Global crude oil prices have risen by more than 75% from near twelve-year lows reached in January. The recent spike was driven largely by unscheduled supply outages in major oil-producing centers including Canada, Ghana and Nigeria. Given the sustained, significant oil imbalance (the excess of supply over demand), the outages were seen by not a few traders as a major step towards a long-awaited, supply re-balancing.

Estimates of the total oil supply reduction due to the outages including other withdrawals year-to-date, stood at about 2.5 million barrels per day, bpd, just a few days ago. Not discounting the recent price spike, such rapid supply withdrawal ordinarily would have generated a global price shock. The rather tepid market response was perhaps informative.

Fundamentals

Quite a few analysts believe an oil supply re-balancing is imminent, if not in progress already. Such sentiment however is not altogether consistent with extant market fundamentals.

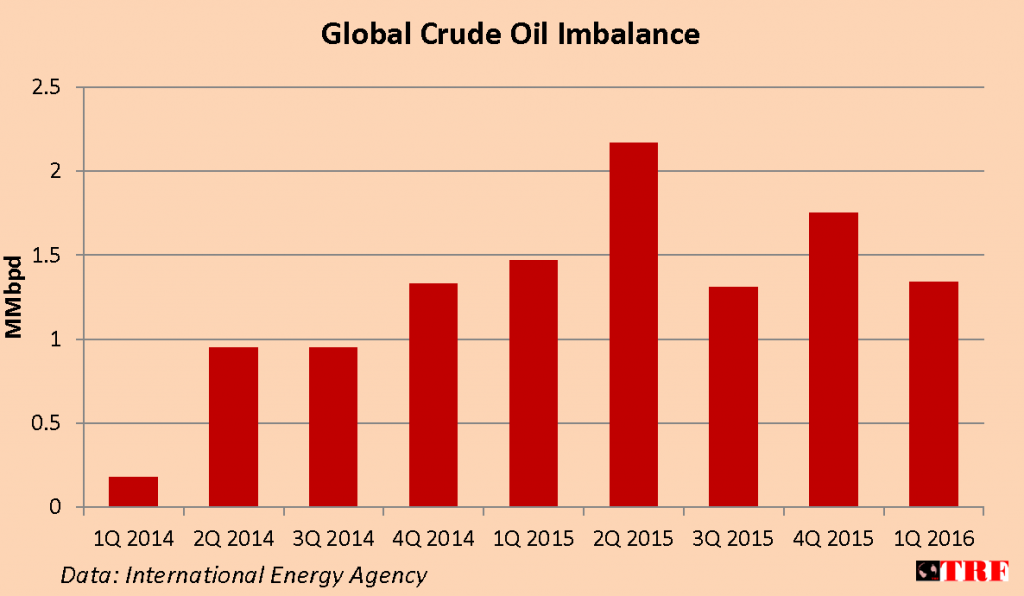

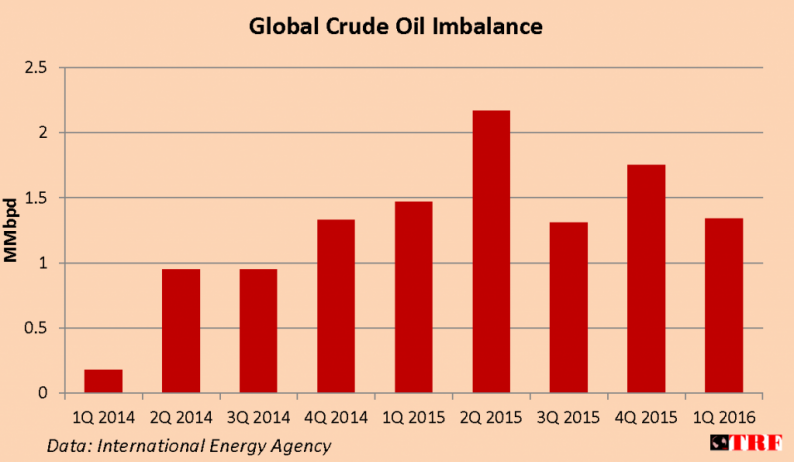

While the global oil imbalance has declined somewhat ? having fallen to 1.34 MMbpd in 1Q 2016 from 1.75 MMbpd in 4Q 2015 ? that decline was not driven by a growth in demand. According to recent data from International Energy Agency, IEA, global oil demand fell consecutively from 3Q 2015 through 1Q 2016, for a total decline of 660,000 bpd.

This is significant. Some analysts had based their re-balancing projections on a spike in demand, particularly since recent attempts at a supply re-balancing failed dismally; but as some of the recent unscheduled production outages are coming back on stream, global oil supply is set for additions. Suncor Energy Inc. (SU), Syncrude Canada Ltd and Imperial Oil Ltd (IMO), Canada’s oil sands operators in Fort McMurray, for example are restarting operations and are expected to attain pre-disruption output levels shortly. Libya’s jostling leadership factions have reached a negotiated ? even if tenuous ? modus vivendi and are currently loading export cargoes having reached almost 75% of pre-disruption output. Even Venezuela has successfully renewed an oil-for-loan agreement with China. The case of Nigeria however, is somewhat uncertain especially with the threat of militant uprising in the oil-producing Niger Delta region and concerns about the tenor of president Muhammadu Buhari’s response; operations by Exxon Mobil (XOM), Shell (SHLX), Chevron (CVX) as well as Agip have been affected and the country has seen production fall to near twenty-year lows.

Leave A Comment