Could the U.S. economy grow faster than the current forecast? This is important not just to the political arguments for the tax cut, but for business planning. How much growth your company should plan for depends critically on how much the economy grows. (This content is available on video.)

Video Length: 00:05:55

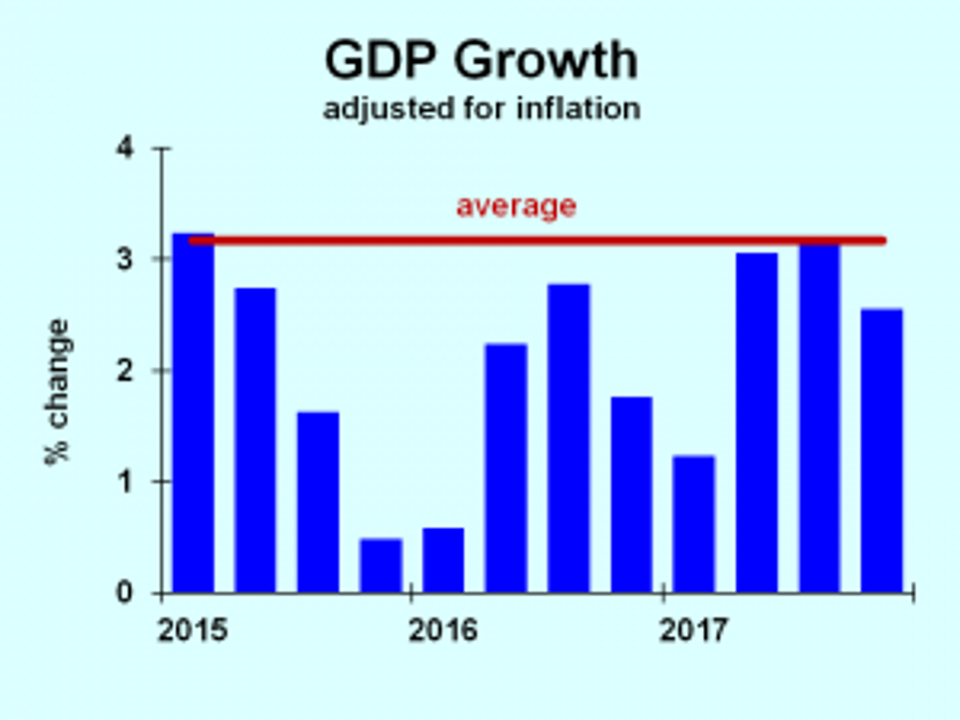

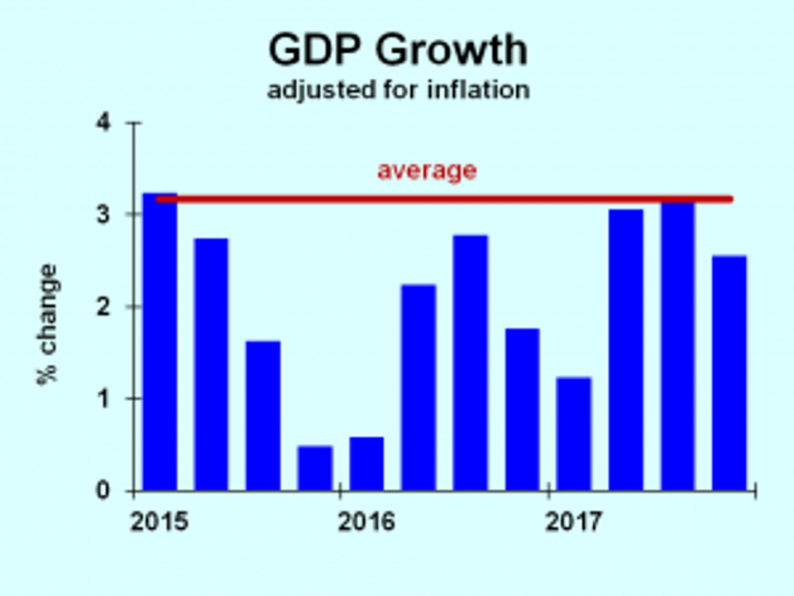

Let’s look at recent economic growth, using data as of February 2018. The last three quarters have been near average, but earlier growth was sub-par. The economy reminded me of my 5th grade report card. Mrs. Anderson wrote, “Bill does not work up to his potential.” That was 5thgrade. And 6th grade. Through to graduate school.

Dr. Bill Conerly based on data from Bureau of Economic Analysis – GDP

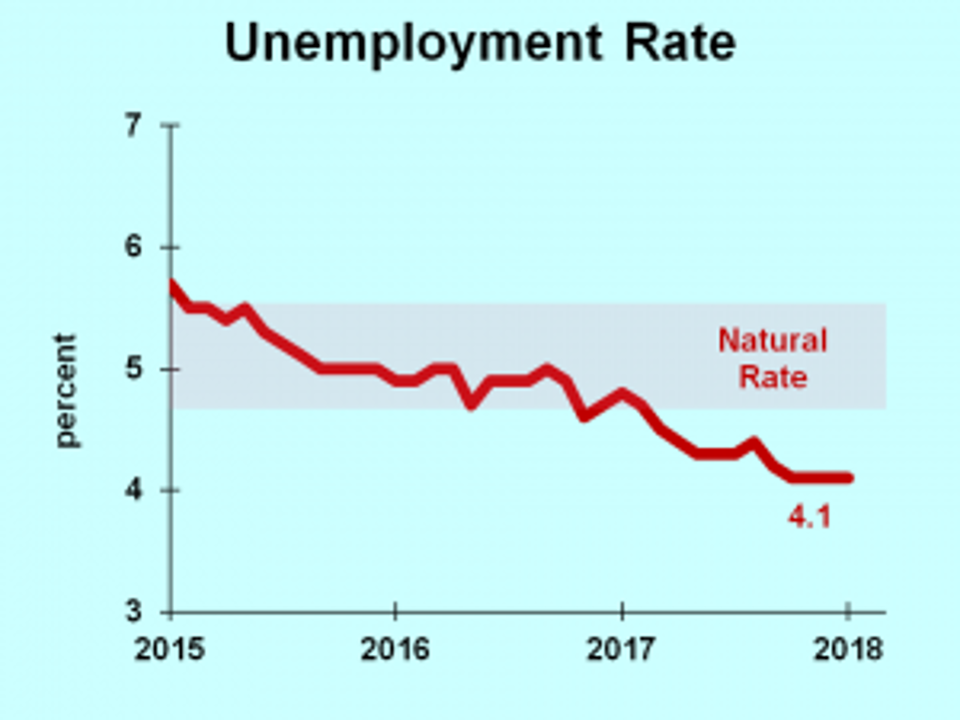

Now most economists are predicting a good 2018, but how good could it get? We have very low unemployment, just 4.1 percent. The “natural rate” is around 5 percent. We say that because some unemployment is normal. As people first enter the labor force, it takes them time to find jobs. And if one job is lost at the same time that another company adds a position, it will take some time for the job-seeker to find the employer. (The natural rate is not known with certainty, so I represent it with a band reflecting various estimates.)

Dr. Bill Conerly based partially on data from Bureau of Labor Statistics – unemployment

We are currently below the natural rate of unemployment, and some simple economic models say we can’t grow faster than normal because of this limit. Here’s how I think of it. Low unemployment is not a brick wall. It’s more like a rubber wall. Yes, it’s a wall, but it has some give. If we push hard enough, we can find more workers.

So let’s look at the overall economy. Total output equals output per hour, multiplied by the number of hours worked. Let’s look at each factor and see if there’s room to grow.

Output per hour worked we call productivity. It jumps around a lot, but it has been low recently. Here are the upside possibilities. First, capital spending usually boosts productivity. That can mean fancy robots with artificial intelligence, or just a more efficient version of your order entry software. And capital spending is likely to grow. Incentives in the new tax bill will increase capital spending. An additional boost comes from the tight labor market itself. People worry about robots replacing people. The first wave of capital spending this year will be machines and software replacing empty chairs, positions that companies could not fill because of the tight labor market.

Leave A Comment