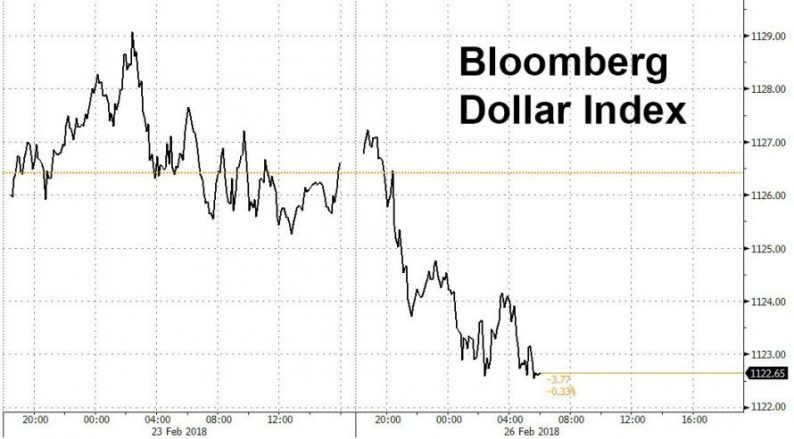

Any hopes that the dollar may have halted its recent tumble have been, for now, dashed, when the greenback resumed its slide overnight, the DXY falling below 90 again and down for a third day against all G-10 peers ahead of Fed Chair Jerome Powell’s first Congressional testimony in which investors bet the new head of the Federal Reserve will steer a steady course on policy.

“Given he’s speaking on behalf of the committee it would be a big surprise to see much deviation from recent Fed commentary, but much will probably be made of how he handles the scrutiny,” said Deutsche Bank’s Jim Reid in preview of Powell’s comments.

“Powell’s testimony on Tuesday could be key in determining whether the recent market reluctance to price Fed much more aggressively despite inflationary impulses is warranted or not,” said Christin Tuxen, chief currency analyst at Danske Bank. “If Powell comes out hawkish, the potential for EUR/USD downside would be non-negligible. Possible downside EUR risks loom this weekend with the general election in Italy and the SPD vote.”

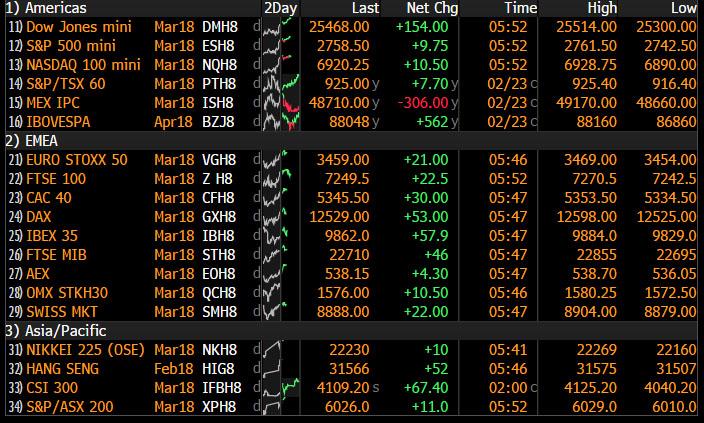

Dollar weakness has pushed the euro higher and the yen strengthens after Governor Kuroda said “prices are gradually rising more and more” even as the BOJ has no plans to overhaul its current form of easing. U.S. 10-yr yields are little changed after falling 5bps Friday, while global stocks have all sprinted out of the gate in what right now is a sea of green…

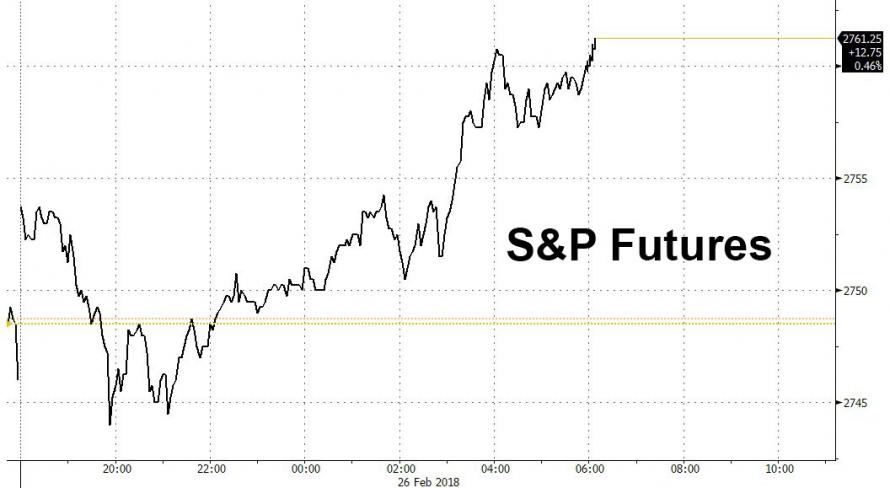

… and S&P futures are currently at session highs, up 12 points or 0.4%.

With the dollar slumping, and 10Y TSY yields failing to rise above 2.90%, European shares followed their Asian counterparts higher amid some modest concerns what Jay Powell may say tomorrow.

In other macro news, the pound advanced, finding some support after the BOE Deputy Governor Dave Ramsden said in an interview that rates may need to be raised sooner than previously thought due to signs of accelerating pay growth. The euro rose ahead of ECB President Draghi’s statement before European lawmakers. Russia’s ruble appreciated the most in emerging markets after S&P Global Ratings boosted its credit score to investment grade. The yen firmed to a one-week high, gold climbed and European sovereign bonds were mixed. Asia’s emerging-market currencies rose as regional stocks tracked U.S. equities higher and lower Treasury yields supported demand for developing-nation assets. Most sovereign bonds also climbed.

FX recap from BBG:

Looking at global equities, the Europe Stoxx 600 Index jumped to its highest level in more than three weeks, with nearly all major industry groups rallying. The gains this morning have been largely broad-based across all major sectors, while material names outperform with miners tracking the moves higher in commodity prices which have been buoyed by the softer USD. Moves higher in the FTSE 100 have been capped by the GBP strength which had been given a boost by surprisingly hawkish comments from BoE’s Ramsden, while election risks have contained the upside in the FTSE MIB. All of 19 Stoxx 600 sectors rise; financial services sector has the biggest volume at 128% of its 30-day average; 529 Stoxx 600 members gain, 60 decline. Top Stoxx 600 outperformers include: Steinhoff International Holdings +6.5%, Telefonaktiebolaget LM Ericsson +3.8%, Nokia +3.8%, Swedish Orphan Biovitrum +3.5%, Suez +2.4%.

“This week looks set to be a long wait for the Italian election and the German SPD vote on a new Grand Coalition on Sunday,” Societe Generale strategists write in note. “While we expect a hung parliament in Italy and a small majority in favor in Germany, uncertainty remains high.”

Asia was also green across the board, with Australia’s ASX 200 (+0.7%) and the Nikkei 225 (+1.2%) both higher as earnings fuelled the biggest gainers in Australia, while Japanese exporters weathered a firmer JPY and led the region’s advances. Elsewhere, Hang Seng (+0.7%) and Shanghai Comp. (+1.2%) were in the green with Geely Auto the outperformer after reports its parent amassed a near 10% stake in Daimler, although Chinese property names were less fortunate with the Shanghai Comp. Property Index slumping 3% in early trade after the latest House data showed efforts to curb the sector were gaining fruition. Elsewhere, Bank of Japan Governor Haruhiko Kuroda said the central bank has no plan to overhaul its current form of easing, adding that he saw no need to do another comprehensive assessment of the effectiveness of the bank’s policies.

Over in the US, as stocks rebound from their early February correction, the S&P P/E ratio is almost back to where it was when yields took off, which however is clearly not bothering investors for now.

Much of the market’s focus during the coming week will be on monetary policy, with the heads of the European Central Bank and Bank of England set to give speeches. But they are likely to be overshadowed by Fed chair Jerome Powell. U.S. stock markets calmed on Friday after the Fed said it saw steady economic growth continuing and no serious risks on the horizon.

Powell may help set a new direction for investors at a time when some of the biggest names in markets are at odds over the implications of this month’s surge in U.S. bond yields. Morgan Stanley put out a bullish call on Treasuries Monday, countering warnings on the securities from Goldman Sachs Group Inc. and Warren Buffett. Bond traders are still pricing less than the three-quarter-point interest-rate hikes that Fed officials have signaled as likely this year.

Leave A Comment