In our previous commentary on gold, we wrote that gold prices would keep falling for three reasons: (1) accelerating US inflation, (2) decelerating growth outside the United States and (3) an ongoing slowdown across emerging markets. Ultimately, all three factors were supportive for the US dollar, gold’s ultimate nemesis. Since that time (May 17), gold prices have weakened from around $1,290 to $1,197 on August 14.

Predictably, we were heavily criticized for our outlook thanks to a small, but vocal, number of gold bugs. Looking ahead, gold is likely to find some support from US inflation, which we expect to begin decelerating in the near future. The precious metal is also likely to run into resistance based on excessively bearish sentiment, as shorting gold has become a consensus trade in the speculator community. Unfortunately, it’s still too early to call the bottom for gold, as the US dollar is likely to keep strengthening. As a result, we expect gold to keep weakening.

Stars lining up for the US dollar, and that’s bad news for gold

In the past, we wrote that the US dollar would keep strengthening thanks to accelerating US growth and inflation. More recently, we have changed our view on US economic conditions going forward. Specifically, we now forecast that both US growth and inflation will begin decelerating in rate-of-change terms. Paradoxically, an economic downturn (even in the US) is typically great news for the US dollar. This is because of the US dollar’s safe haven qualities.

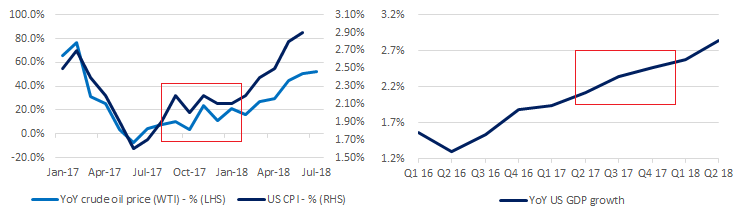

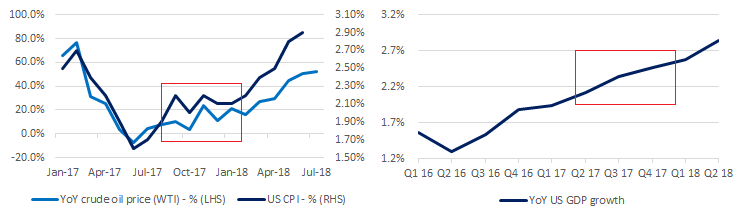

An overview of recent trends in US inflation and year-over-year GDP growth are shown below for reference:

US economic data: upcoming shift

Source: US BEA, EIA, BLS, MarketsNow

Thanks to weakening commodity prices (our outlook on crude oil is now bearish), the primary driver behind year-over-year inflation is already softening. At this time last year (see indicated area in red), inflation began meaningfully accelerating. As a result, continued growth in year-over-year inflation for the rest of 2018 will become increasingly challenging going forward. Thus the combination of weak commodity prices and steepening base effects is likely to weigh on future inflation data.

Leave A Comment