There is a mixed picture in Asia today as Chinese stocks are trading higher while Japanese Stocks are trading in the red, in a low volatility environment caused by the general lack of investor speculation amid a holiday week. The USD is slightly stronger against a basket of currencies while Gold dropped to 1066 from 1071.50 on Friday. Overall CAD remains the weakest currency this month as the drop in oil prices has taken its toll on the so called Loonie, while EUR is the strongest. Generally, it’s not expected that markets will be particularly active this week due to the Holiday season. In terms of news, today we have the German PPI followed by EZ consumer Confidence. This week the main focus will be US durable goods, personal income and spending, new home sales and jobless claims. UK and US will release Q3 GDP.

Trading quote of the day:

What seems too high and risky to the majority generally goes higher and what seems low and cheap generally goes lower.

William O’Neil

Green lines are resistance, Red lines are support.

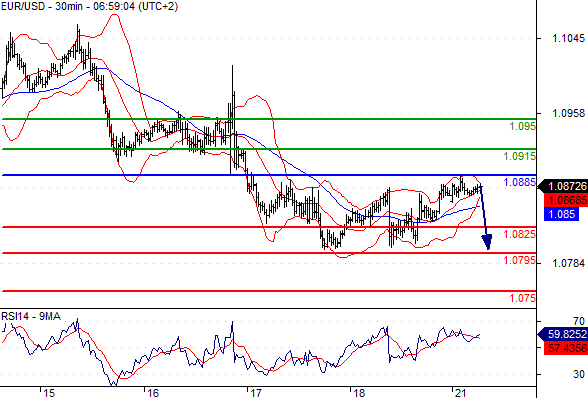

EUR/USD

Pivot: 1.0885

Likely scenario: short positions below 1.0885 with targets @ 1.0825 & 1.0795 in extension.

Alternative scenario: above 1.0885 look for further upside with 1.0915 & 1.095 as targets.

Comment: intraday technical indicators are mixed and call for caution.

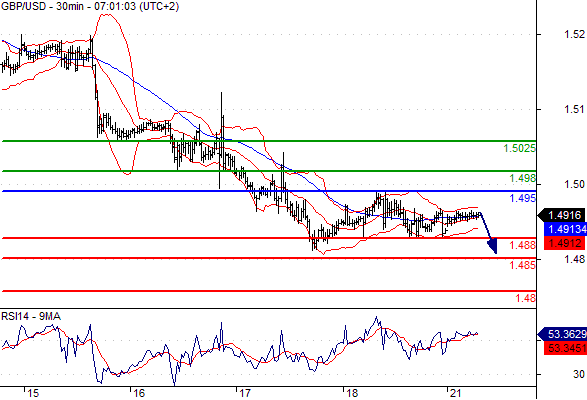

GBP/USD

Pivot: 1.495

Likely scenario: short positions below 1.495 with targets @ 1.488 & 1.485 in extension.

Alternative scenario: above 1.495 look for further upside with 1.498 & 1.5025 as targets.

Comment: the RSI lacks upward momentum.

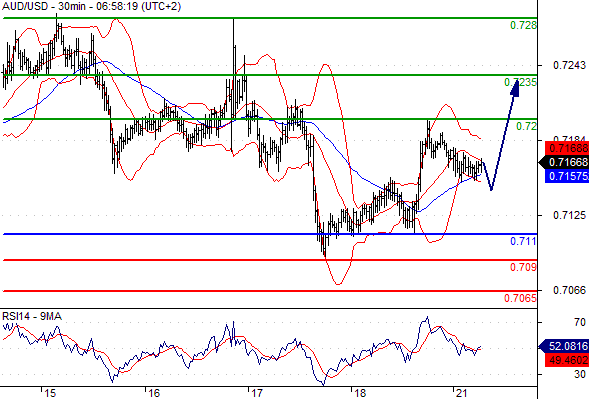

AUD/USD

Pivot: 0.711

Likely scenario: long positions above 0.711 with targets @ 0.72 & 0.7235 in extension.

Alternative scenario: below 0.711 look for further downside with 0.709 & 0.7065 as targets.

Comment: even though a continuation of the consolidation cannot be ruled out, its extent should be limited.

USD/JPY

Pivot: 121.75

Likely scenario: short positions below 121.75 with targets @ 120.85 & 120.55 in extension.

Alternative scenario: above 121.75 look for further upside with 122.15 & 122.6 as targets.

Comment: the RSI lacks upward momentum.

Leave A Comment