When it comes to low-risk dividend investing, it’s usually hard to go wrong with dividend aristocrats, those 51 S&P 500 companies that have managed to grow their payouts for at least 25 consecutive years.

After all, such consistent growth generally requires that a company operate in a stable, growing, and wide moat business.

As importantly, management needs to be conservative and take a long-term disciplined approach to growth, while continuously evolving the business in case the industry undergoes large and or rapid changes.

However, as the saying goes, “past performance is no guarantee of future results.” From time to time, secular technological or social shifts can occur that can make even mighty dividend aristocrats not worth owning.

Franklin Resources (BEN), also known as Franklin Templeton Investments, has delivered not only 34 straight years of increasing dividends, but blisteringly fast payout growth as well.

In fact, Franklin Resources’ dividend has grown at an annual rate of 18.2% over the past 30 years. That has helped the stock generate 11% annual total returns over the past two decades, beating the S&P 500 by about 2.3% a year.

However, as impressive as this track record is, there are numerous challenges facing the company going forward that will likely challenge Franklin to recreate its past success.

Let’s take a closer look at this struggling dividend aristocrat to see what its future likely holds and if it could be worth consideration today as a value stock in a diversified dividend portfolio.

Business Overview

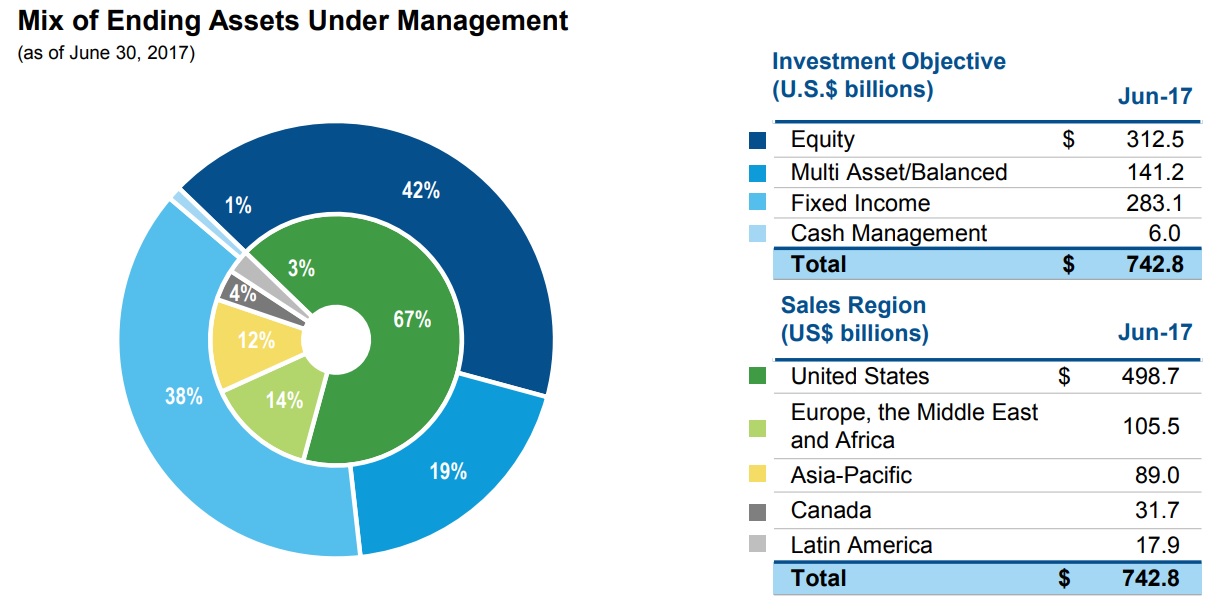

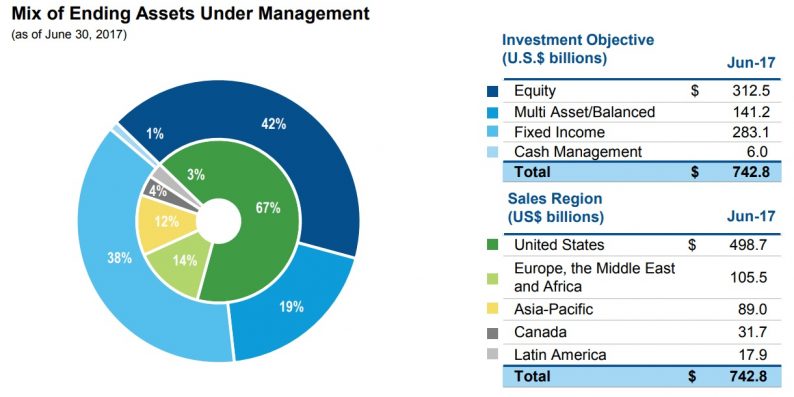

Founded in 1947 in New York City, Franklin Resources is the 23rd largest asset manager in the world. Its 9,000 employees (including 650 investment professionals) manage $742.8 billion in assets for a client base located in more than 180 nations around the globe.

Franklin Resources is almost a pure play active management firm, with about two thirds of its business coming from the U.S. and a primary focus on providing equity funds (42% of assets under management):

Source: Investor Presentation

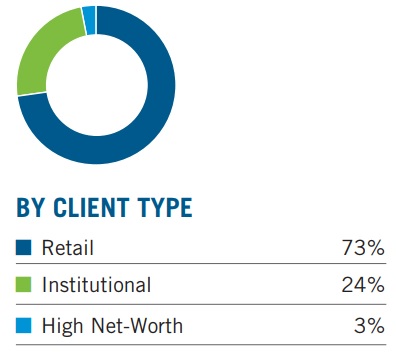

The vast majority of its business is with retail investors, specifically through their 401Ks and IRAs.

Only 27% of Franklin’s clients are institutional (pensions, insurance companies, endowments, sovereign wealth funds) or high-net worth individuals who are utilizing its alternative asset management (hedge fund) services.

Business Analysis

The asset management business is theoretically ideal for generating secure and fast-growing dividends for the long-term.

After all, it’s a capital light industry that is highly scalable; relatively small fixed overhead costs can be amortized over vast asset bases, resulting in some very fat margins and returns on shareholder capital as an asset manager’s business expands.

Best of all, since the stock market generally rises over time (9.1% annually since 1871), asset managers should theoretically have the wind at their backs when it comes to steady, strong, and highly profitable growth in sales, earnings, and cash flow.

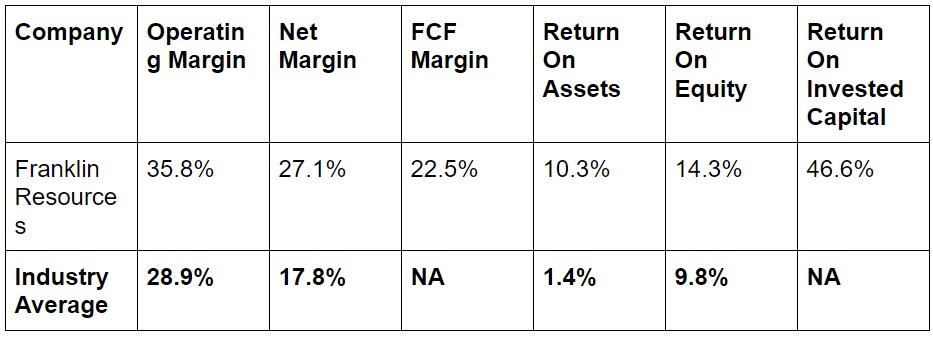

And indeed, thanks to a highly disciplined and cost cutting-focused management team, Franklin Resources enjoys higher-than-average profitability, including an impressive free cash flow margin that has allowed it to shower investors with buybacks and dividends to the tune of $13 billion over the last decade.

Franklin Resources Trailing-12 Month Profitability

Sources: Morningstar, Gurufocus

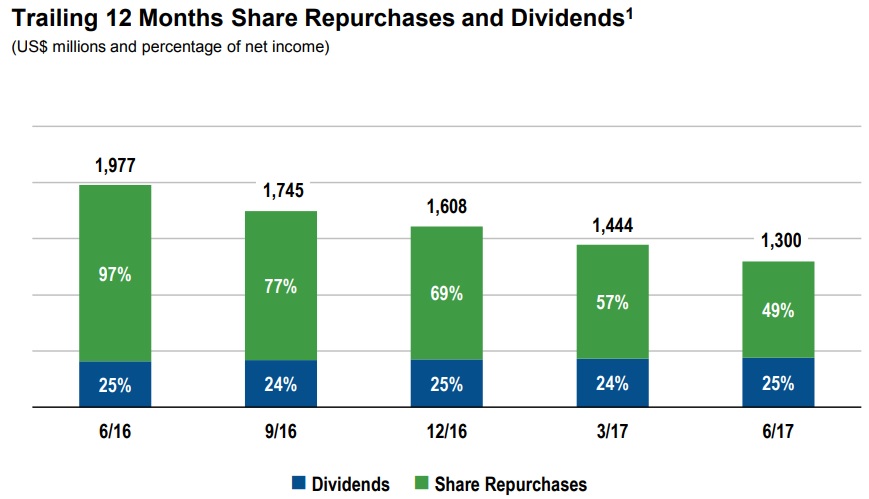

The company’s capital returns have been slowing in recent years because Franklin faces a secular trend that threatens not only its ability to continue growing in the coming years, but possibly its very existence over the long-term.

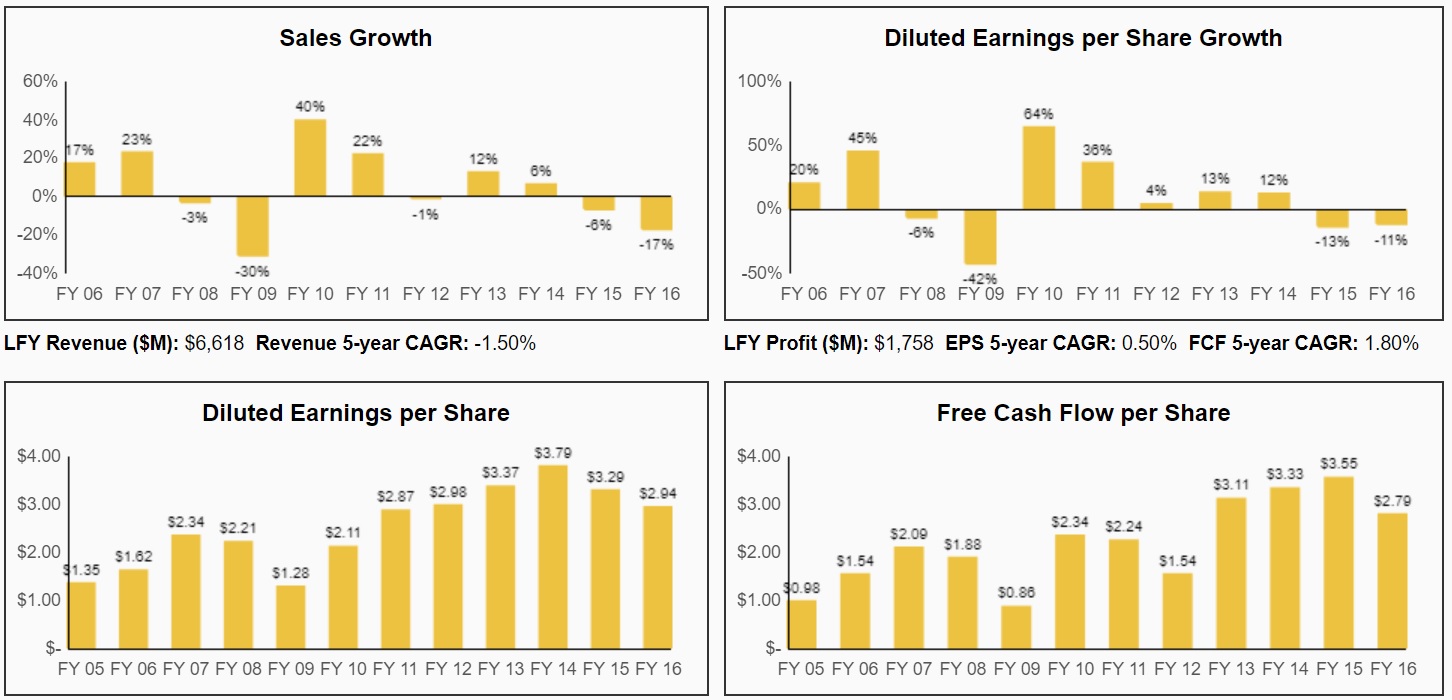

You can see that the company’s sales, earnings, and free cash flow per share have faced challenges in recent years.

Source: Simply Safe Dividends

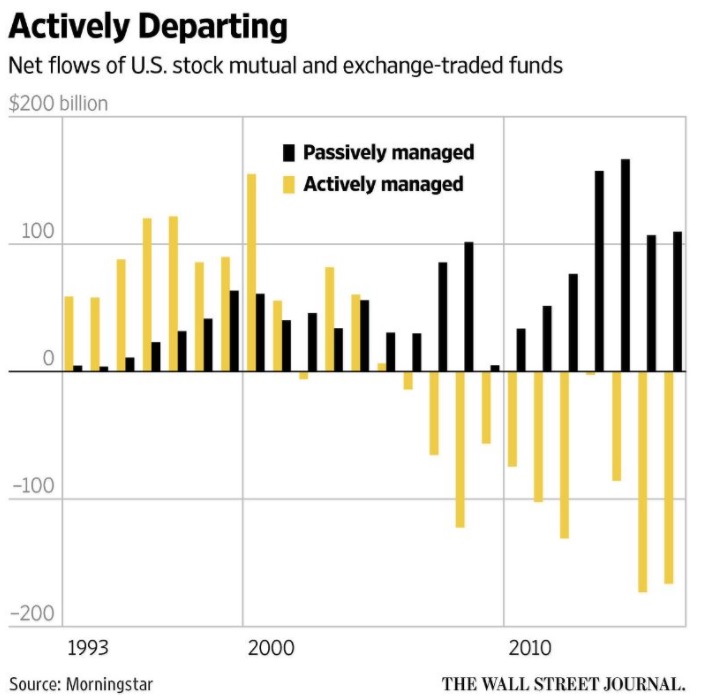

As you can see, the bull market of the 1990’s was a golden age for active asset managers. Thanks to the soaring stock market they were able to continue to attract new investor funds despite having much higher fees than passively managed counterparts, such as index ETFs.

However, starting around 2005 this changed and has become a stampede of investors who have finally realized that low costs are the best way to maximize long-term returns.

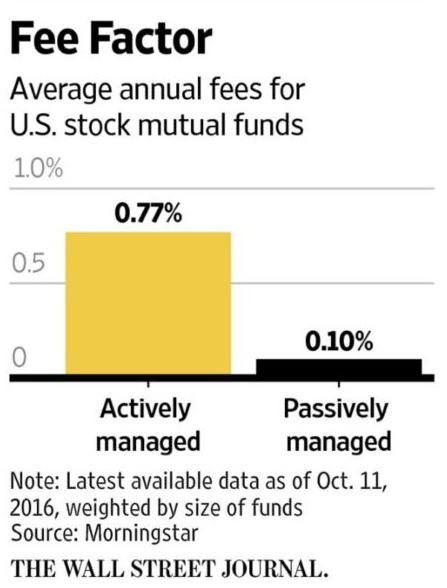

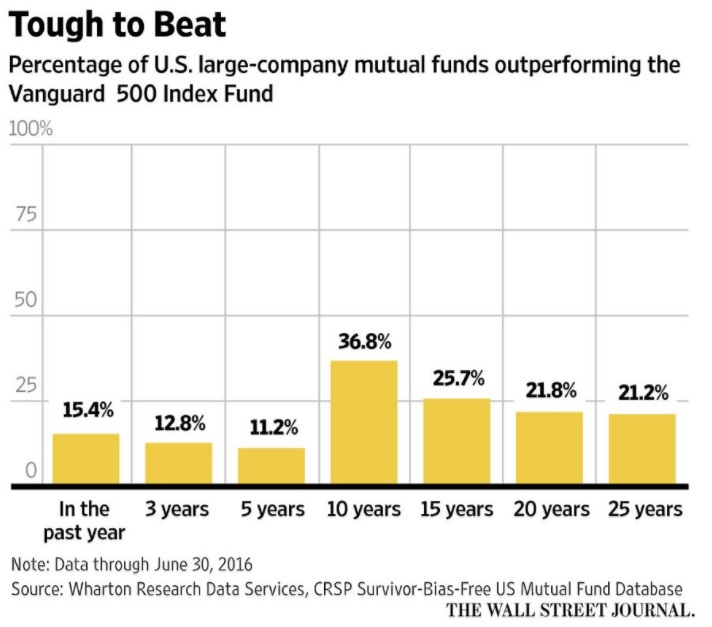

Given these much higher costs, combined with the fact that over the past 15 years 92% of large cap fund managers have failed to outperform their benchmarks (95% for small cap managers), as well as the S&P 500 in general, it’s not hard to see why passive index pioneers such as Vanguard and BlackRock (BLK) have done so well, with assets under management exploding to $4.4 trillion and $5.7 trillion, respectively.

In fact, even the greatest investor in history, Warren Buffett, who over the last 50 years has generated 20% annual returns at Berkshire Hathaway (BRK-B), has said that his advice to those seeking to save for retirement is to “consistently buy an S&P 500 low-cost index fund. I think it’s the thing that makes the most sense practically all of the time.”

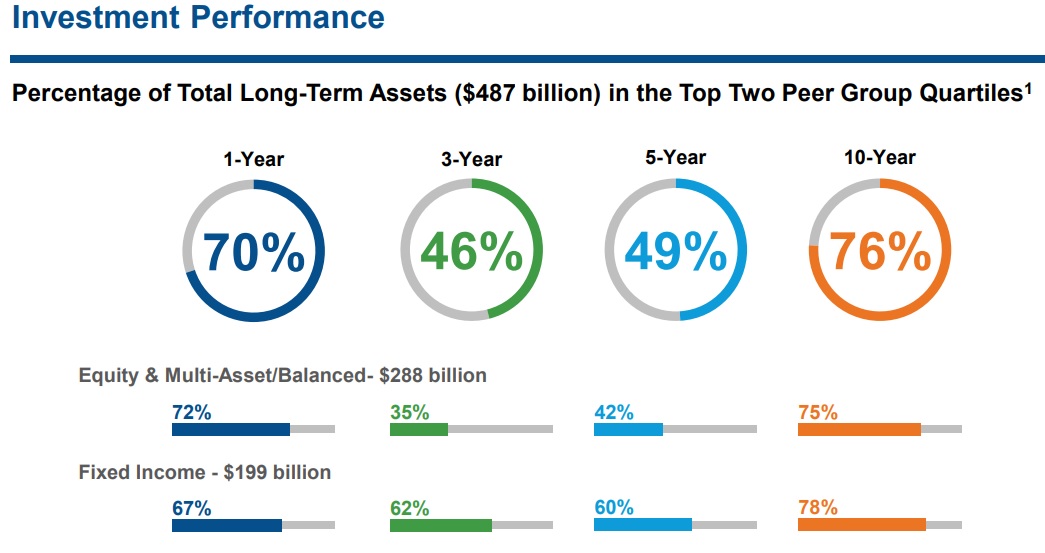

And thanks to some rather poor performance by its funds (only 35% of its equity & multi-asset / balanced funds are beating half of their peers over the past three years), Franklin has been consistently losing market share, resulting in significant asset outflows in recent years.

Keep in mind that even though Franklin’s bond funds did slightly better than its peers during this time, the “top two quartiles” is a low bar to clear because it just means that Franklin’s funds were beaten by no more than half its actively managed competition. And given how poorly active managers have done over time, this achievement deserves little more than faint praise.

In fact, in fiscal 2016 organic assets under management fell by 12% and are expected to decline by another 6% to 9% in fiscal 2017.

Leave A Comment