Back in November 2016, the BIS picked up on a topic we have often discussed over the years, namely the critical role that dollar abundance (or shortage) plays in defining market stress, and going one step further, published a research report which made the striking claim that while the VIX was now dead as an indicator of market risk, it had been replaced with the value of the dollar. This is what the Bank of International Settlement said then:

Just as the VIX index was a good summary measure of the price of balance sheet before the crisis, so the dollar has become a good measure of the price of balance sheet after the crisis. The mantle of the barometer of risk appetite and leverage has slipped from the VIX, and has passed to the dollar.

What explains the dollar’s role as the summary measure of the appetite for leverage? In a nutshell… there is a tight “triangular” relationship between (1) the dollar, (2) cross-border bank capital flows in dollars and (3) the deviation from CIP. The key to understanding this relationship is that dollar cross-border capital flows closely track the leverage decisions of global banks. The triangular relationship says volumes about the role of the US dollar in the global banking system, and ultimately how the monetary policy backdrop determines global financial conditions.

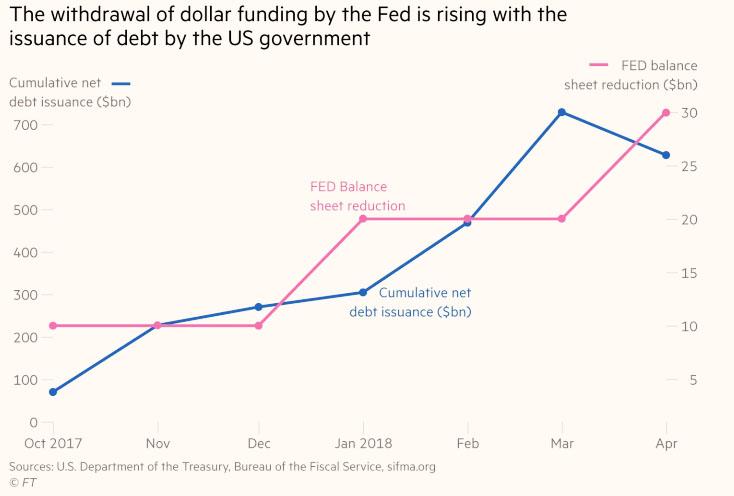

Fast forward to this June, when the head of the Reserve Bank of India, Urjit Patel, made a solemn appeal to the Fed: stop shrinking your balance sheet because, in combination with the soaring US budget deficit (which requires a surge in new Treasury issuance), you are draining precious USD-liquidity out of the market.

This was the first time this cycle that a prominent foreign central banker accused the Fed of stirring trouble for emerging markets, with its ongoing tightening:

Global spillovers did not manifest themselves until October of last year. But they have been playing out vividly since the Fed started shrinking its balance sheet. This is because the Fed has not adjusted to, or even explicitly recognised, the previously unexpected rise in US government debt issuance. It must now do so.

Leave A Comment