Thanksgiving Wednesday was never going to generate an exciting day but it was good to see early week gains retained. Upcoming Thanksgiving Friday is typically a day when Junior traders go wild and decent gains are posted – even if trading volume is light. With last week’s lead action I wouldn’t be surprised if this pattern was to repeat.

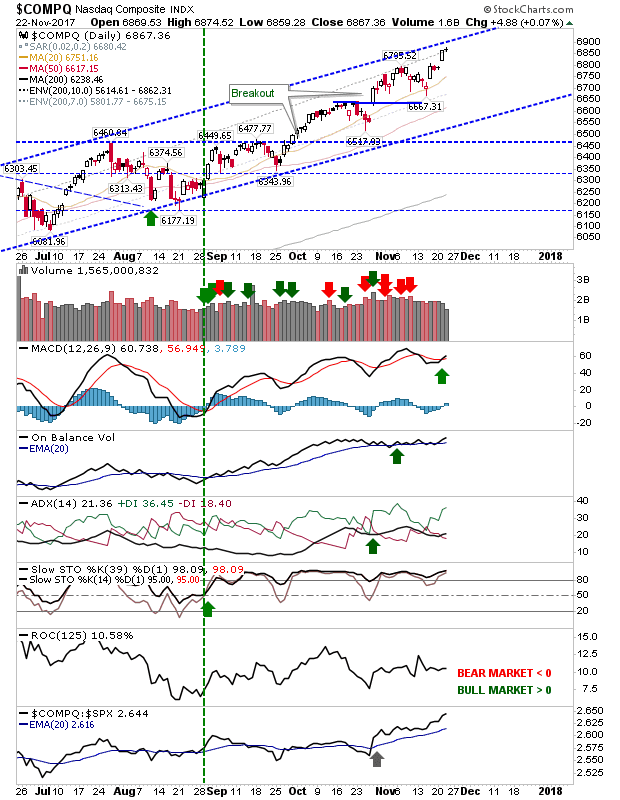

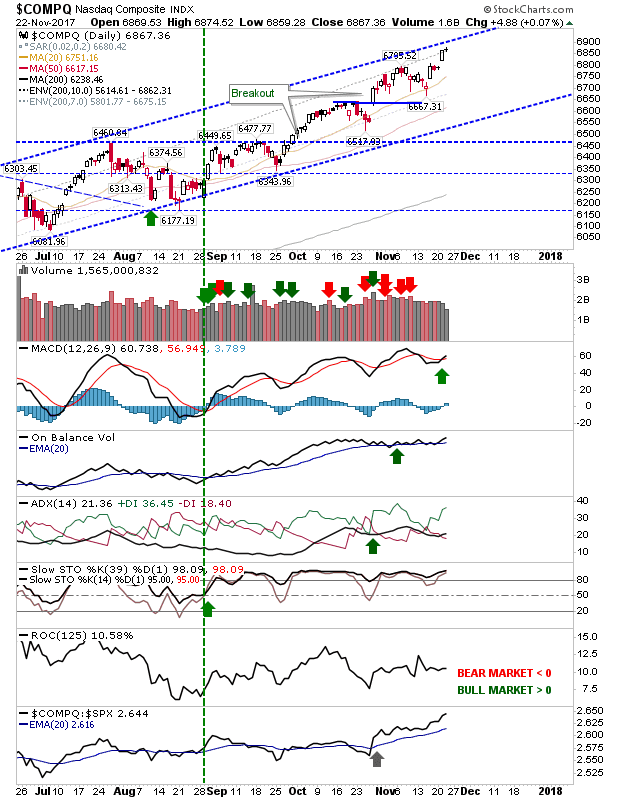

Tech Indices have been leading the charge in recent days and I would look to the Nasdaq and Nasdaq 100 to be the primary chargers on Friday. Technicals are firmly in the green.

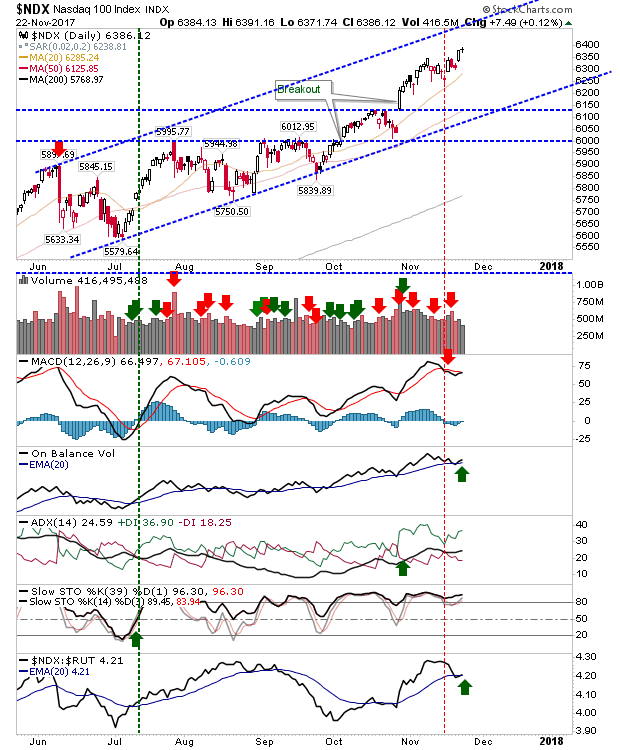

The Nasdaq 100 is a little weaker technically with the MACD trigger ‘sell’ still in play but given it’s on the verge of a new ‘buy’ trigger it’s still an attractive trading opportunity.

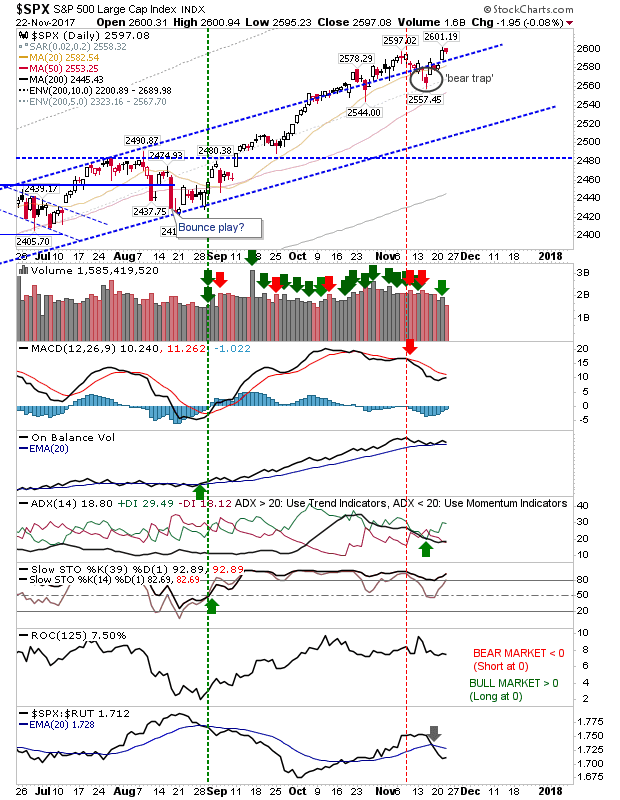

The S&P posted minor losses but is knocking on the door of new highs. It’s still a few days from a new MACD trigger ‘buy’ but should this occur then look for a new wave of buying.

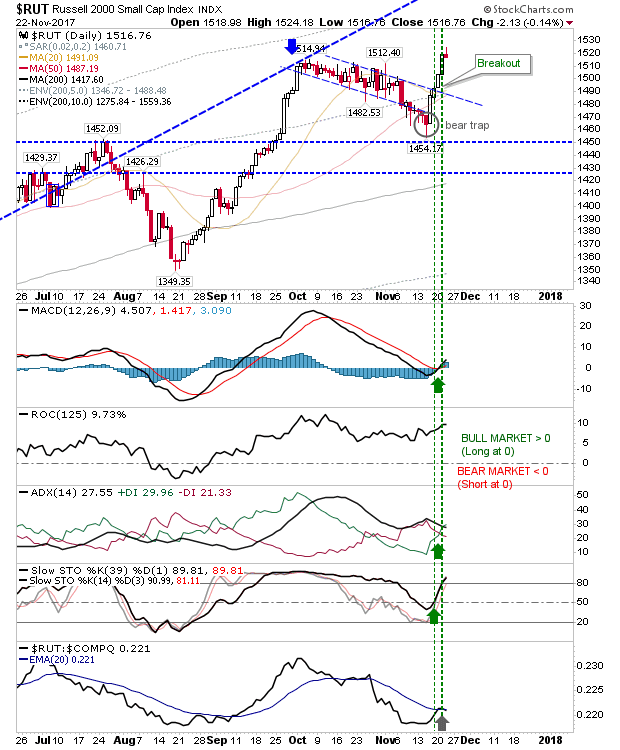

The Russell 2000 has enjoyed a very strong run of form but it may be a little stretched to keep this going on into Friday. Technicals are all net green so should this ease back into next week I would look at it as a buying opportunity – a retest of the 50-day MA would be ideal in this regard.

Friday could be short-but-sweet day of low volume buying. A feel-good Turkey blitz should be the order of the day given prior bullish action.

Leave A Comment