The last 10 days have been fascinating in particular with reference to 2 stocks that have dominated the headlines – Volkwagen (Cars) and Glencore (commodities). VW has suffered a major hit it was a €220 stock 3 months ago, today it closed at around €106 per share with much of the collapse in the last 10 days. As fear about US fines, product recalls and lawsuits rattle investors. See chart below:

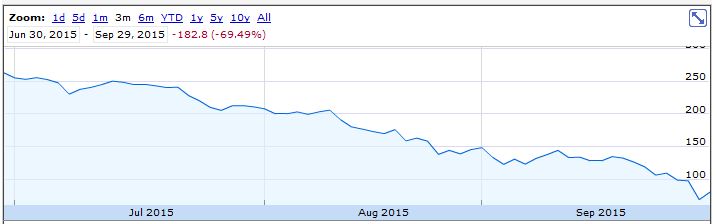

Next we have Glencore a commodities all rounder collapsing in price – 3 months ago 250 pence a share today closing at 80 pence a share with a complete rout in the last month (140 pence to 70 pence yesterday). Of course the bigger story is it came to the stock market at 510 pence in May 2011. So you are crying if you bought then!

Well these share prices might be justified in worst case scenarios. Yes Volkswagen (VLKAF) might be fined $34,000 per car times 500,000 units in the US, it might be sued by dissatisfied car buyers in the US and Europe that were misled about its emissions. There will be product recall charges and tighter controls meaning more costs going forward. Similarly with its mountain of £30 billion of debt combined with the current low price of commodities then Glencore (GLCNF) might be worth 80 pence a share in a worst case scenario.

However, these are really worst case scenarios which may have a 10-15% chance of happening. You can also make out a positive cases for both companies arguing they are at least 50% undervalued (eg Volkswagen fines are a lot less and commodity prices rise). Hence as a long term investor you want to buy at low prices for these two great companies which are now pricing in only worst case scenarios. There is an 85% chance that they are significantly undervalued,. So its simple, buy low and sell high. In one year’s time neither of these companies will be bankrupt and both have good long term business models and good prospective profits. The worst case scenario for VW will not happen and the same is true of Glencore. Also commodities won’t get much cheaper and Glencroe can be restructured, assets sold off to reduce the debt and raise their profits. So yes both are a great risk return investment for the next year or two at today’s market price.

Leave A Comment