The relentless selling in the stock market last week has given many investors a massive hangover after the Quarter 3 celebration. The stock market was acting nervous at the start of October, even before Federal Reserve Chair Jerome Powell commented about a “Remarkably Positive Set of Economic Circumstances” on October 3.

In fact, the first week of the new quarter was full of signs that the stock market was tired. On October 1, the S&P 500 opened 13 points higher, and quickly rallied another eleven points before turning negative–all before lunch. It finished the day higher, but below where it opened. The next day, the market-leading Dow Industrials made a new high, but the rest of the market averages did not.

At the end of September, I commented on the mixed signals from the A/D lines. The NYSE All-Issues A/D line “failed to make a new high the week ending September 21.” The other A/D lines that I follow, including the NYSE Stocks-Only A/D line, had not formed any negative divergences. Still, the mixed signals were a reason to be cautious. By October 2, both the NYSE All-Issues and Stocks-Only daily A/D lines had broken their up trends.

TOMASPRAY – VIPERREPORT.COM

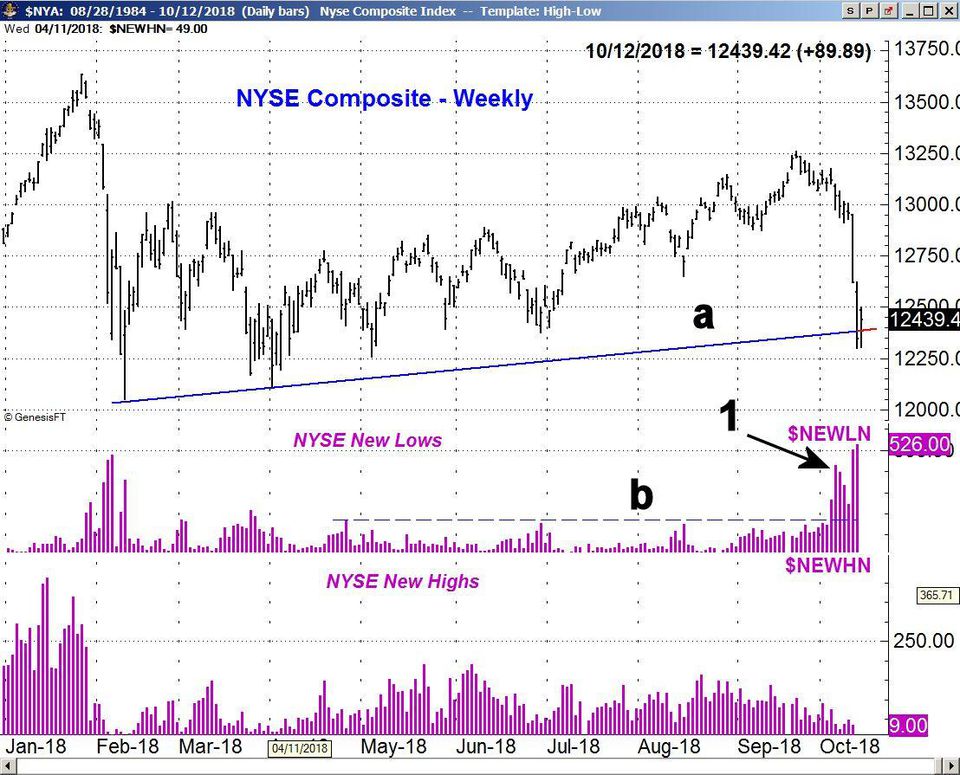

The weight of the evidence clearly shifted to the sell side on October 4, as the number of NYSE stocks making new 52-week lows surged to 430 (point 1). This surge was by far the highest reading since there were 166 new lows in April (line a). This was a further sign that the market was getting weaker. There were 535 NYSE stocks making new lows last Thursday, and there are no signs yet it is bottoming.

The NYSE Composite closed below the support (line a) last Thursday that goes back to the February-April lows, before it rebounded. The NYSE dropped below the weekly and daily starc- bands last week, which is consistent with a market that is very oversold.

The Dow Transports were hit the hardest last week. down 6.4% for the week despite a 0.90% rally on Friday. The S&P 500 and Dow Industrials were both down over 4% while the beaten-down Russell 2000 lost over 5%.

Leave A Comment