Pressure against U.S.-based tobacco companies has been building recently, amid ongoing trade disputes, the potential for stricter product regulation, as well as the likelihood of regional crop damage from Hurricane Florence.

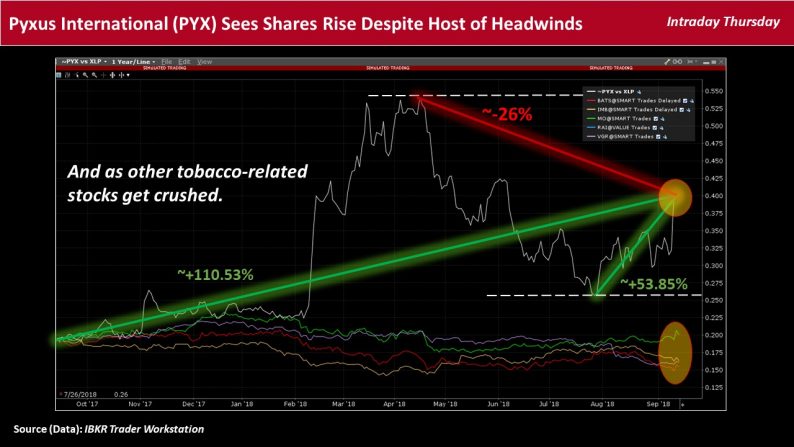

Shares of North Carolina-headquartered Pyxus International (NYSE: PYX), for example, took a nosedive in intraday trading Thursday, as the company grapples with a host of adverse financial and operational risks.

While PYX’s stock had shot up about 35% on the day Wednesday, amid an update to investors and analysts on its business transformation, it has since retraced some of those gains.

Among other products and services, the company – formerly known as Alliance One International – offers blends of tobacco, menthol and flavors for cigarettes, pipes, ‘roll-your-own’ (RYO) and cigars. However, given its product line, PYX, along with other domestic tobacco companies, face a potential regulatory threat from the U.S. Food and Drug Administration (FDA).

FDA commissioner Scott Gottlieb said Wednesday that, among other steps aimed at combatting youth access to tobacco products, the administration was targeting the use of flavors.

Gottlieb said, “We know that the flavors play an important role in driving the youth appeal. And in view of the trends underway, we may take steps to curtail the marketing and selling of flavored products. We’re now actively evaluating how we’d implement such a policy.”

Higher prices among myriad of risks

The FDA commissioner’s recent rhetoric has added to an existing mountain of risks for the tobacco industry.

Jitters about the potential implementation of the new regulation have been compounded by fears of crop devastation by Hurricane Florence in North Carolina – the top U.S. tobacco producing state – as well as by Chinese export duties on cigarettes imposed in July as part of China’s tit-for-tat tariff tactics.

Leave A Comment