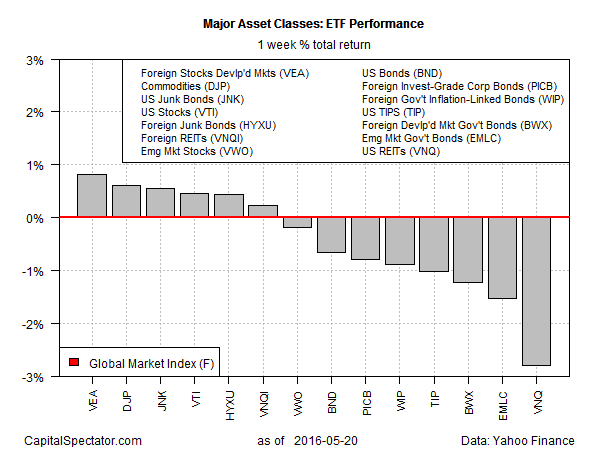

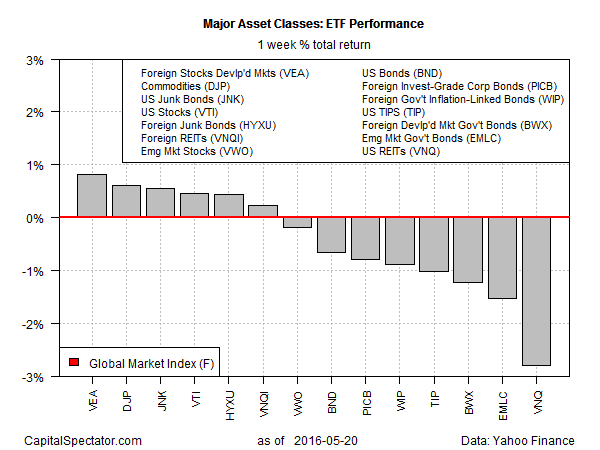

Stock markets in the developed world outside the US led the major asset classes higher last week, based on a set of proxy ETFs. Vanguard FTSE Developed Markets (VEA) posted an 0.8% total return for the five trading days through May 20, delivering a slightly stronger performance vs. the rest of the field.

Last week’s biggest loser: US real estate investment trusts (REITs), which gave back some of the strong gains earned over the past three months. Although Vanguard REIT ETF (VNQ) is still up 10% for the trailing 3-month period, Fed chatter in recent days about a rate hike convinced the crowd to lighten up on this yield-sensitive asset class, pushing VNQ down by 2.8% last week. Eric Rosengren, president of the Federal Reserve Bank of Boston, told the Financial Times on Sunday that the conditions for a rate hike are “on the verge of broadly being met.”

Meanwhile, an ETF-based version of the Global Markets Index (GMI.F), an investable, unmanaged benchmark that holds all the major asset classes in market-value weights, was unchanged last week.

Despite the latest slide in US REITs, securitized real estate in the US continues to hold the top slot for performance in the year-over-year column. VNQ is up 6.6% for the year through May 20 on a total-return basis, which represents a substantially stronger gain vs. the other major asset classes.

The big loser over the past 12 months: emerging-market stocks. The Vanguard FTSE Emerging Markets ETF (VWO) has shed more than 23% for the trailing one-year period through May 20.

“Bets for a June Fed hike have gone through the roof, providing a negative backdrop for emerging-market assets,” Joseph Dayan, the head of markets at BCS Financial Group, told Bloomberg last week. “We have had a good run and some investors were looking to take profit. This was the trigger that allowed that profit-taking to happen.”

The broad trend for markets generally remains weak as well for the trailing one-year period, based on GMI.F. This benchmark of the major asset classes is down 3.9% through May 20.

Leave A Comment