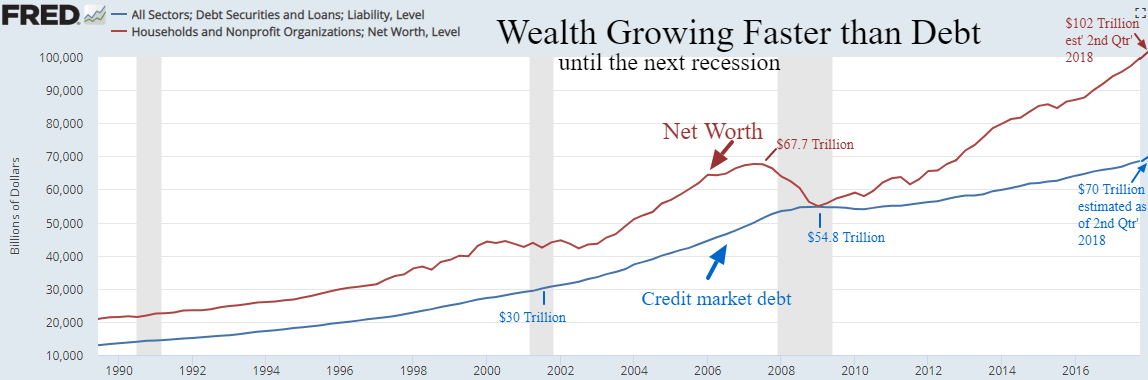

David Stockman, former budget director for President Ronald Reagan, says “I think all hell is going to break loose,” as the result of the Trump tax cut. Past assertions indicate he expects a 40 to 70% stock market collapse, but no idea when. For Stockman it has always been about debt and that we ‘can’t handle the debt’.In 2010, Stockman was a super Bear alarmed by the huge rise in the US Credit market debt to $52 Trillion. Well, today we have roughly $70 Trillion. However, relative to our assets, debt isn’t that alarming. How much debt is too much? We’ll know when banks tighten credit and defaults soar sending the economy into a liquidity induced contraction.

Other well-known analysts and money managers have echoed Stockman’s theme:

Throughout this nearly 10-year Bull market, false prophets have foretold of doom and gloom around the bend. Certainly, this chorus of more credible Cassandras may be correct and gain the investor following that sends equities plunging. Remember Cassandra was the beautiful daughter of Troy’s king who was blessed with the gift of prophecy and cursed with no believers. We’ll see when credit and earnings reverse their uptrend to join the doom and gloom crowd. 2019-2020 could certainly be a top (as we have also alluded to in the past), but instead of forecasting a bubble and credit stress, let’s wait for them to appear. China and the mid-term elections are the primary concerns for us in coming months.

Leave A Comment