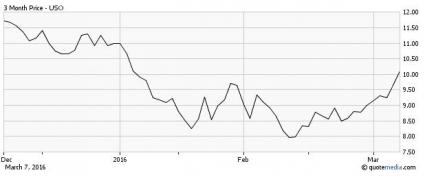

Over the last four weeks we have seen an amazing bounce in equity markets. Crude oil is now well over the $35 level and looks poised to potentially test $40. Many oil stocks have followed crude’s lead by surging higher; some have had triple digit moves just in the last week.

The recent move has an old saying going through my head: “Nobody ever went broke taking profits” This is echoing through the minds of many right now as investors decide how to position themselves for the rest of the year.

While it seems like a bottom is in for oil, many companies still face fundamental issues they absorbed over the last couple years. If oil stays under the $50-60 area, these companies will still face debt and margin pressures.

Given the recent move in some of these companies, now is the time for the longs to start selling their positions and short sellers to start openings theirs. I am not necessarily saying these companies go back down to lows of the year, but merely pointing out the possibility of a profitable trade.

Will oil run out of steam soon?

Currently sitting at $36.50a barrel, oil has turned positive for the year after seeing a $26.05 low on February 11th and a high of $38.39 this morning. This is a almost 50% move that has caused stocks that were severely beaten down to rally to November levels. So did the last three months not happen? Or are we willing to bet that the oil trend continues lower.

Is the short squeeze over?

Crude oil and stocks in the sector were oversold a month ago. Markets were pricing in defaults and bankruptcies for well known oil names. This created fear across the equity markets which lead to many short sellers to pile on the oil names and drive their stocks down expecting them to fall to zero.

When oil started to bounce of its lows and head towards $30, stocks started to rise and shorts either exited positions or stubbornly added. Over the last five trading days we have seen the stubborn shorts start to cover aggressively as oil continued its rise to $38. In the case of SDRL shorts have taken a $2 stock to $7. In the case of CHK a $1.50 stock to $5. These examples are just a couple that show the bloody mess short sellers have gotten themselves into.

Leave A Comment