We warned earlier in the week that the credit risk of the world’s financial institutions were on the rise and that trend has worsened as the week ends.

Global Bank Risk is spiking…

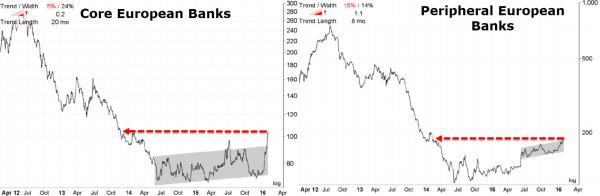

European Bank Risk is blowing out in Core and Peripheral nations…

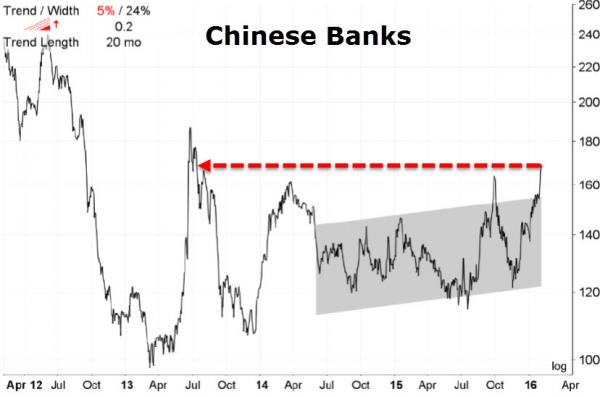

And China Bank credit risk has broken to new cycle highs..

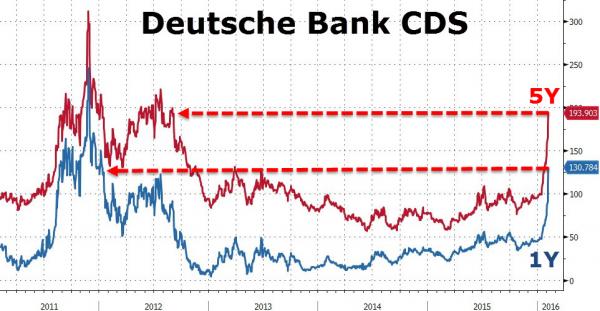

Some idiocysncratic names to keep an eye on…

Deutsche Bank – Europe’s largest derivatives exposure (and thus epicenter of collapse should things turn out as bad as the bank’s CoCos suggest) – is suffering seriously… It is becomeing very clear that banks are buying protection on DB to hedge their counterparty exposure…

ICBC Bank is among China’s largest banks (depending on the volatility of the day) and as China bank risk soars so China’s sovereign risk is soaring too with devaluation and systemic crisis co-priced into these contracts…

National Commercial Bank – the largest Saudi bank and proxy for The Kingdom’s wealth – is seeing its credit risk explode. As one analyst noted, if NCB has a crisis then Saudi military adventurism is in grave jeopardy…

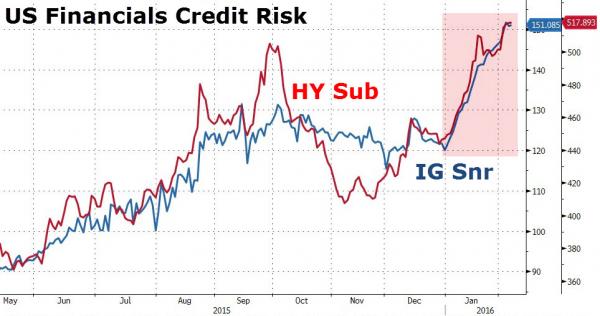

And finally – yes it is spilling over to American banks and their “fortress” balance sheets…

But apart from that “storm in a teacup” – Buy The F**king Dip, right?

Leave A Comment