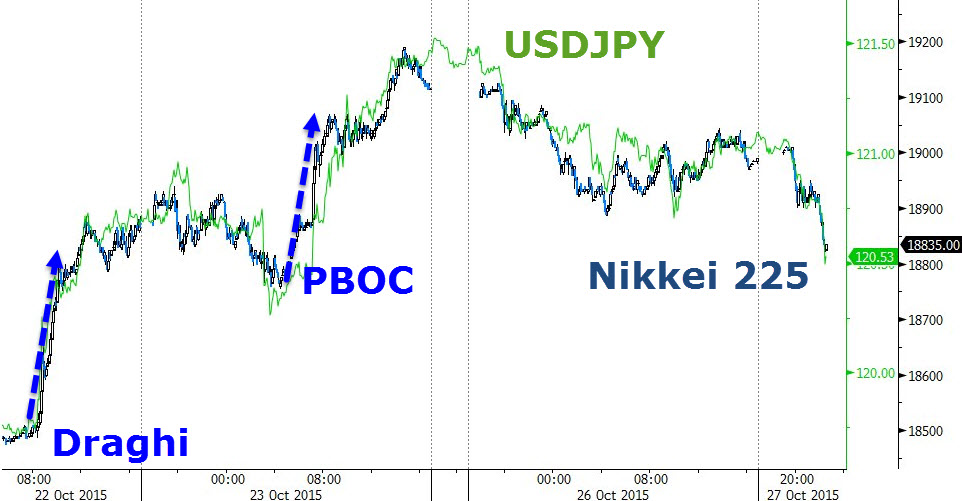

Two biggest move overnight came from everyone’s favorite carry pair, the USDJPY, which may have finally read what we said yesterday, namely that with the Fed and ECB both doing its job, there is little need for the Bank of Japan to repeat its Halloween massacre for the second year in a row, and as a result will keep its QQE program unchanged. It promptly tumbled from its 121 tractor level, to just above 120.25, where BOJ bids were said to be found.

Click on image to enlarge

With the FOMC October meeting starting today, the other overnight catalyst was not surprisingly the latest Hilsenrath scribe in which he removed any uncertainty about a Wednesday hike, “leaving mid-December as the central bank’s last chance to raise rates this year.”

The timetable poses twin challenges for Fed Chairwoman Janet Yellen: Deciding whether the U.S. economy is ready for an interest-rate increase, and signaling central bank intentions without causing further market confusion.

The problem is that not even Hilsenrath’s Fed “source” has any idea what will happen in December. “The Fed’s uncertainty is contagious. A Wall Street Journal survey of market economists this month found that 64% believe the Fed will raise rates by December. Futures markets put the odds at 35%.” Who’s wrong? Well, the Fed’s model of the economy, and the “dot plot” are certainly accurate, so it has to be the economy’s fault for not complying with the central planners’ vision:

One cause of the confusion isn’t the fault of the central bank. The economy isn’t cooperating. With unemployment falling rapidly, Ms. Yellen and most of her colleagues began the year thinking the economy would be strong enough to lift rates.

One of these years the Fed will realize that the reason the “economy isn’t cooperating” is because of the Fed. But don’t hold your breath, we give it at least another 24-36 months before the S&P is at 3000 and Yellen is still “confused.”

In other news, there was the usual macro disappointment, when UK Q3 GDP printed at 0.5%, below the 0.6% expected, and down from 0.7% in Q2, driven by the weakest construction sector contribution to GDP in years. Are the Chinese no longer buying?

Speaking of Chinese buying, perhaps they were not too excited about stocks, but with the SHCOMP down most of the day, we were relieved to see the National team stage its usual last hour intervention, and drag the Chinese stock market from down -2% to close up 0.14% with the traditional furious last hour ramp to eliminate the bitter aftertaste from the latest drop in industrial profits which dropped -0.1% Y/Y, following a -8.8% drop in August.

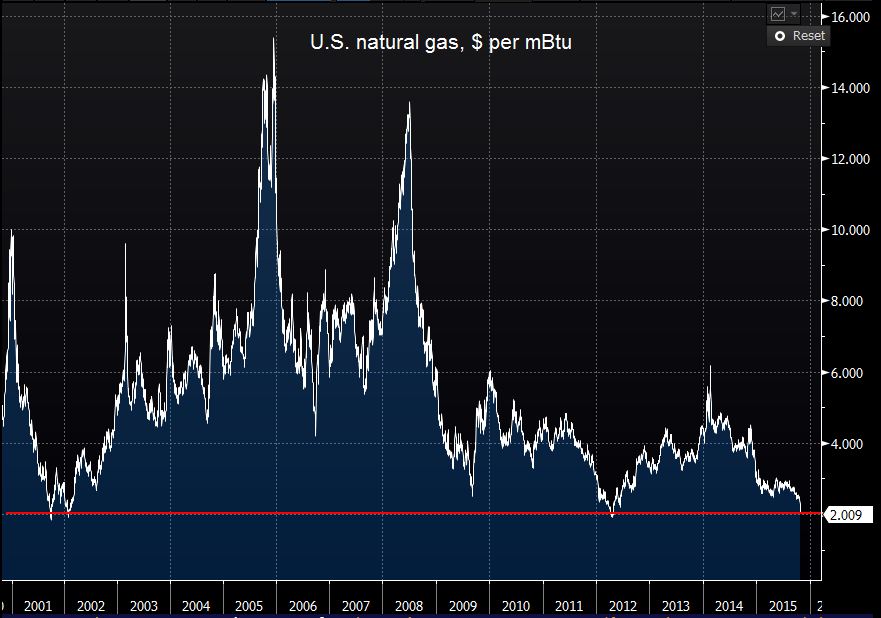

One thing the Chinese were definitely not buying was natgas which overnight dropped continued their steep descent and dropped below $2.00 for the first time since 2012 and just the 4th time in the 21st century.

Click on image to enlarge

Elsewhere in Asian equity markets traded lower led by the slump in Chinese stocks as they shrugged off the recent easing measures by the PBoC , while subdued trade was also observed as participants await the FOMC and BoJ policy decisions. Shanghai Comp. (+0.1%) retreated from 2-month highs amid a continued decline in industrial profits (-0.10% vs. Prey. -8.80%), however, heading into the European open some losses have been pared. Nikkei 225 (-0.9%) was pressured by losses in the energy sector which also weighed on the ASX 200 (0.0%). JGBs traded higher as the lacklustre risk sentiment drove inflows into the safer asset, while a stronger than prior 40yr auction added support.

European equities kicked off the session firmly in negative territory before paring the losses throughout the morning (Euro Stoxx: -0.1%). Equities have been weighed on notably by healthcare and materials names in the wake of downbeat earnings from Novartis (-1.4%) and BASF (-4.1%). While fixed income markets have seen Bunds continue to be supported by softer stocks, with Dutch 4.0% 2019 and 2.5% 2033 Bonds (equiv to approx 20k Bund futures) seeing a relatively successful auction. Of note, there is a fair amount of supply today, with ESM expected to issue 5y syndication and Cyprus’ lOy syndication.

Leave A Comment