If you’re new to the Wall Street Daily nation, here’s the rundown…

I’ve embraced the adage that “a picture is worth a thousand words.” So each Friday, I hand-select compelling graphics to put the week’s investment news into perspective.

All it takes is a quick glance and you’ll be up to speed — this time, regarding analyst sentiment, digital disruption and the dumbest trade in the market.

Whoever said achieving enlightenment isn’t easy? Enjoy!

Consensus or Contrarian

Sell-side analysts are notoriously liberal with their buy ratings and stingy with their sell ratings. At any given time, buy ratings outnumber sell ratings by a factor of 8:1.

Clearly, all those stocks aren’t screaming buys, though. So what are analysts good for? Absolutely nothing — except perhaps serving as a contrarian indicator.

Don’t just take my word for it.

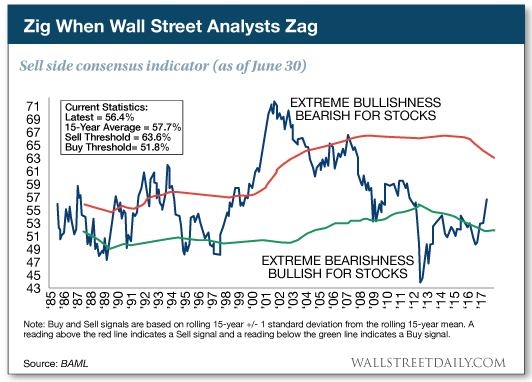

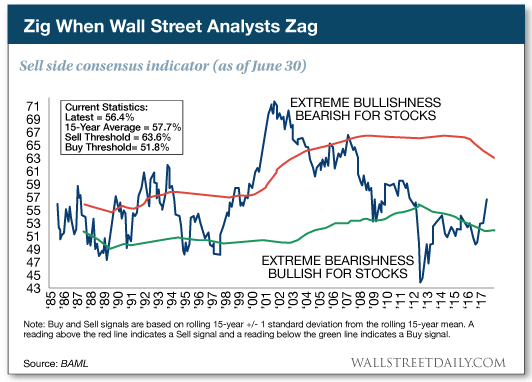

“We have found that Wall Street’s consensus equity allocation has been a reliable contrary indicator,” says Savita Subramanian, the head of equity and quant strategy at Bank of America Merrill Lynch.

“In other words, it has historically been a bullish signal when Wall Street was extremely bearish, and vice versa.”

Where do we stand now? Well, don’t kill the messenger. But the consensus is trending rapidly in a bearish direction.

In fact, the latest survey of Wall Street strategists’ asset allocation recommendations is at its most bullish level since 2011:

We’d be hard-pressed to find an individual analyst that’s calling for an outright end to the eight-year-old bull market. Their collective opinions, however, might be signaling it. Be on guard!

Speaking of caution…

A Mind-Numbingly Dumb Trade

We’ve been chronicling the absence of volatility in the stock market for months now.

And we’ve struck a cautious (not cavalier) tone. That is, we should expect volatility to return with a vengeance — and prepare for it. Either by going long the CBOE Volatility Index (VIX) or by implementing trailing stops to protect your profits in the event of any sudden and severe market sell-offs.

Leave A Comment