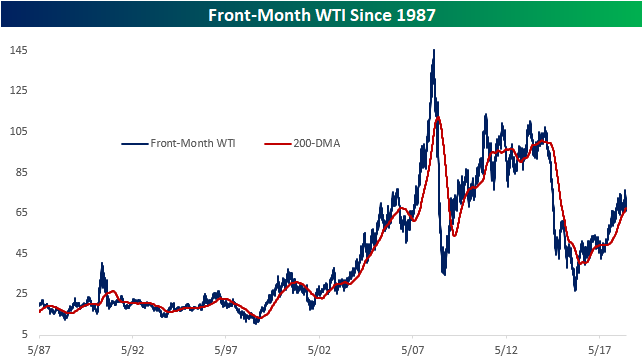

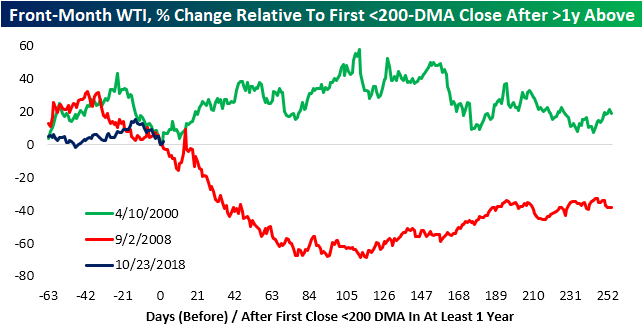

Earlier this week, oil prices did something they have only done a couple times in the past. After spending 262 consecutive trading days above the 200-DMA, oil closed below this average. Similar streaks of more than a year (254 trading days) above the 200-DMA has only happened two other times in the past 3 decades. The first occurrence was on April 10, 2000, ending a 272-day streak, and the second was back on September 2, 2008, when a 330-day streak came to a close.

As you can see in the chart below, it is basically a coin flip to see what will happen now. In 2000, oil managed positive returns over the course of the following year. But the opposite happened in 2008. The year following a move below the 200-DMA saw consistent declines. Of course, keep in mind that oil prices were nearly twice as high in the summer of 2008 and the economy and financial markets were melting down until Q2 2009 at the least, meaning a repeat of the 2008 declines looks pretty unlikely today. Only time will tell which scenario the current one will more closely resemble.

Leave A Comment