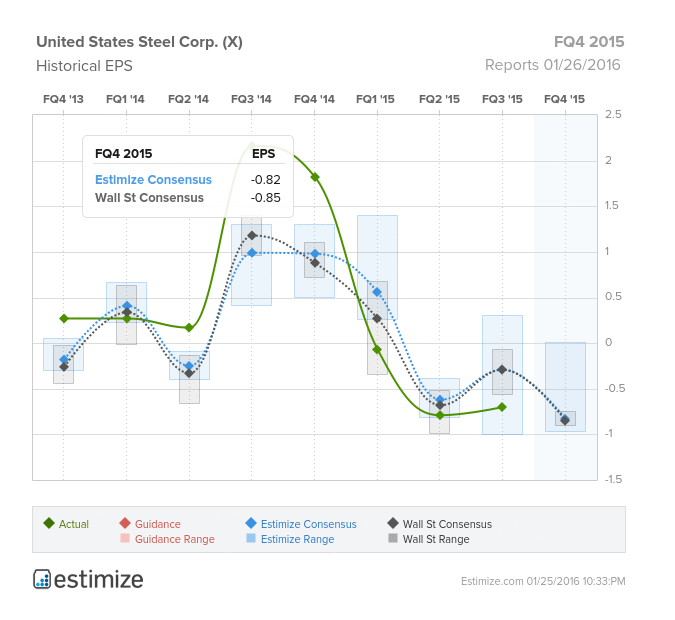

United States Steel (X)

Materials – Metals & Mining | Reports January 26, after the close.

The Estimize consensus calls for EPS of -$0.82, still 3 cents higher than Wall Street, but reflecting a downward trend. Profit estimates have slid 64 cents in the past three months. Revisions activity for revenues are not as steep, but the current estimates of $2.515B still reflects a 12% drop during that period.

What to Watch: After a dismal year, the steel industry is poised to continue its drop-off in 2016. China’s slowdown, which is expected to carry into 2016, has had huge implications for commodities and especially steel. China is the largest producer of steel, but its falling demand forced steel prices down by 5% in Q4 alone, and nearly 60% in 2015. Continually dropping oil prices have also been crippling for US Steel. The company produces steel pipes and tubes used in gas drilling and exploration. With Brent Crude declining 30% in Q4, so has demand from energy companies for US Steels products. Just last week the company announced they were laying off close to 700 workers in its Texas pipe plant.

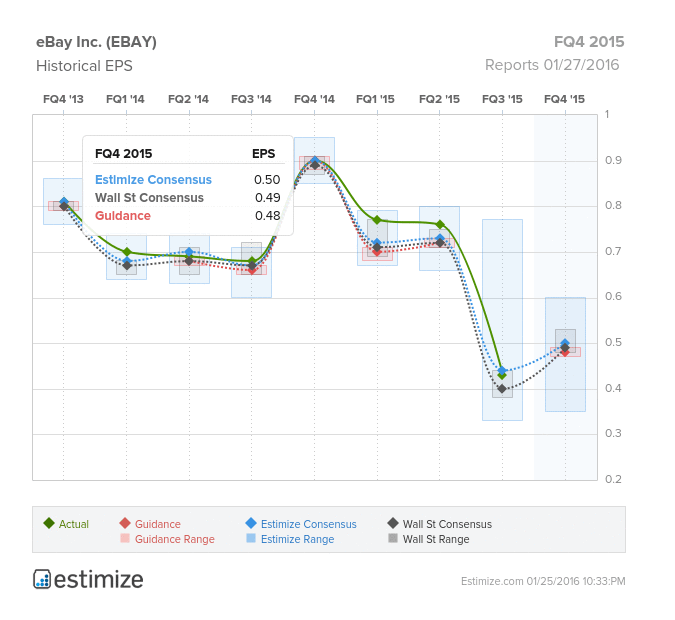

eBay (EBAY)

Information Technology – Internet Software & Services | Reports January 27, before the open.

The Estimize consensus calls for EPS of $0.50, one cent above the Wall Street consensus and two cents above corporate guidance. Profit estimates have continually dropped since EBAY’s Q3 2015 report, falling 12% since then. Revenue estimates have seen an even deeper cut of 15%, currently expected to come in at $2.306B, nearly $10M below the Wall Street estimate.

What to Watch: After an abysmal third quarter, eBay is slowly losing ground among the top ecommerce websites. The online auction house continues to transition away from its core business in light of Amazon’s booming success. More recently, eBay has begun encouraging users to utilize a fixed price listing which is believed to help move products and boost sales. Fixed pricing is somewhat similar to Amazon’s model and had always been a secondary option to eBay’s core business. However, the competitive pressure from Amazon has forced eBay’s hand as the company is poised for a massive YoY contraction. Moreover, currency headwinds have contributed to declining growth as a strong dollar has negatively impacted worldwide operations. eBay remains in flux as it attempts to recover from its separation with online payment system PayPal. With stiff competition, currency headwinds, and the loss of PayPal working against it, eBay’s fourth quarter earnings are expected to underwhelm investors.

Leave A Comment