Gilead Sciences Inc. (GILD – Free Report) released its third quarter fiscal 2016 financial results, posting earnings of $2.70 and revenues of $7.4 billion. GILD is a Zacks Rank #5 (Strong Sell), and is up 0.24% to $74.25 per share in after-hours trading shortly after its earnings report was released.

Missed earnings estimates. The company reported earnings of $2.70 cents per share, lagging behind the Zacks Consensus Estimate of $2.74 per share. This number excludes 21 cents from non-recurring items.

Beat revenue estimates. The company saw revenue figures of $7.4 billion, surpassing our consensus estimate of $7.387 billion but decreasing 9.5% year-over-year.

Antiviral product sales, which include primarily products in Gilead’s HIV and liver disease areas, were $6.8 billion for the third quarter of 2016 compared to $7.7 billionfor the same period in 2015.

Other product sales, which include Letairis® (ambrisentan), Ranexa® (ranolazine) and AmBisome® (amphotericin B liposome for injection), were $564 million for the third quarter of 2016 compared to $509 million for the same period in 2015.

Gilead reiterated its full year 2016 guidance, with revenues expected to be in the range of $29.5 billion to $30 billion.

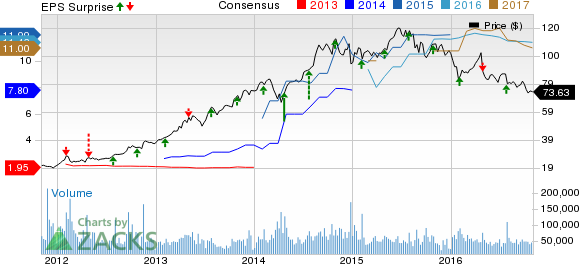

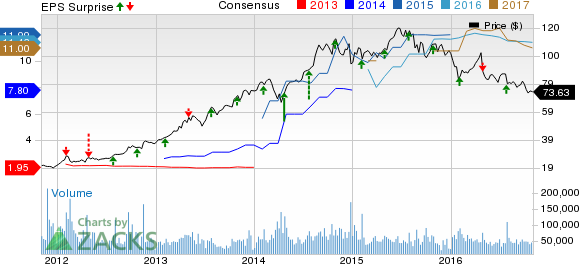

Here’s a graph that looks at Gilead’s price, consensus, and EPS surprise:

GILEAD SCIENCES Price, Consensus and EPS Surprise

GILEAD SCIENCES Price, Consensus and EPS Surprise | GILEAD SCIENCES Quote

Gilead Sciences, Inc. is an independent biopharmaceutical company that seeks to provide accelerated solutions for patients and the people who care for them. They have a broad-based focus on developing and marketing drugs to treat patients with infectious diseases, including viral infections, fungal infections and bacterial infections, and a specialized focus on cancer. They have expertise in liposomal drug delivery technology, a technology that the company uses to develop drugs that are safer, easier for patients to tolerate and more effective.

Leave A Comment