Today, I wanted to find 5 Large Cap stocks that had great current momentum so I used Barchart to sort the S&P 500 Large Cap Index stocks first for the most frequent number of new highs in the last month, then again for technical buy signals of 80% or more.

Today’s watch-list includes: Ansys, DR Horton, TE Connectivity, Texas Instruments and Entergy.

Ansys (ANSS)

Barchart technical indicators:

96% technical buy signals

Trend Spotter buy signal

Above its 20, 50 and 100 day moving averages

17 new highs and up 10.12% in the last month

Relative Strength Index 70.76%

Technical support level at 131.69

Recently traded at 132.90 with a 50 day moving average of 126.96

DR Horton (DHI)

Barchart technical indicators:

96% technical buy signals

Trend Spotter buy signal

Above its 20, 50 and 100 day moving averages

17 new highs and up 16.26% in the last month

Relative Strength Index 85.94%

Technical support level at 42.85

Recently traded at 43.63 with a 50 day moving average of 38.56

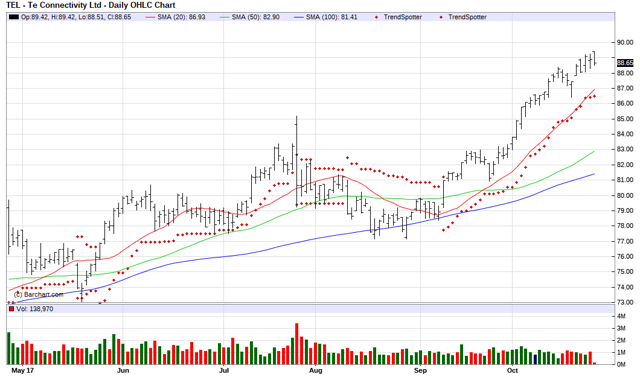

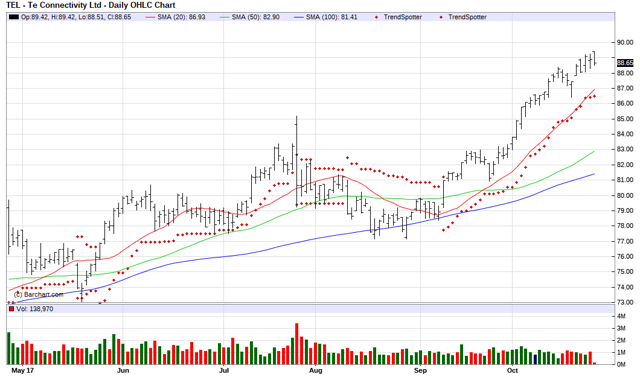

TE Connectivity (TEL)

Barchart technical indicators:

96% technical buy signals

Trend Spotter buy signal

Above its 20, 50 and 100 day moving averages

17 new highs and up 7.98% in the last month

Relative Strength Index 70.70%

Technical support level at 88.39

Recently traded at 88.48 with a 50 day moving average of 82.90

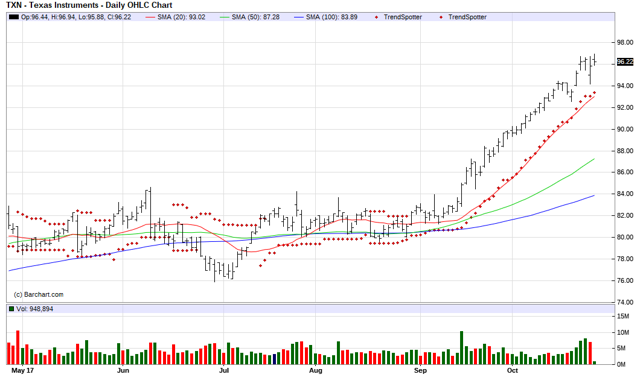

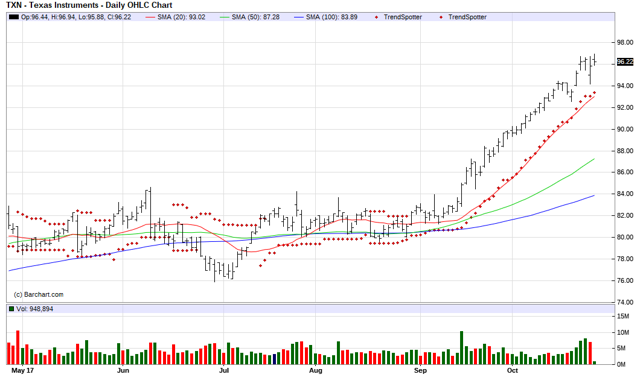

Texas Instruments (TXN)

Barchart technical indicators:

96% technical buy signals

Trend Spotter buy signal

Above its 20, 50 and 100 day moving averages

17 new highs and up 9.52% in the last month

Relative Strength Index 77.72%

Technical support level at 94.42

Recently traded at 96.24 with a 50 day moving average of 87.27

Entergy (ETR)

Barchart technical indicators:

96% technical buy signals

Trend Spotter buy signal

Above its 20, 50 and 100 day moving averages

16 new highs and up 11.71% in the last month

Relative Strength Index 78.79%

Technical support level at 84.98

Recently traded at 86.87 with a 50 day moving average of 79.86

Leave A Comment