With the markets closed yesterday, there is little to update you on with respect to the technical backdrop from this weekend’s missive. However, this is a good opportunity to review the fundamentals as Q2-earnings season comes to a close.

Not surprisingly, the cuts to corporate tax rates in December led to a surge in quarterly earnings numbers. During the first two quarters of this year, 12-month operating earnings per share rose from $124.51 per share in Q4 of 2017 to $132.23 and $140.45 in Q1 and Q2 of 2018 respectively or more than 6% in each quarter. While operating earnings are widely discussed by analysts and the general media; there are many problems with the way in which these earnings are derived due to one-time charges, inclusion/exclusion of material events, and outright manipulation to “beat earnings.”

Therefore, from a historical valuation perspective, reported earnings are much more relevant in determining market over/undervaluation levels. There was good news found here as well with reported earnings also getting a tax-related surge. For the quarter, 12-month reported earnings per share rose from $109.88 in Q4 of 2017 to $115.44 and $122.47 in Q1 and Q2 of 2018 respectively. This also translated into roughly a 6% increase in both quarters.

However, despite the improvement in reported earnings for the first quarter, the thing that jumped out was the decline in revenues per share which slumped from $329.59/share in Q4 to $320.39/share in Q1.

In other words, while top line SALES fell, bottom line revenue expanded as share buybacks and accounting gimmickry escalated for the quarter. The question is whether sales dramatically expanded in Q2? Given some of the recent economic data, we have our doubts and expect a smaller increase. (I will update this chart when S&P updates the sales/share figure for Q2) As shown in the chart below, the biggest support for earnings expansion in Q2 continues to be the dramatic decline in shares outstanding.

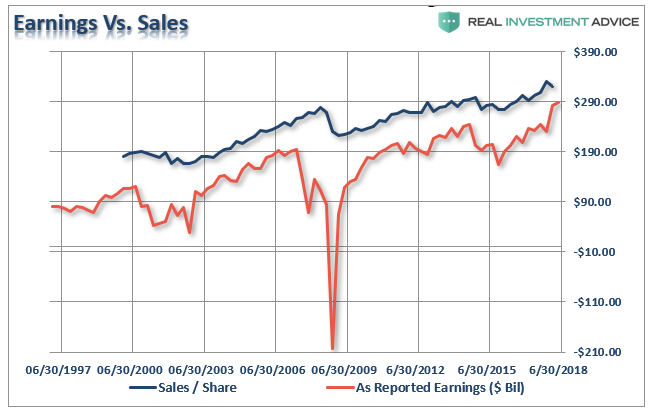

Of course, such should not be a surprise. Since the recessionary lows, much of the rise in “profitability” have come from a variety of cost-cutting measures and accounting gimmicks rather than actual increases in top-line revenue. While tax cuts certainly provided the capital for a surge in buybacks, revenue growth, which is directly connected to a consumption-based economy, has remained muted. Since 2009, the reported earnings per share of corporations has increased by a total of 353%. This is the sharpest post-recession rise in reported EPS in history. However, the increase in earnings did not come from a commensurate increase in revenue which has only grown by a marginal 44% during the same period and declined from 49% in Q1.

Leave A Comment