European stocks are steady in post-Christmas trading if struggling for traction after a mixed session in Asia, amid trading thinned by a holiday-shortened week and ongoing worries about the tech sector; however a strong rally in commodities – including copper and oil – buoyed expectations for a strong 2018 and helped offset concerns over the technology sector triggered by reports of soft iPhone X demand.

U.S. equity futures nudged higher while the dollar weakened against most G-10 peers as investors await the release of U.S. consumer-confidence data, with much of the spotlight falling on commodity currencies. The OZ dollar holds onto gains as copper surges to a three-year high; oil retreats after reaching the highest close in more than two years following a pipeline explosion in Libya on Tuesday. Treasuries and core European core bond yields are a touch lower.

The Stoxx Europe 600 Index edged lower, with tech stocks hit for the third day amid rumors of weak iPhone demand and leading the decline as chipmakers slumped after analysts lowered iPhone X shipment projections, sending the Nasdaq Composite Index lower overnight. While mining and oil stocks strengthened due to a surge in copper prices to a 3.5 year high (see below), the European STOXX 600 index slipped 0.1% as European tech stocks tumbled on reports that demand for Apple’s iPhone X may be weaker than expected. The equity benchmark index is poised for an annual gain of 8.1%, the best advance in four years. Elsewhere, Volvo rose as China’s Geely bought Cevian’s stake in the truckmaker, making it Volvo AB’s largest stakeholder. IWG surged the most since 2009 after confirming it has received a a non-binding takeover offer from a consortium backed by Brookfield Asset Management and Onex.

In Asia earlier Japanese equity benchmarks posted slight gains, Australian stocks were flat and China’s domestic shares dropped.Asian shares climbed 0.3% to near a recent one-month high, though it was more of a mixed picture in European stock markets. Shares of China’s new-energy automakers surged after the government announced it will extend purchase-tax exemption for another three years, through Dec. 31, 2020. BYD climbed as much as 5.9% on the mainland to the highest since Nov. 24; Zhongtong Bus & Holding Co. rises by 10% daily limit.

Shares of new energy vehicles #NEVs makers are surging, after the Ministry of Finance said #China will continue to exempt the purchase tax on new-energy vehicles through 31 Dec 2020 pic.twitter.com/R5QhIZK1uU

— YUAN TALKS (@YuanTalks) December 27, 2017

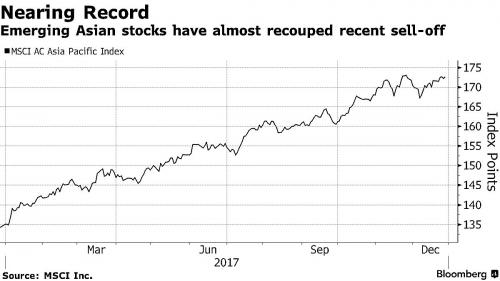

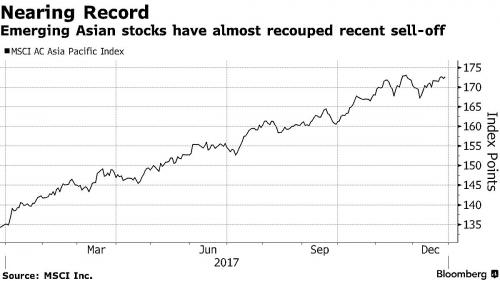

As the chart below shows, the recent dip in Emerging Asian stocks has been largely bought, and the selloff gap has been mostly filled.

In commodities, oil and copper prices rocketed to multi-year highs, pushing the MSCI world equity index 0.1% higher. While oil prices were strengthened largely because of an attack on a crude pipeline in Libya, the surge in copper was particularly eye-catching as the metal is seen as a proxy for global growth. Miners gained as copper climbed to a three-year high after China ordered its top producer to halt output to combat winter pollution.

Leave A Comment