General Electric (GE) is one of the most unloved blue chip stocks. Almost anywhere you read a GE article on the internet, commentators are quick to rip into CEO Jeff Immelt, the company’s poor capital allocation decisions, the dividend cut during the financial crisis, the bureaucracy, the lack of capital returned to shareholders, the company’s deceptive PR efforts, and more.

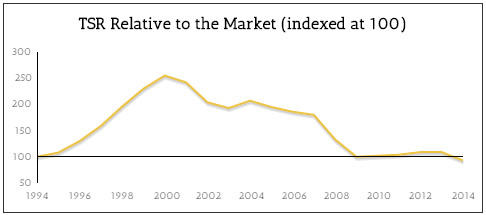

And why not – there is plenty to be frustrated about if you are or were a long-term GE shareholder. Since Immelt took over the role of CEO from Welch in 2001, GE’s total shareholder return (includes dividends) is a whopping 0%. Without dividends, the stock is down more than 35% compared to the near doubling of the rest of the industrial sector.

As seen below, GE’s total shareholder return (“TSR”) has trailed the market just about every year since 2000 (represented by a falling line). The financial crisis dealt the company a huge blow in 2008, but the stock has actually performed more in line with the market since then, compounding at a respectable 14.4% annualized rate from 2010-2014.

With so many investors still anchored on GE’s lost decade and expressing distrust toward Immelt and his ongoing portfolio transformation efforts, we see an interesting investment case building for long-term dividend investors and include GE in our Top 20 Dividend Stocks list.

Most analysis on GE is quick to rip the mistakes the company has made over the last 15 years – selling NBCUniversal not long after the financial crisis, possibly leaving significant money on the table; overpaying for a biotech firm acquired in 2004 for $10 billion; overextending into too many non-core markets; mismanaging its bank operations, resulting in a shocking dividend cut during the crisis; overpaying management and diluting shareholders, etc. While taking a few potshots at GE is easy, the factors that have made GE an industrial giant in the first place and that persist today are just as easily overlooked.

Of the 12 firms that constituted the original Dow Jones Industrial Average in 1896, GE is the only one still on the list. Surviving for more than 100 years is no small feat and speaks to the company’s historical innovation and managerial skill. R&D has been at the core of GE’s industrial operations for more than a century, and the long-term track record of many of its technologies are likely a key selling point when it comes to bidding on new deals – given the mission-critical nature of GE’s products, customers would prefer to buy from a vendor that can provide decades of equipment performance data. Today, GE invests about $5 billion per year into R&D to ensure its products remain competitive and further benefits from sharing insights between its industrial divisions, which often share technologies like turbines or imaging capabilities.

The future GE will look quite different from the GE of the past, assuming management executes successfully on the current plan. As seen below, GE’s industrial earnings are expected to grow from 57% of total earnings in 2014 to more than 90% of total earnings by 2018 (up from just 37% in 2001) as the company divests its non-core GE Capital assets. The remaining financial operations will focus on providing commercial and industrial loans and equipment and aircraft leasing, supporting the industrial core. GE Capital almost killed the company during the financial crisis and adds significant complexity to analyzing GE’s business, so this is a very welcome change from our perspective.

GE’s industrial core consists of a handful of business lines selling multi-million dollar products such as gas turbines, aircraft engines, oilfield equipment, locomotives, and medical imaging. The majority of revenues are overseas. To understand the dominant market share GE has accumulated across most of its markets (e.g. 30% in the global engine & turbine market vs CAT at 19%; 49% in wind turbines vs Vestas Wind Systems at 18%), a closer look at the company’s three competitive advantages is needed – economies of scale, long-term customer relationships, and continual investment in R&D.

GE’s sheer size provides it with tremendous purchasing power over its suppliers. When combined with the company’s long focus on lean six sigma, GE can underbid most competitors for contracts to supply customers with large equipment. Once GE has secured a deal, it enjoys service contracts lasting 10-20+ years to keep customers’ mission-critical equipment up and running. This is where the real money is made because service contracts generate 30%+ margins, keep the customer further locked in with GE, and elevate switching costs.

Leave A Comment