Fundamental Forecast for GBP: Neutral

STERLING (GBP) TALKING POINTS:

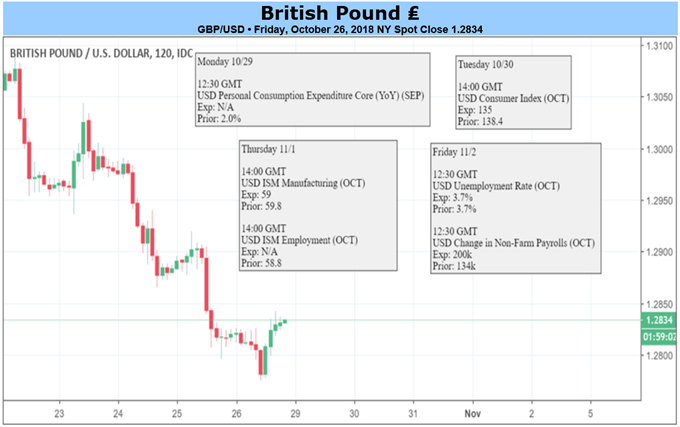

Sterling continues to falter against an uncompromising Brexit background with no-deal expectations growing as the UK government’s internal fighting continues. Earlier this week PM Theresa May survived a meeting with the influential 1922 Conservative Committee and remains in her role, although the numbers of letters of no confidence in the Prime Minister are said to be very close to triggering a leadership contest. The EU will be looking at the internal politicking in the government closely and at present are in no rush to make any concessions – primarily over the Irish border – to help push a deal forward.

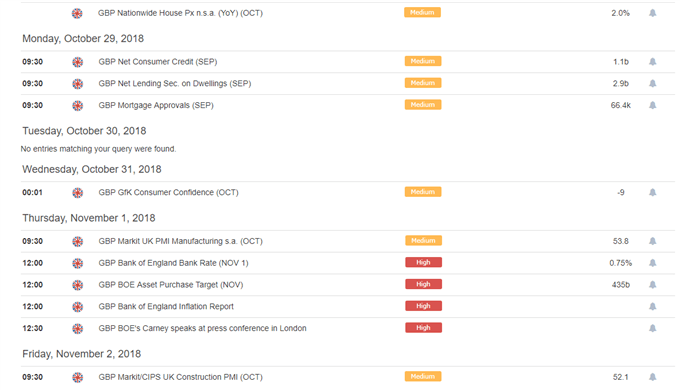

The Autumn Budget on Monday may bring some slight relief from current austerity policies, and a funding boost for the NHS, but Chancellor Hammond’s hands are tied as he continues to make contingency plans for a potential no-deal Brexit. The Chancellor is expected to change rules so that pension funds can be used to fund start-up businesses and infrastructure projects.

On Thursday the Bank of England will likely keep all monetary policy settings unchanged and may lower growth and inflation forecasts for the foreseeable future, sending out a message that interest rates are not going to be hiked until at least mid-next year. As always, all remains dependent on the outcome of UK-EU negotiations.

Brexit Effect on Pound and UK Stocks – Impact of a Deal or No Deal.

IG Client Sentiment data show that retail investors are 77.0% net-long GBPUSD, a bearish contrarian indicator. However, recent daily and weekly shifts in sentiment give us a strong GBPUSD bearish bias.

GBPUSD continues to be hit on both sides and remains pointed to the downside. The August 15 low at 1.2662 remains the obvious target as things stand.

Leave A Comment