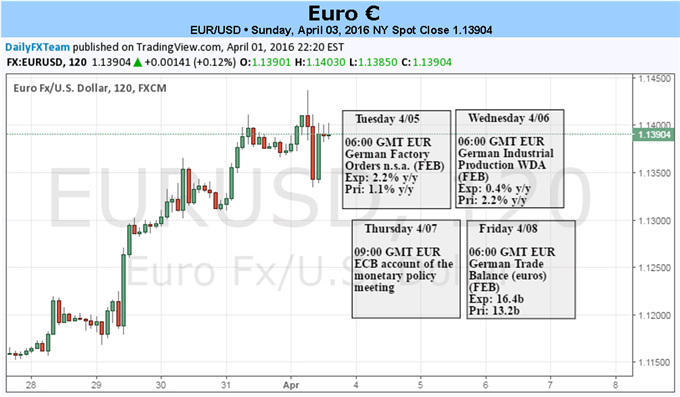

Fundamental Forecast for EUR/USD: Neutral

– EUR/USD quickly moved into a bullish breakout posture after Fed Chair Yellen’s comments.

– Despite a ‘good enough’ US jobs report, EUR/USD’s ascent was only momentarily stalled intraday.

– As market volatility ebbs, it’s a good time to review risk management principles.

The Euro finished out the quarter on mostly strong footing, rallying further against recently embattled currencies like the British Pound (EUR/GBP +1.31%) and the US Dollar (EUR/USD +1.97%). Yet with commodity prices, mainly Crude Oil, slumping again, the commodity currencies weren’t able to post sizeable gains (if at all; EUR/CAD rallied by +0.01%) around the latest round of dovish commentary from Federal Reserve Chair Janet Yellen.

As EUR/USD appears to be primed for a technical breakout to the topside thanks to the Fed, it comes against the backdrop of the European Central Bank recently admitting that its latest measures aren’t aimed at the FX channel. For more information on this, and why we diagnosed the Euro as having greater potential for upside immediately after the ECB’s March 10 reading, you might find the Euro weekly trading forecast from the week of March 13, 2016 helpful, “ECB’s Measures Aimed at Credit, Not FX – Euro Gains Breathing Room.”Now that the ECB’s new easing measures are in effect (as of this Friday, the start of Q2’16), further Euro upside wholly depends on the ECB keeping quiet about the Euro’s exchange rate.

To be clear, now that some the latest tweaks to the ECB’s easing measures are in effect – notably the increased pace of asset purchases, up by €20 billion to €80 billion per month – the Euro may be a bit more susceptible to weakness if risk markets rally (the portfolio rebalancing channel effect is still in play). However, the sensitivity the Euro will have to gains by equity markets and lower core sovereign yields may be limited thanks to Fed Chair Yellen’s heightened dovish posture.

Leave A Comment