Asian bourses and European shares fell after surprisingly bad Chinese PMI and Japanese econ data added to a perceived hawkish tilt in Fed policy emerging from Chair Powell’s testimony which weighed on global equities. Benchmark Treasury yields held near a four-year high and the dollar was steady after Tuesday’s jump.

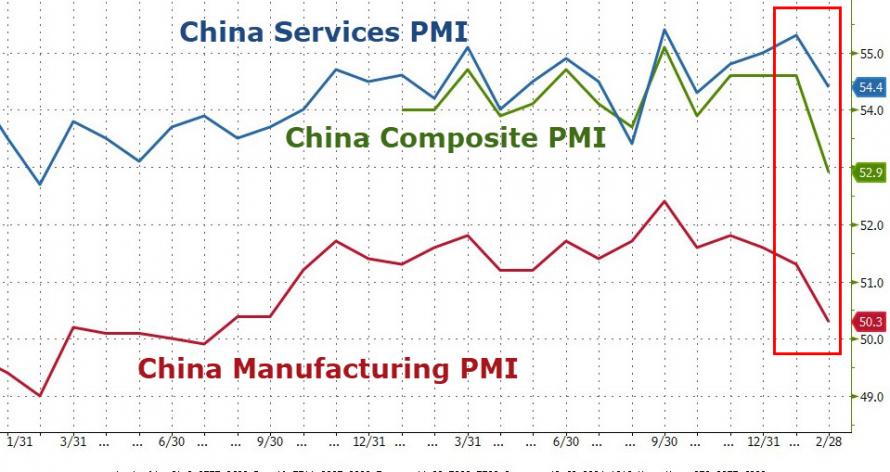

As a reminder, in addition to the unexpectedly hawkish Powell testimony, surprisingly bad Chinese PMI and Japanese econ data with a broadly weak set of Mfg and Service surveys, as the Chinese NBS Manufacturing PMI printed 50.3 vs. Exp. 51.1 (down from 51.3), and the lowest since September 2016, while the Chinese NBS Non-Manufacturing PMI dropped from 55.3 to 54.4 vs. Exp. 55.0.

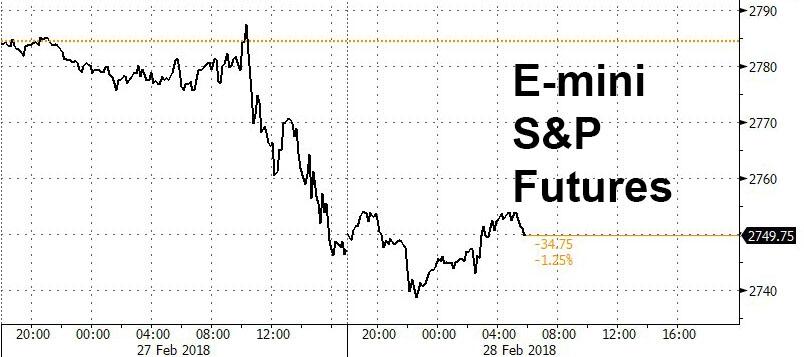

The result has been a sea in most global stock markets…

… if not S&P futures, which after hitting session lows shortly before midnight ET have managed to stage another modest rebound and were on the green side of unchanged this morning.

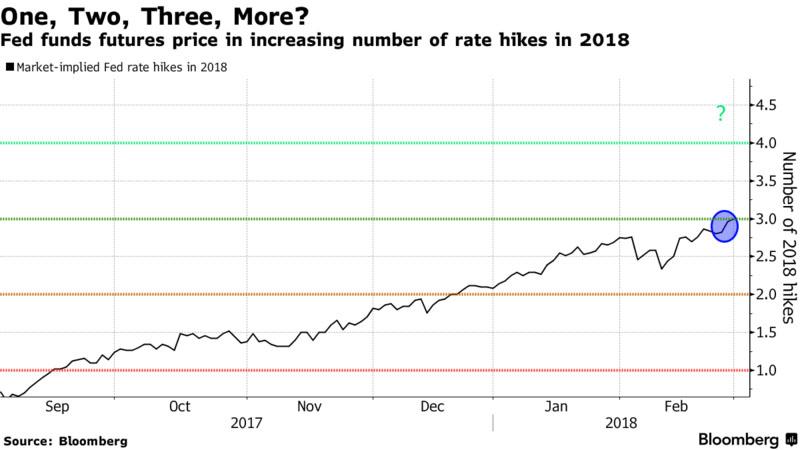

As noted above, the watercooler topic this morning was Fed Chair Jay Powell’s upbeat assessment of the world’s biggest economy, whose inaugural testimony provided a hawkish view on inflation and was also optimistic on economic growth, which raised the prospects of 4 hikes for this year and subsequently weighed on equity markets across the globe. The market noticed, and has pushed the number of priced-in Fed hikes for 2018 to precisely 3, the highest yet; a little more hawkishness from Powell and the market will start considering 4 hikes as a realistic option.

“What the markets are telling you today and year-to-date is that interest rate hikes are expected and that’s getting priced in,” Medha Samant, Fidelity International investment director, told Bloomberg TV. “The question is, despite all the upbeat data that we see coming out of the U.S., what is going to be the pace of these rate hikes and how quickly is it going to happen.”

Still, not everyone is convinced: as SocGen’s Kit Juckes notes in the aftermath of the disappointing Chinese PMI data, “it would take a big surprise from US ISM data to avoid a second monthly decline in global PMI measures. That, along with falling economic surprise indices, and signs that at a global level inflationary pressures aren’t noticeably building, fuels the view that the growth spurt at the end of 2017 is now behind us. The case for fading the long-end Treasury sell-off would seem to be growing” (more on this note shortly).

Investors’ focus now shifts to U.S. GDP data due Wednesday after Powell opened the door to four Fed rate increases this year, saying his personal outlook for the economy had strengthened. U.S. and European bond yields have soared in recent months amid speculation that the Fed’s monetary policy will be tightened at a faster pace, but for equity investors, that’s testing nerves. As Bloomberg notes, global stocks are poised for their worst month since January 2016 after years of central-bank stimulus push up valuations.

* * *

Meanwhile, European equities slide in tandem with their U.S. and Asian counterparts as investors digested Powell’s testimony; miners lead declines after weaker-than-expected China manufacturing PMI data. However, losses have been pared throughout the morning (Eurostoxx 50 -0.4%). In terms of sector specific performance, movements have been relatively broad-based with support for IT names following strong earnings from Dialog Semiconductor (+10%) which has sent their shares to the top of the Stoxx 600, energy names also firmer as crude modestly recoups some of its post-API losses. Most euro-area and U.K. bonds rise, while Germany underperforms after a soft 10-year auction.

The MSCI Asia Pacific Index also dropped across the board as the impact from Fed Chair Powell’s testimony reverberated in the region and as participants also digested disappointing Chinese PMI data. ASX 200 (-0.7%) and Nikkei 225 (-1.4%) were lower with the worst performers in Australia also dampened by poor earnings results, while Nikkei 225 suffered from a firmer JPY as well as weak Industrial Production and Retail Sales data. Elsewhere, Hang Seng (-1.4%) and Shanghai Comp. (-1.0%) were the early laggards.

Of note: Bloomberg highlights that Chinese offshore investors became sellers of mainland-listed equities in February for the first time since 2016, dumping net 564 million yuan ($89 million) of A shares via the exchange links with Shanghai and Shenzhen, Bloomberg calculations based on daily quota usage showed. That translates into average daily net selling of 37.6 million yuan.

Elsewhere, the Bloomberg Dollar Spot Index consolidated and stays near 2 1/2-week high seen yesterday; yen outperforms after the Bank of Japan cut purchases of ultra-long JGBs, although offsetting tapering fears, the BOJ left its planned bond purchase amounts for March unchanged from February. The Bloomberg Dollar Spot Index is set to halt a three-month decline, with the yield on Treasury 10-year notes holding around 2.9%, close to cycle highs.

On the topic of the dollar, Citi writes that “all anyone in markets can talk about Jerome Powell, but has the game really changed that much overnight? Any sustained USD strength from here faces evident headwinds, but in the short-term, today is month-end, which might mean just the opposite.”

Indeed, it has been another difficult day for euro bulls as a still-crowded trade becomes a pain one for leveraged names. The euro briefly slipped below 1.22 handle for the first time since Jan. 18 as leveraged names that have been supporting the common currency in the past week offload part of their longs, but euro-area inflation data which met estimates helped to keep the currency off its day low. Month-end flows do no favors as they lean toward the dollar-supportive side, keeping cable below 1.3900 ahead of the EU’s draft Brexit treaty.

Elsewhere, crude oil was little changed as the International Energy Agency warned about seemingly unstoppable U.S. shale production. Sterling added to yesterday’s decline as U.K. Prime Minister Theresa May squared off for a fight with the European Union over a Brexit deal. Brent crude recovered from day lows, though remains below $67/barrel, with WTI crude near $62.60. Traders will also be mindful of yesterday’s source reports stating that OPEC are set to meet with US shale producers next Monday. In metals markets, spot gold is particularly flat today in the wake of yesterday’s Powell-inspired sell-off whilst Chinese steel futures were seen higher overnight with the move to the upside capped by soft demand. Dalian iron ore weakens for second day.

Leave A Comment