While the focus in the overnight session has traditionally been about two things, namely oil and China, today one can also throw in AAPL which is down 4% in the pre-market after its disappointing earnings yesterday in which it confirmed our channel-checked warnings about China from last summer, and the Fed which is set to release the January FOMC statement this afternoon.

Unlike yesterday, when the National Team allowed stocks to tumble, today the Chinese Plunge Protection Team intervened, and with the Shanghai Composite down as low at 2,638, the benchmark stock index pared the loss of as much as 4.1%, spurred by rallies for PetroChina, ICBC and other shares that are long considered favorite holdings of state-linked rescue funds. The result was a -0.52% drop in the composite, preventing what could have been the latest two-day -10% correction.Still, after today’s close the index dropped to the lowest since December 2014.

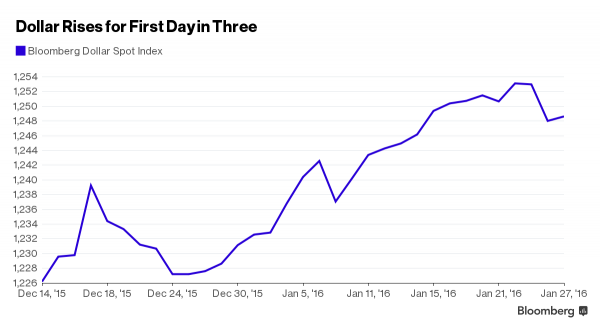

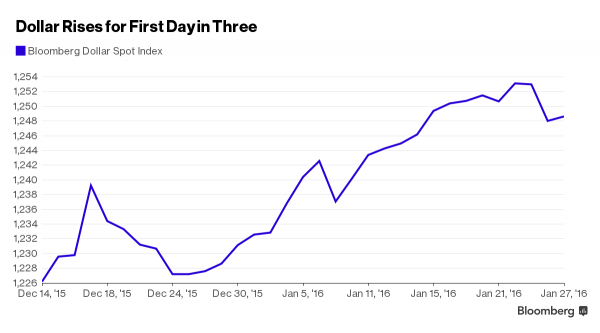

With the Fed set to take center stage today, the dollar’s prospects – which increasingly many recognize needs to somehow decline to avoid a worsening global recession – rest on the wording of the Fed’s policy statement. Since the U.S. central bank raised interest rates on Dec.16 for the first time in almost a decade, a Bloomberg gauge tracking the dollar against 10 of its leading global peers has risen 1.5 percent, touching a record high on Friday. Those gains have been fueled in part by indications from the Fed that there will be four rate hikes in 2016. Investors are watching for any deviation from that plan. Traders have been more dovish than the Fed, pricing in roughly one rate increase this year. At the end of December the odds of a March move were 51 percent. Fed fund futures now put the probability at 25 percent.

Elsewhere, Apple showed that contrary to Tim Cook’s email to Jim Cramer, the tech company isn’t immune to China’s troubles. The world’s biggest company is beginning to see “economic softness” in Greater China, which includes Taiwan and Hong Kong. Apple also projected its first quarterly sales decline since 2003

The negative sentiment weighed in on crude, and after yesterday’s gargantuan 11.4 million barrel API inventory build, oil resumed declines amid further evidence of a global glut, dragging European stocks and U.S. equity index futures lower before the Federal Reserve’s first policy statement this year. European bonds gained and the yen strengthened.

West Texas Intermediate crude fell toward $30 a barrel after U.S. industry data showed stockpiles increased. European stocks deepened a monthly rout as disappointing earnings reports reignited investor concern about global growth prospects, with Apple Inc. forecasting its first drop in sales since 2003. Yields on Treasuries due in a decade held at around 2 percent and German note yields fell to record lows, while Malaysia’s ringgit climbed to a seven-week high as Prime Minister Najib Razak was cleared in a corruption probe.

Today it wasn’t just about crude: as Bloomberg adds, Iron ore will will be the worst performing metal this year. That’s the verdict of the World Bank, which cites low-cost supply outstripping consumption. The Washington-based lender says prices will average $42 a metric ton in 2016, a drop of 25 percent from 2015. Ore with 62 percent content delivered to Qingdao, a global benchmark, sank to a record low of $38.30 in December, having lost almost half its value last year. The slowdown in China has restricted demand from the world’s biggest user. At the same time the biggest mining companies are raising production to build market share. The World Bank forecasts nickel may fall 16 percent in 2016, while copper may drop 9 percent.

“Nobody is really sure where we go from here, and nobody is brave enough to make the call,” Peter Dixon, Commerzbank AG’s global equities economist in London told Bloomberg. “Corporate earnings season won’t provide much of a support – markets may find a floor if the Fed is extremely dovish tonight. At least investors will have time to think and reassess valuations.”

Looking at markets around the globe, we start in Asia, where stocks traded mostly higher following the firm close on Wall St. where strong earnings and a rebound in the energy complex supported risk sentiment. Nikkei 225 (+2.7%) was led higher by the telecoms sector after index giant Softbank rose the most in 21 months following strong earnings report from its Sprint unit, while the ASX 200 (-1.2%) traded lower as it played catch up to yesterday’s regional losses on its return from holiday. Shanghai Comp. (-0.5%) initially underperformed after Chinese industrial profits printed its largest decline in 4 months and 4th consecutive monthly decline, however, the index was granted some reprieve heading into the EU open amid support for energy names. 10yr JGBs traded higher despite the inflows into riskier assets, while the BoJ also entered the market to purchase JPY 1.26tr1 in government bonds.

Leave A Comment