Global trade was front and center again, after the Trump administration proposed another round of trade talks with Beijing before slapping China with $200BN in tariffs in the absence of key concessions from Beijing, while traders were on edge ahead of a slew of central bank announcements and critical CPI data in the US.

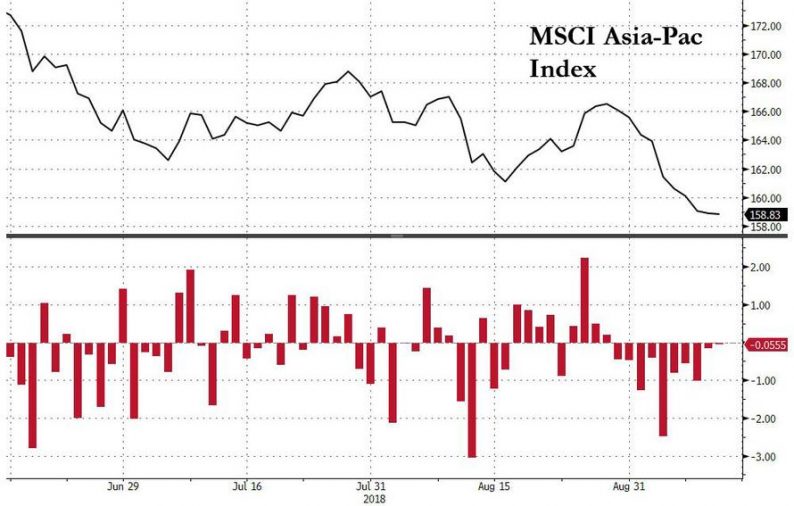

One day after Apple’s latest iPhone unveiling disappointed shareholders who sold AAPL stock and pressured tech stocks, world markets calmed and MSCI’s All World index was set for a fourth straight day of gains with S&P futures slightly higher after Asian shares jumped ending a 10 day losing streak, the longest in 16 years, on renewed hopes of fresh trade negotiations between the US and China.

Shanghai, Tokyo, Jakarta stocks all gained around 1% following Wednesday’s sharp drop in the dollar, while Hong Kong’s Hang Seng finished up 1.8%, while China’s yuan also edged higher in the currency markets even if the Shanghai Composite barely budged amid ongoing skepticism inside Ground Zero, China, that talk this time will be different.

Initially, Europe also moved higher, led by automakers with gains between 0.2% and 0.6% for German, French, Italian and Spanish shares offsetting a weaker FTSE in London which was hit by weaker oil and tobacco stocks. However, Europe’s Stoxx 600 index erased gains of as much as 0.3% as the Turkish lira plunged after country’s President Recep Tayyip Erdogan attacked the central bank for continuously missing inflation targets and saying the CBRT “should cut this high-interest rate”, just hours before rate decision.

European shares have remained especially sensitive to rising EM risks, especially in Turkey, as exporters and banks have exposure to developing nations. Meanwhile, The euro edged lower and the pound was steady ahead of central bank announcements which are not expected to deliver any major surprises.

Staying in Europe there was some more Italian drama after La Stampa reported that Italian Finance Minister Giovanni Tria called Prime Minister Giuseppe Conte to discuss the struggle over the 2019 budget and threatened to resign. The FTSE MIB was trying to bounce back after a 17% drop in the past four months, while Italian bonds declined for a third day after the nation’s latest debt auction drew weaker demand.

Meanwhile, as previewed earlier, as part of today’s ECB announcement, the biggest “surprise” will likely be that growth forecasts are tweaked lower, even as the central bank keeps its guidance on interest rates which will stay at record lows “at least through the summer” of next year. According to Bloomberg, given the highly negative sentiment toward the banks – the sector index SX7P is down more than 20% since a peak in January, trades below book value and at 9.3x expected earnings which is its lowest P/E ratio in two years, with a dividend yield of 5% – risk seems to be on the upside for the sector heading into Draghi’s press conference.

Over in the US, index futures all pointed to a slightly firmer open.

In FX, the dollar nudged higher after a weaker than expected PPI report which saw producer prices drop for the first time in 18 months, undermined the case for a faster pace of policy tightening by the Federal Reserve. The latest CPI data is due out at 8:30am today.

The euro hovered around $1.1624 having gained around 0.6 percent so far this week. The yen weakened 0.2 percent to 111.47 per dollar on the soothing trade noises. Sterling held near a six-week high of $1.3087 as Brexit-supporting lawmakers in British Prime Minister Theresa May’s party publicly pledged support for her to stay in power.

Treasuries edged lower while Italy’s bonds underperformed other European sovereign debt as speculation swirled around the fate of the country’s finance minister.

Elsewhere, emerging-market shares and currencies climbed helped by the recent weakness in the dollar, with South Africa’s rand leading the pack. Crude oil pared two days of gains made on the outlook for tighter supply. The potential impact on commodities from Hurricane Florence faded with lower wind speeds. Meanwhile, copper held above $6,000 in London as metals broadly keep Wednesday’s gains on optimism around an easing in the US-China trade war.

Market Snapshot

Top Overnight News

Leave A Comment