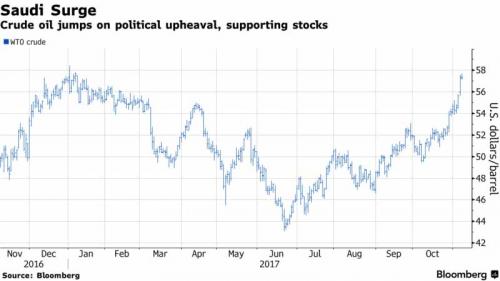

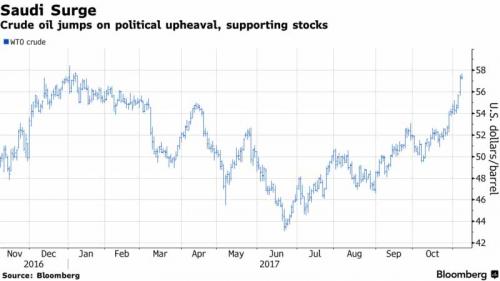

The global risk levitation continues, sending Asian stocks just shy of records, to the highest since November 2007 and Japan’s Nikkei topped 22,750 – a level last seen in 1992 – while European shares and US equity futures were mixed, and the dollar rose across the board, gains accelerating through the European session with EUR/USD sumping below 1.16 shortly German industrial output shrank more than forecast, eventually dropping to the lowest point since last month’s ECB meeting. Meanwhile soaring iron-ore prices couldn’t provide relief to the Aussie as the RBA held rates unchanged as expected; Oil traded unchanged at 2.5 year highs, while TSY 10-year yields rose while the German curve bear steepened, both driven by selling from global investors.

The Stoxx Europe 600 Index edged lower, erasing an early advance, despite earlier euphoria in stocks from Japan to Sydney, which reached fresh milestones. Disappointing reports from BMW AG and Associated British Foods Plc weighed on the European index as third-quarter earnings season continued. Earlier, the Stoxx Europe 600 Index rose as much as 0.3%, just shy of a 2-year high it reached last week. Maersk was among the worst performers after posting a quarterly loss, saying a cyberattack in the summer cost more than previously predicted. Spain’s IBEX 35 gains crossed back above its 200 day moving average. European bank stocks trimmed gains after European Central Bank President Mario Draghi said that the problem of non-performing loans isn’t solved yet, though supervision has improved the resilience of the banking sector in the euro region. Draghi was speaking at a conference in Frankfurt.

Over in Asia, equities rose to a decade high, with energy and commodities stocks leading gains as oil and metals prices rallied. The MSCI Asia Pacific Index gained 0.8 percent to 171.40, advancing for a second consecutive session. Oil-related shares advanced the most among sub-indexes as Inpex Corp. rose 3.7 percent and China Oilfield Services Ltd. added 4.6 percent. The MSCI EM Asia Index climbed to a fresh record. The Asia-wide gauge has risen 27 percent this year, outperforming a measure of global markets. The regional index is trading at the highest level since November 2007. Hong Kong’s equity benchmark was at its highest since December 2007 as Tencent Holdings Ltd. advanced for an eighth session. Australia’s S&P/ASX 200 index closed at its highest level since the financial crisis.

Japanese stocks climbed, bolstered by strong corporate earnings, with the Nikkei 225 Stock Average closing 1.7% higher at 22,937.60 at 3 pm in Tokyo, climbing for 23 out of the past 25 trading sessions. Japan’s main stock index has gained 20% this year with Tokyo Electron, Fanuc, SoftBank and Kyocera providing the biggest boosts, as the Topix index rises 1.2% to 1,813.29 from Monday, pushing it up +19% YTD.

“Oil and other commodities’ fundamentals are improving amid OPEC’s efforts, stagnating U.S. production and stable growth in China are positive for most Asian markets,” said Hans Goetti, founder of HG Research, referring to output caps put in place by the Organization of Petroleum Exporting Countries. “Economic growth differentials also are in favor of Asian markets, so the rally should continue.”

The euro declined to a four-month low and bund yields nudged higher after German industrial production fell more than expected in September. WTI crude hovered near the highest since January as political upheaval in Saudi Arabia reverberated through the market. Yen traded at 113.99 per dollar from 113.71 on Monday; currency +2.6% YTD.

In rates, the yield on 10Y TSYs rose two basis points to 2.33%; Germany’s 10-year gained 1 bp to 0.34%; Britain’s 10-year yield rose 1 basis point to 1.263% while Japan’s 10-year yield advanced one basis point to 0.032%.

Investors’ focus returned to geopolitics as Trump continued his tour of Asia, while Saudi Arabia launched a crackdown on corruption. Speaking next to South Korean President Moon Jae-in in Seoul, Trump said he saw some progress on North Korea, said that now is the time to act with urgency and determination with North Korea, and called on the rogue state to “come to the table”. He added that the U.S. and South Korea will act together to confront North Korea’s actions, and the U.S. stands ready to use its full range of military capabilities “if need be.” Meanwhile, the South Korean President Moon says that he and Trump reaffirmed resolve to peacefully end N. Korean nuclear standoff.

Bulletin Headline Summary from RanSquawK

Market Snapshot

Leave A Comment