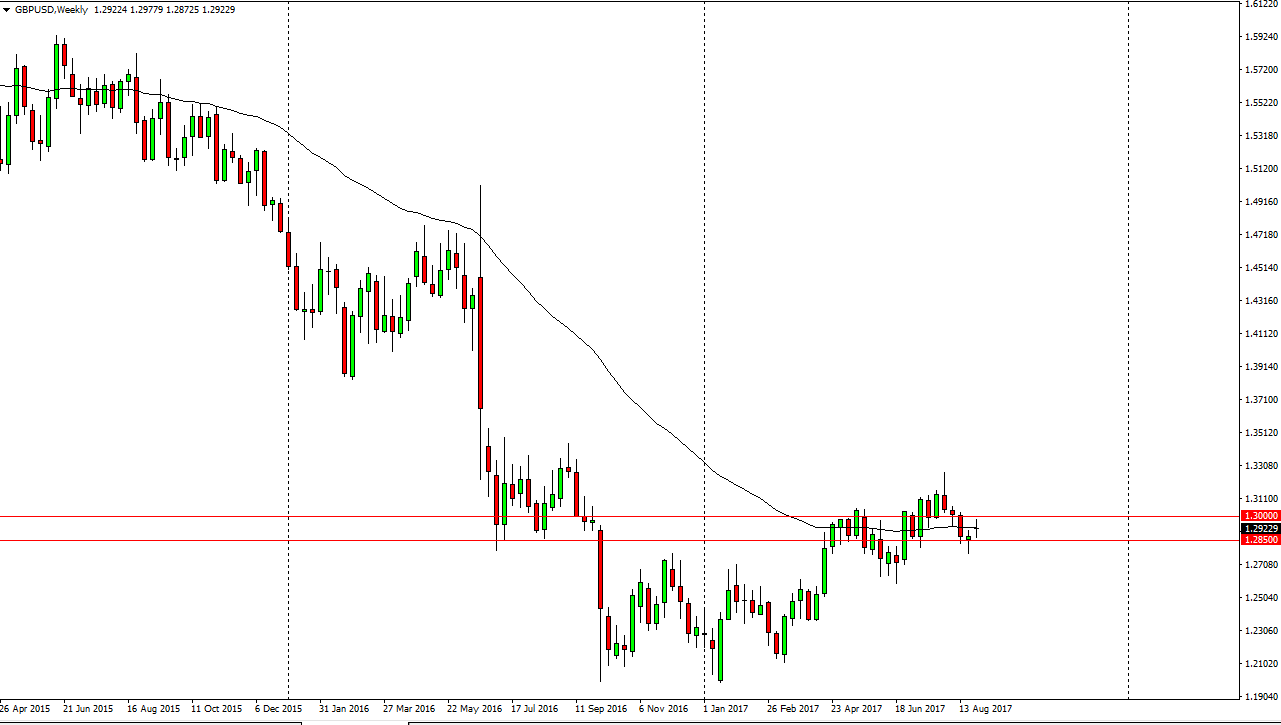

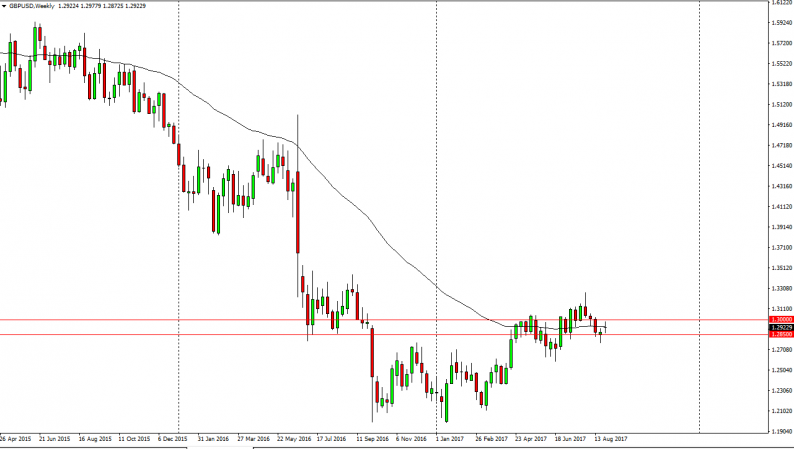

The British pound has been very volatile over the last several weeks, and as we roll into September we should see a significant amount of volume jump into the marketplace. I think that we will more than likely see a significant amount of choppiness, and I don’t expect some type of massive move in the short term. I think there are a lot of concerns when it comes to the British economy, and with the Federal Reserve looking a bit soft after the hurricane in Texas, I think this market might essentially be “dead money” in general. That’s not to say that we can’t go higher or lower, I just don’t think that we go very far. Short-term trading will probably continue to be the norm over the next several weeks, with the 1.33 level above being resistance, and the 1.27 level at the bottom offering support.

Short-term charts, small positions

There is an argument for short-term trading going back and forth, but I think you would have to do small positions. Ultimately, this is a market that could offer a lot of scalping opportunities, and if you are short-term trader, this could be a good month for you. However, if we break above the 1.33 handle, the market probably goes to the 1.35 handle next. Alternately, if we break down below the 1.27 level, the market probably goes down to the 1.25 handle. Ultimately, this is a market that will be difficult but I think that there will be potential opportunities on the chart such as the 15 minutes level. If you have the ability to trade options, that might be opportunity as well. Clarity involving the United Kingdom leaving the European Union is probably going to be necessary to put any real amount of money to work.

Leave A Comment