Is it going to be another May 17, when US stocks tumbled as concerns of a Trump impeachment over obstruction of justice and impeachment surged ahead of Comey’s tetimony?

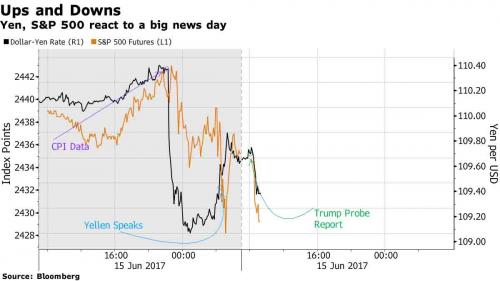

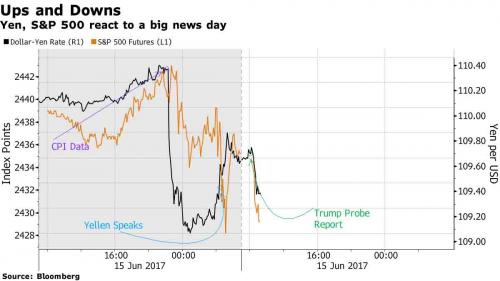

Overnight, S&P500 futures accelerated their decline following yesterday’s WaPo report that Special Counsel Mueller has launched a probe into potential obstruction of justice by Trump…

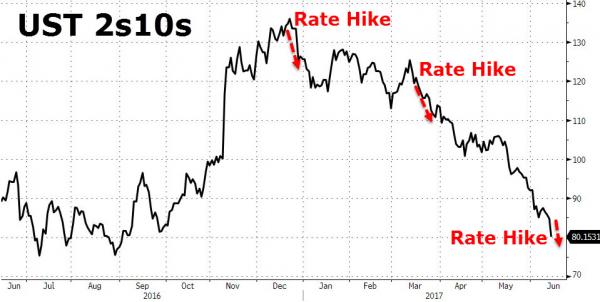

… while European and Asian markets dropped dragged lower by commodities which reacted to the latest Fed rate hike, as copper dropped and oil fluctuated. The Bloomberg commodity index fell to the lowest in more than a year, pressuring miners and E&P companies which were among the big losers as the Stoxx Europe 600 Index retreated for a second day. The dollar advanced after the Fed raised interest rates for the second time in 2017 and Yellen suggested the strength of the U.S. labor market will ultimately prevail over recent weakness in inflation, which however the bond market strongly disagrees with, sending the curve the flattest its has been since October.

Traders were surprised as Yellen played down the recent drop in inflation and voiced confidence the central bank was on course to hit its 2% inflation goal, something it hasn’t done in three years. As Bloomberg notes, the Fed’s actions and words struck a careful balance between showing resolve to continue tightening in response to falling unemployment while acknowledging the persistence of unexpectedly low inflation this year. Adding to the uncertainty, the WaPo reported that the special counsel investigating Russia’s interference in the 2016 election plans to interview two top U.S. intelligence officials about whether Trump sought to “pressure” them to back off a related probe of former National Security Adviser Michael Flynn.

In China, overnight the PBOC injected net 90 billion yuan with reverse repos, strengthens CNY fixing to strongest since November, however unlike in March, this time the PBOC did not raise rates on its reverse repo operations, thereby not following the Fed by tightening further. Dalian iron ore slides two percent. Australia’s S&P/ASX 200 Index slumped 1.2% , with energy and raw-material shares dropping more than 2% . The Hang Seng Index slid 1.2 percent as Hong Kong followed the Fed’s move, elevating the risk of a selloff in the world’s priciest housing market.

European equities followed Asia’s lead, opening lower after the Fed raised rates for the second time this year. Subsequent dollar strength persisted while Treasuries were range-bound, having dropped after Yellen’s comments. French and Spanish bond sales pressured European fixed income; OATs extended losses, demand in 10Y Spain supply strong. WTI futures trade below $45, having dropped sharply on higher-than-expected U.S. inventories. Weaker-than-forecast U.K. retail sales helped push GBP lower, though largely driven by dollar gains, before the BOE decision at 12 p.m. in London.

S&P 500 futures dropped 0.7 percent as of 6:45am EDT. The index dropped 0.1% on Wednesday, while the tech-heavy Nasdaq indexes retreated 0.4%. The Dow Jones Industrial Average edged higher to a fresh record. The Stoxx Europe 600 Index retreated 0.7 percent.

The Bloomberg Dollar Spot Index rose 0.2 percent following three days of losses. The yen was little changed at 109.57 per dollar after climbing 0.5 percent Wednesday. The British pound weakened 0.4 percent to $1.2703 and the euro retreated 0.3 percent to $1.1181. The Australian dollar strengthened 0.3 percent after employment surged in May. The New Zealand dollar fell 0.5 percent as data showed the economy grew less than expected in the first quarter.

In rates, the 10-year Yield rose one basis point to 2.14% after dropping 8.5 bps Wednesday to 2.13 percent, the lowest level since November, a clear indicator that the bond market is convinced the Fed is making a mistake. The yield on benchmark U.K. bonds rose three basis points to 0.96% , while those of French and German peers also increased two basis points.

WTI swung around the flatline before falling 0.1 percent to $44.70 a barrel, extending a 3.7% drop in the previous session. U.S. gasoline supplies unexpectedly rose for a second week. Gold rose less than 0.1 percent to $1,261.42 an ounce after sliding 0.5 percent the previous day.

Overnight Media Digest

Market Snapshot

Leave A Comment