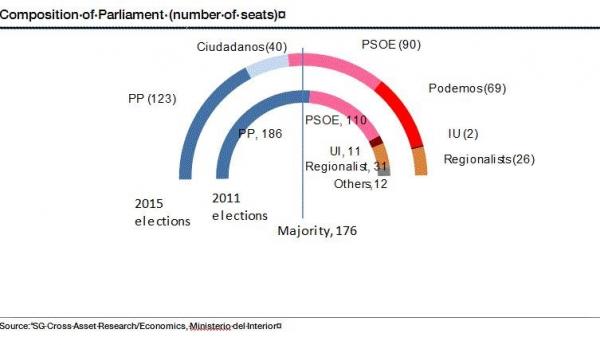

In a weekend of little macro newsflow facilitated by the release of the latest Star Wars sequel, the biggest political and economic event was the Spanish general election which confirmed the end of the PP-PSOE political duopoly at national level, with Rajoy’s leading block losing the absolute majority it had enjoyed since the last elections while rewarding the anti-austerity Podemos and the liberal Ciudadanos party, who between them took 109 seats in the 350-member parliament. As a result no clear governing majority emerged.

But the main surprise was the extent of the underperformance of liberal-reformist Citizens relative to opinion polls. This changes the post-election scenarios – a center-right coalition cannot reach a majority – and injects even greater political uncertainty. This isunlikely to be a positive development for markets.

“The [Spanish] election outcome failed to provide us a clear picture of who will take power,” said Anders Moller Lumholtz, chief analyst with Danske Bank in Copenhagen. “It is likely to take time before we get clarity, and uncertainty is not a friend of the market. ECB QE buying could cushion some of the knee-jerk reaction, but as Monday is the last day before the QE goes on pause we probably shouldn’t expect much effect from that side.”

As a result, there was some early underperformance in SPGBs and initial equity weakness across European stocks, which however was promptly offset and at last check the Stoxx 600 was up 0.4% to 363, even as China’s Shanghai Composite surged +1.8% with sentiment supported by the PBoC injecting CNY100 billion of funds into the interbank market, and US equity futures were up nearly 1% after Friday’s oversold drubbing.

In other key news, the commodity slide continues with Brent Oil dropping to a fresh 11-year low as futures fell as much as 2.2% in London after a 2.8% drop last week.

This is where markets are right now:

A closer look at regional markets shows Asian stocks trading mixed as stocks shrugged off Friday’s lacklustre close on Wall St. Nikkei 225 (-0.4%) underperformed albeit off worst levels amid JPY weakness, which pared earlier Toshiba led losses, while gains in energy name WorleyParsons, offset the healthcare sector pressure in the ASX 200 (+0.10%). Shanghai Comp. (+1.8%) traded higher with sentiment supported following reports that regulators approved the first cross-border mutual funds and the PBoC injecting CNY 100 bln of funds into the interbank market. JGBs finished marginally lower with trade lacking any significant price direction ahead of the holiday season, while the BoJ were in the market to purchase JPY 1.08trl in government bonds. Elsewhere, USD/CNH fell after the PBoC firmed the reference for the 1st time in 11 days. Finally, heading into the European open, JPY saw a bout of weakness as risk sentiment picked up.

Top Asian News:

Leave A Comment