At this particular juncture eight months into 2018, the only thing that will help is abrupt and serious acceleration. On this side of May 29, it is way past time for it to get real. The global economy either synchronizes in a major, unambiguous breakout or markets retrench even more.

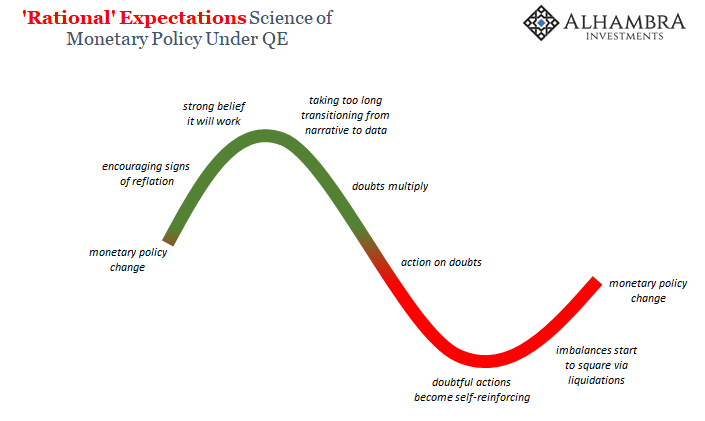

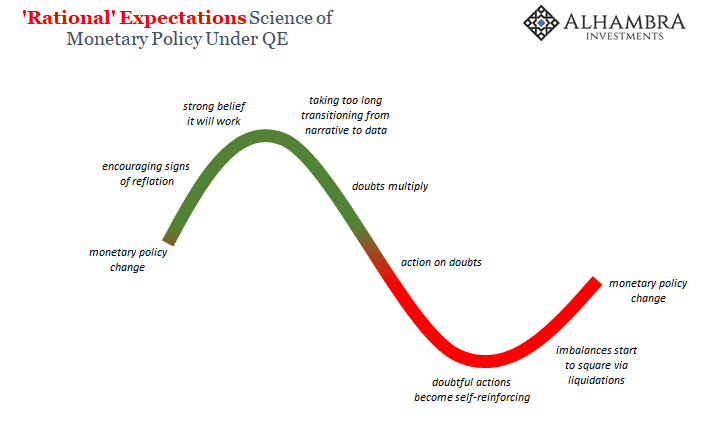

That’s been the basis of this thing from Day 1; or, more accurately, Day 3.01. Reflation #3 wasn’t really any different in type from either Reflation #1 or Reflation #2 (though, I have to admit, with the last benchmark GDP revisions I am moving closer to separating Reflation #1 from Reflation #1a with now two negative quarters sitting in 2011; meaning Reflation #3 was really Reflation #4, and consequently this Eurodollar Event #4 may be Eurodollar Event #5).

It began with the same promise of legitimate recovery waiting for everyone. If there was something different about this one it was in how relatively unenthusiastic markets were even at its heyday in early 2017. They were reasonably jaded after so many false dawns, however many there may have been unofficial.

Markit today released its flood of flash PMI’s for a major swath of the global economy, including the composite indices for both the US and Europe. There wasn’t any good news in either, and not really much bad news to be honest. It was instead more of the same 2018 lethargy.

But this is lethal lethargy in the context of where the economy this year was supposed to have been. There are now too many questions (risks) about the status of the global economy, which puts us solidly in the red in terms of the cycle. These PMI’s won’t do anything to change that, which can only mean (important) market participants (not stocks) are going to be characteristically edgy moving forward.

Without some more reasonable assurance about economic upside (opportunity) these obvious and immediate risks are again more and more absolute.

For the US economy, Markit had this to say – from their press release to eurodollar market ears:

Leave A Comment