“The global markets aren’t doing well and China’s economic fundamentals aren’t picking up,” said Wang Zheng, the Shanghai-based chief investment officer at Jingxi Investment Management Co.

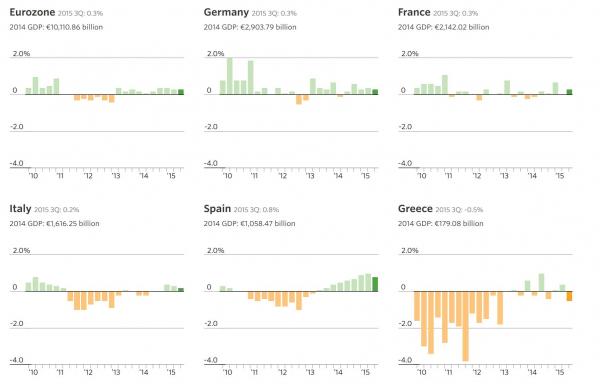

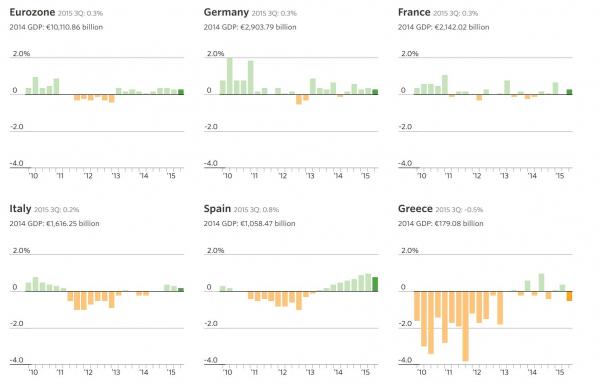

For once, the overnight session was not dominated by weak Chinese economic data (which probably explains why the Shanghai Composite dropped for the second day in a row, declining 1.4%, and ending an impressive run since the beginning of November) and instead Europe took the spotlight with its own poor data in the form of Q3 GDP which printed below expectations at 0.3% Q/Q, down also from the 0.4% increase in Q2, with several key economies rolling over including Germany, Italy, and Spain while Europe’s poster child of “successful austerity” saw Q3 GDP tumble 0.5%, far worse than consensus expected.

Ironically, the main source of weakness was a deterioration in exports – this in the continent that has engaged in Q€ and has been jawboning for the past several months, all in an attempt to weaken the Euro and boost exports.

According to the WSJ, “the eurozone economy slowed in the three months to September as exports to large developing economies weakened, a development that makes it more likely the European Central Bank will expand its stimulus programs in December. The slowdown was led by Germany, the currency area’s exporting powerhouse, while Italian economic growth also eased. There were fresh contractions in Greece, Finland and Estonia, while Portugal’s economy stagnated.

Here is a summary of the key European economic datapoints:

Another problem: with both a rate cut and more QE from the ECB already largely priced in, the weak European data did not boost risk assets, and so the Stoxx Europe 600 Index is on track for its biggest weekly decline in two months.

Every major Western European equity index has dropped. Portugal’s PSI 20 is the worst performing index, with a decline of 5 percent, its biggest of 2015. Earlier this week the government of Pedro Passos Coelho was ousted by a left-wing alliance. The country’s president will decide who to ask to try to form the next administration.

As of this moment both US equity futures and European equities were trading at their lows as follows:

Global stocks are heading for the third consecutive weekly drop. The explanation, according to Bloomberg: “weak Chinese data and the prospect of a U.S. interest rate hike in December breeds caution among investors.” And yes, this is the same justification given to soaring stocks just a few weeks earlier.

The losing run for the MSCI All Country World Index is the longest since the end of August. The takeaway from the handful of Fed officials who spoke Thursday is rates are likely to rise this year, but the pace thereafter will be gradual. Chinese stocks on the mainland and in Hong Kong sank after data late Thursday showed the country’s broadest measure of new credit tumbled to a 15-month low, demonstrating that rate cuts have yet to ignite borrowing.

A far bigger concern that emerged yesterday, was the renewed rout in the commodity sector: a gauge tracking 22 commodities is on track for a 5th weekly decline. A culmination of the strong dollar and a slowing Chinese economy are battering the Bloomberg Commodities Index, sending it to the lowest in 16 years.

Leave A Comment