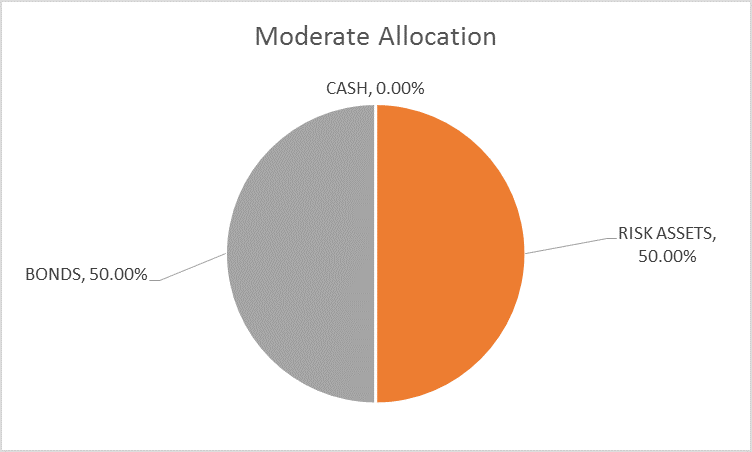

The risk budget is unchanged again this month. For the moderate risk investor, the allocation between bonds and risk assets is 50/50.

Decoupling anyone? That’s what the market is whispering right now, that the recent troubles in foreign economies is contained and won’t affect the US. The most obvious example of that trend is the performance of US stocks versus the rest of the world. I am painfully aware of the divergence in performance as I have had the temerity to try and diversify my portfolio away from very expensive large-cap US stocks. That has been a mistake for going on a decade now and one has to wonder if diversification is still the free lunch Harry Markowitz thought. The bill for continuing to believe it prudent to own a variety of assets has been particularly steep this year.

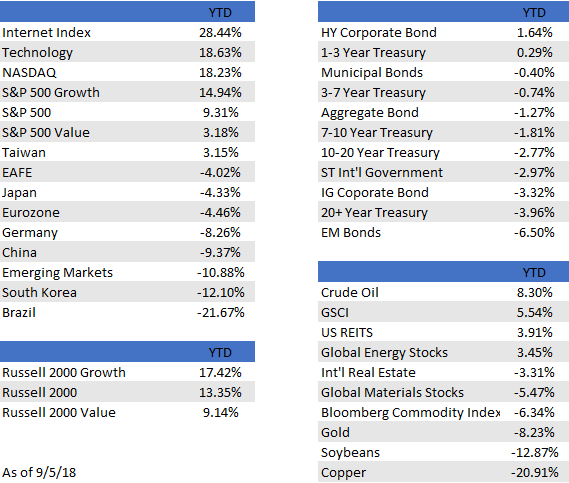

There are only a few assets that have generated positive returns this year and many of those show significant overlap. The NASDAQ is up over 18% this year but that was driven to a large degree by technology (+18.63%) and more specifically, internet stocks (+28.44%). A similar story shows up in the S&P 500 (+9.31%) where gains have been concentrated in the growth half of the index (+14.94%), while value has barely registered a gain (+3.18%). Same with commodities where the GSCI is up (+5.54%), but that is entirely due to crude oil (+8.3%). The more diversified Bloomberg Commodity index is down (-6.34%) because other commodities like copper (-20.91%) and soybeans (-12.87%) – both victims to some degree of the Trump trade war – are getting hammered.

Bonds haven’t been any help for the balanced investor with only two categories marginally higher and one of those is really a risk asset (HY Corporate bonds, +1.64% and 1-3 Year Treasury index, +0.29%). Losses in other categories range from -0.40% (munis) to -6.5% (Emerging market $ bonds).

But the decoupling aspect is more about foreign stock markets, where winners are very hard to find. Taiwan is a lonely exception (+3.15%) in non-US dollar markets, which have had a rough year and particularly rough August. EAFE, the broad foreign market index, is down over 4%, which is a home run compared to emerging market stocks, which are hitting bear market territory today from their highs and double digits YTD (-10.88%).

Some of the foreign market underperformance is due to the recently strengthening dollar, reducing returns for US investors; but this isn’t just a currency conversion issue. A stronger dollar is both a cause and an effect. The dollar is stronger because capital has been leaving EM and foreign developed markets and landing in the US. Part of that is due to the poor performance of some of those economies (Turkey, Argentina, Brazil), some due to divergence in monetary policy (Europe), and some because US economic growth has been pretty good. As the dollar strengthens from those factors, it starts to weigh on other economies with large US dollar debts (China, Indonesia, and many others) which creates capital flight from those markets back to the dollar which rises and creates more pressure on foreign economies. That is the simplified, classic contagion scenario feared by everyone who invests in these markets.

Since 2008, a number of issues have caused angst among investors. Remember the PIIGS that were going to be the end of the Euro? How about the US debt ceiling debates and the credit downgrade from AAA? Greece’s bailout? Italian elections? Brexit? Emerging market problems (the 2014 version)? Chinese Yuan devaluation? Greek bailout again? Italian elections again?

In the decade since the actual financial crisis in 2008, investors have met each of these new challenges with selling in the country or area having a problem and in the US and other developed markets as well. There has been a persistent worry that this latest “crisis”, whatever it might be, is the next big one, the next global contagion that threatens the entire financial system. Each time though, the worries have proven unfounded and markets have turned around.

But in this latest iteration of the eternal EM crisis, US stocks seem to be immune from foreign turmoil, standing nearly alone in the green column. The question for diversified, balanced investors, is why? There are a number of possibilities.

The US fortress theory is that the US economy is just so strong that whatever happens in faraway lands just won’t have an impact. This is also the preferred scenario of the Trump administration who believe that US strength gives them the space to pursue tough trade negotiations with friend and foe alike. For a number of years early in the recovery from 2008, the US was referred to as the “cleanest dirty shirt in the laundry”, a kind of damning with faint praise where the US economy wasn’t great but it was better than everywhere else.

But today, that dirty shirt metaphor isn’t reckoned to be necessary as the Trump tax cuts, deregulation, and tariffs have set the US economy on a higher growth path. There is some support for that argument, but frankly, I find it wanting despite its popularity. US economic growth did accelerate from Q1 to Q2 but the change was not that unusual and the year-over-year growth rate of 2.9% is just a little above average for this economic cycle. And while bonds are down this year (yields up), a 2.8% yield on the 10-year Treasury and all of 80 basis points on the 10-year TIPS is not supportive of the boom theory the stock market – and Larry Kudlow – wants so badly to believe.

The strong dollar explanation is related to the fortress theory. Three factors are said to be bringing capital back to the US and raising the value of the dollar: strong US growth, tariff barriers, and repatriation of US companies’ foreign profits. As I said, there is some truth to the strong growth idea but one quarter is not a trend. Yes, growth did accelerate in Q2 but how much of that was due to activities intended to alleviate the harm of potential and actual tariffs? I don’t think we can actually quantify that but I have no doubt that some orders were brought forward in an attempt to avoid tariffs. I have spoken to a number of companies who are hoping that they stockpiled enough to last until the trade tiffs blow over, assuming they do.

Leave A Comment