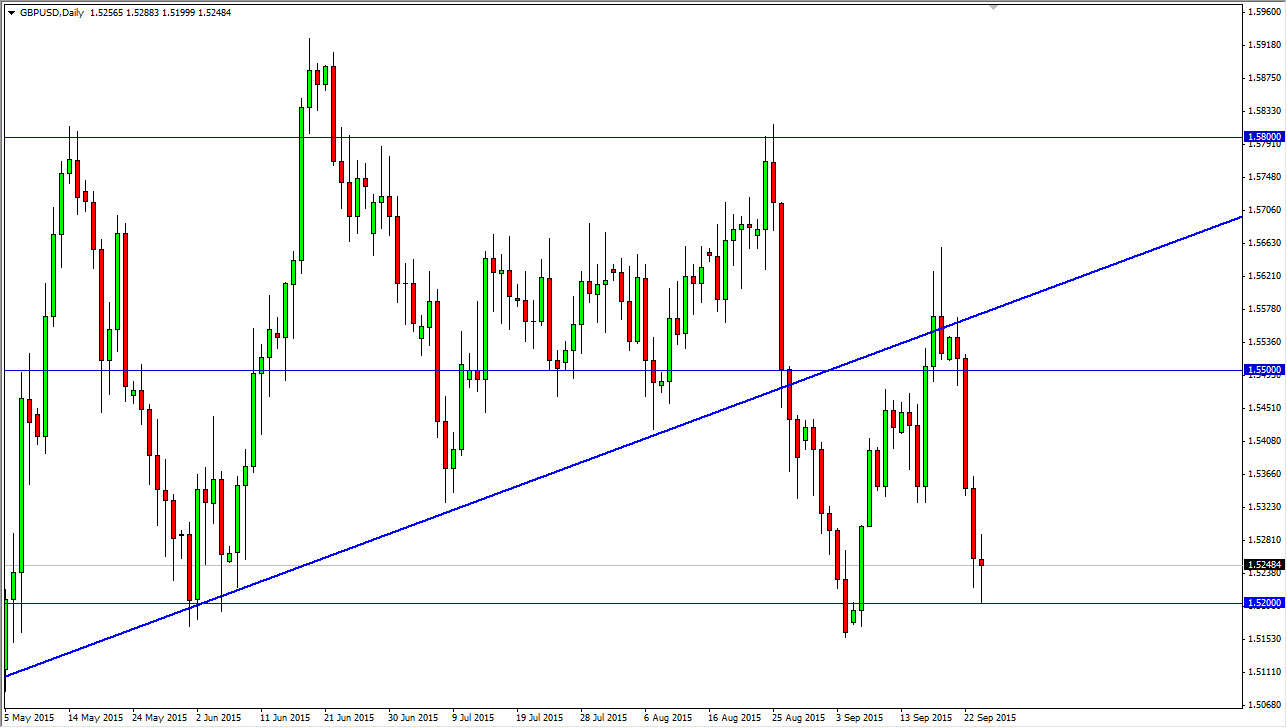

The GBP/USD pair is showing significant support after the Thursday session, as we tested the 1.52 handle for support. That area of course did offer it, and as a result the market ended up forming something akin to a hammer. That hammer of course is a positive sign, and it’s very likely that we could get a bit of a bounce at this point.

If we break the top of this hammer, I think we will reach back towards the 1.54 region. However, I would anticipate that there would be a lot of resistance in that area, and most certainly so at the 1.55 handle. When I look at the totality of this particular currency pair, I see that we have broken down below and uptrend line that had supported the market for the entirety of the summer. The normally means that the market is going to fall significantly, but it will quite often turned back around to test that previous support for resistance. We have done so, and then have fallen yet again.

A fresh new low?

If we can make a fresh new low, and other words break down below the 1.5150 level, I think this market could really fall apart and head towards the psychologically significant 1.50 handle. Any rally at this point time is going to have to deal with a significant amount of bearish pressure though, so unless you are short-term trader it’s going to be almost impossible to buy this pair. With that being said, I think it’s just simply going to be much easier to wait for the breakdown or perhaps the rally and signs of exhaustion in order to start selling. With this, I personally will not be buying this pair but do recognize that short-term traders may be able to as the bounce seems to be trying to telegraph itself. I will be patient, but money will more than likely be offered on both sides of the aisle this time.

Click on picture to enlarge

Leave A Comment