Scandinavian NIRP Bubble

A recent article at Reuters indicates that Sweden’s central planners are beginning to worry slightly about the bubble they have caused in their (so far) vain attempt to destroy the purchasing power of the Swedish crown in terms of consumer goods. They have instituted a giant QE program and reduced central bank lending rates below zero (an economic policy perversion if ever there was one). So the failure is certainly not for lack of trying, as the charts below illustrate.

While the “well-intentioned” plan to impoverish Sweden’s consumers by reducing their real incomes has failed, relative prices have of course been distorted enormously. Price inflation is simply showing up in asset prices, primarily real estate prices, in which a bubble of truly breathtaking proportions is underway.

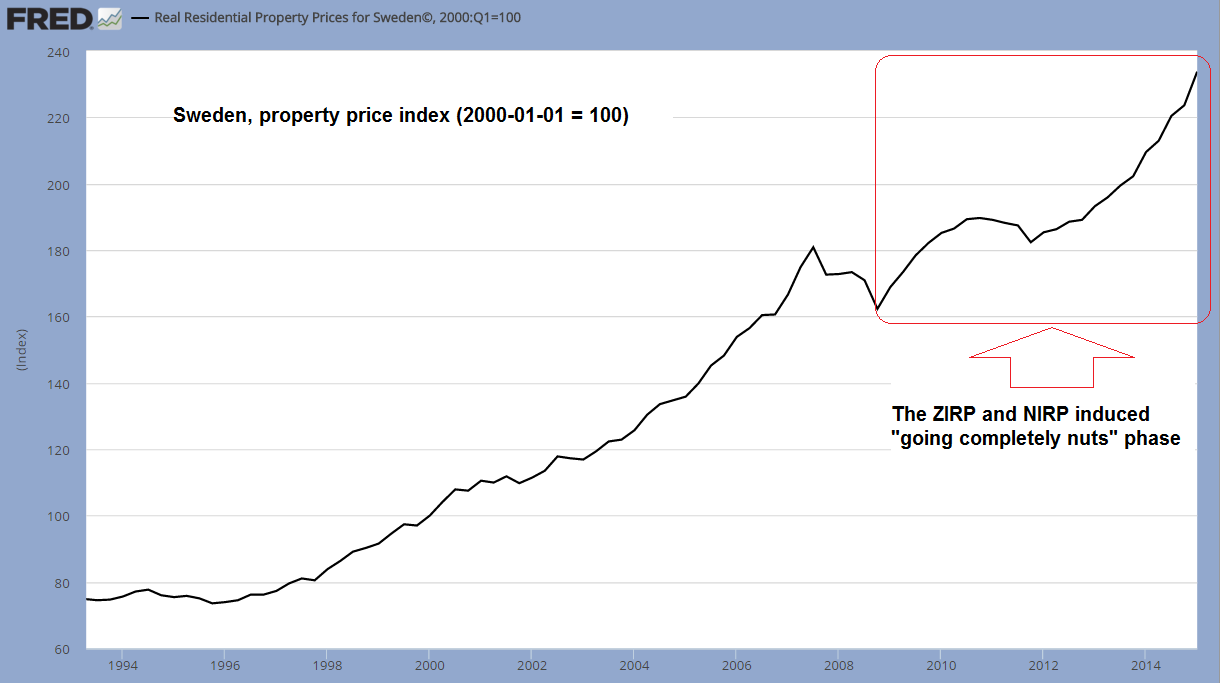

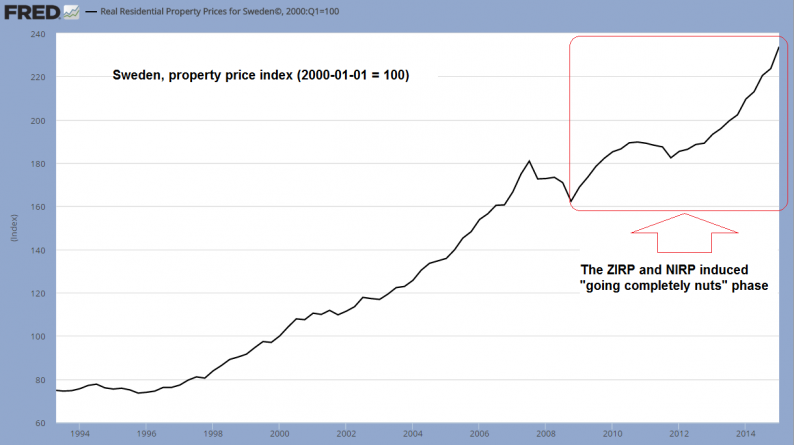

ZIRP and later NIRP-induced lunacy in Sweden, as evidenced by a parabolic increase in property prices. Note that these data are as of Q1 (the most recent chart we could find). In the meantime, prices have shot up further. The latest annual rate of change amounts to 20% – click to enlarge.

A little color from Reuters:

“House buyers in Sweden have never had it so good, at least by some measures. But cheap credit and spiraling prices may be creating a bubble – one that could send the country’s economy reeling when it bursts.

Sweden now has one of the fastest growth rates of any developed economy. Inflation is near zero and official interest rates are below zero. Home buyers can take advantage of interest-only loans and a variety of tax breaks.

On the other hand, consumer debt is about 175 percent of disposable income, one of the highest rates in Europe. Housing prices keep rising – apartments in Stockholm cost around $6,350 per square meter, on a par with London’s $6,750. Most Swedes would take a century to repay mortgages at current rates.

“The prices are just crazy,” said 37-year-old Cathrin Wentzel.

(emphasis added)

It would “take most Swedes a century to repay their mortgages at current rates”? Meaning, at barely perceptible rates of interest? With household debt at 175% of GDP? Good luck ye Vikings!

More from Reuters:

The Riksbank’s decision this week to keep rates lower for longer just extends a bonanza of cheap money that has fueled the real estate prices and borrowing. But the central bank is caught in a dilemma.

Leaving rates so low only encourages home buyers. But raising them enough to tamp down the housing frenzy would also slow an inflation rate that is already flirting with zero and has dipped into outright deflation.

The concern is that Sweden might end up with a local version of the 2008 financial crisis. Homeowners saddled with enormous mortgages might see the value of the homes plummet. They would cut back on spending, try to save more – and hobble the economy.

In the last few months, concerns about a bubble have reached a fever pitch as house prices shot up still further. A government failure to clamp down on lending criteria has fed a 20 percent annual rise in the cost of apartments.

Most bidding in Sweden for flats and houses is done by text messages. Potential buyers scurry off from office meetings or dinner parties to punch in their latest offer – often upping their bids by $10,000 to $20,000 a text. Mortgage borrowing grew at its fastest pace in more than 4 years in September.

Even so, the Riksbank has slashed rates to record low -0.35 percent to rekindle inflation and may go even lower.

Leave A Comment