A week ago I talked about the “need to bleed” for gold stocks. Since then, it could be said that the blood has flowed with gusto.

Until the March 15 FOMC meeting is out of the way, gold and associated investments will be vulnerable against the dollar.

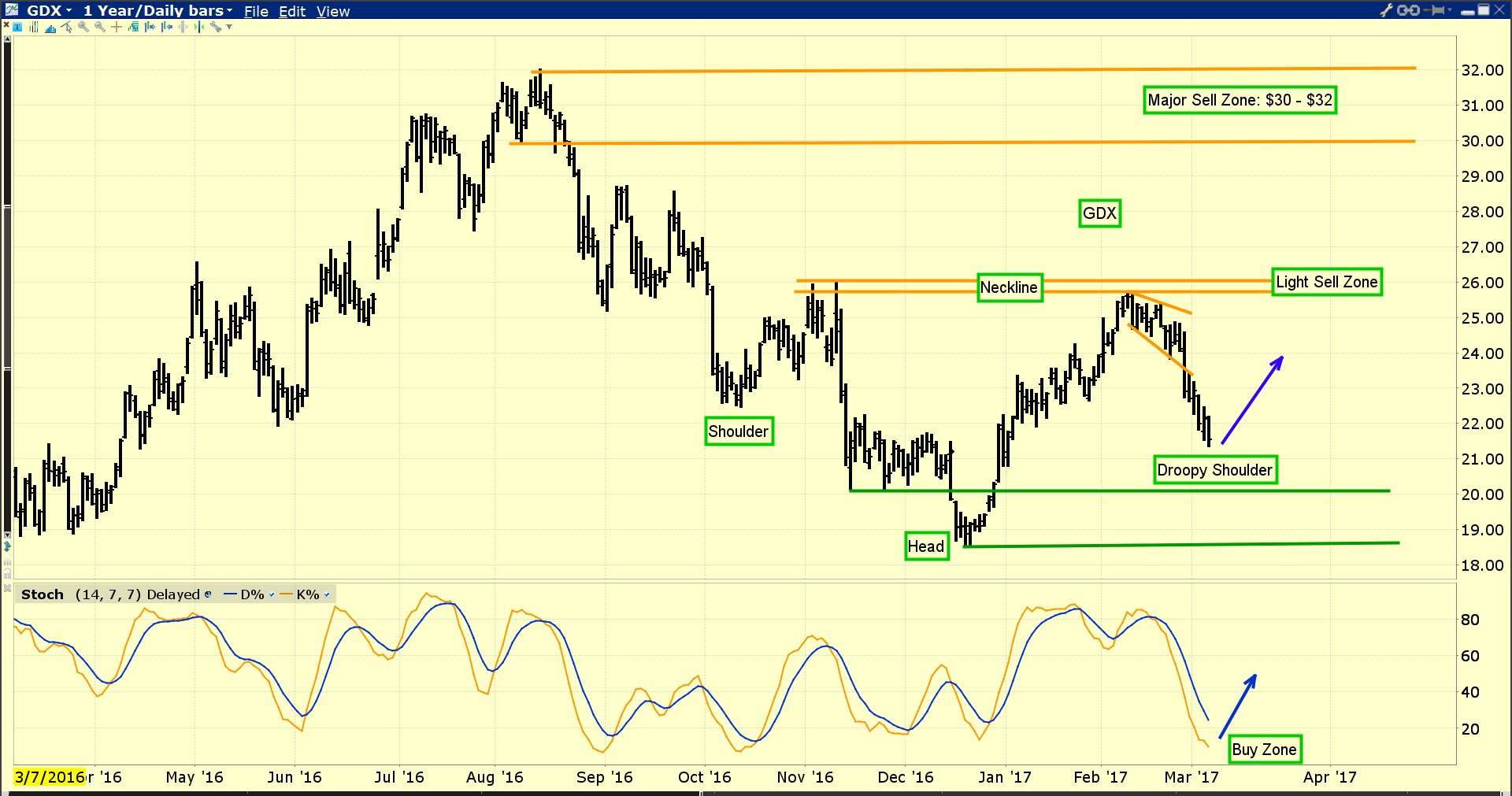

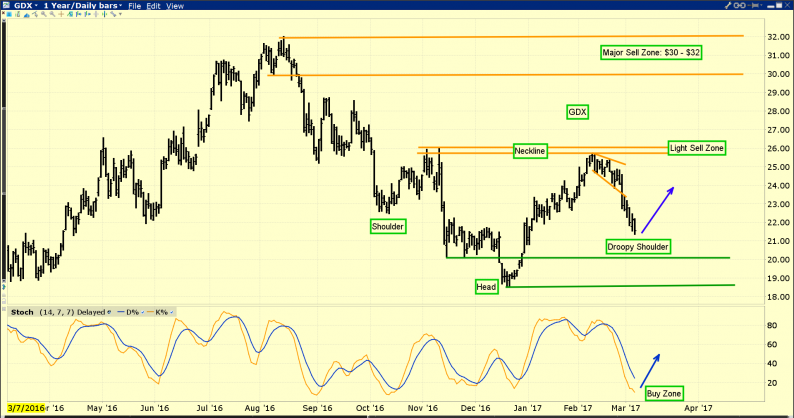

As Chinese new year celebrations waned in February, GDX began trading in a modest broadening formation. Broadening formations tend to be resolved in a somewhat violent manner.

In this case, the breakdown from that formation created a droopy right shoulder of an inverse head and shoulders bottom pattern. The shoulder is droopy because there is considerable market concern about the upcoming FOMC meeting next Wednesday.

There is good news for gold stock enthusiasts, though.

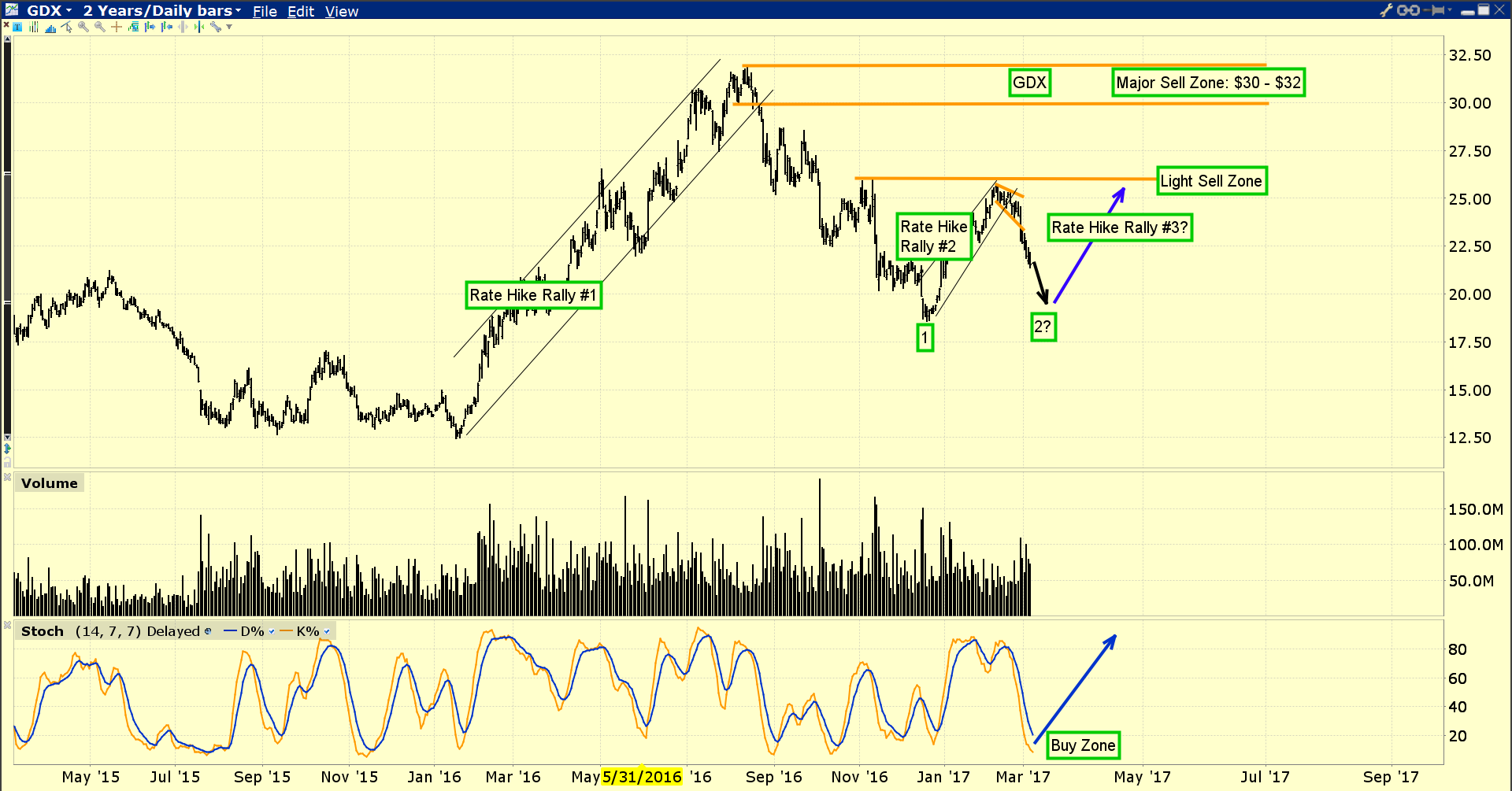

The Fed’s first rate hike created an enormous rally in gold, silver, and associated stocks.

That’s because rate hikes incentivize banks to move money out of government bonds, and into the fractional reserve banking system, where it can be loaned out aggressively.

The result is a boost in money velocity and inflation. Gold stocks mount sustained rallies in that environment.

In late 2016, Janet Yellen suggested an aggressive pace of rate hikes in 2017 would be her play, but most analysts didn’t believe her. After all, back in late 2015 she promised that there would be four rate hikes in 2016, and there was only one.

Gold stocks swooned in mid-2016 when it became apparent that the rate hikes needed to boost money velocity would not be happening.

A rate hike next week should quickly produce “Rate Hike Rally #3” for gold stocks. Also, I should note that the inverse H&S bottom pattern for GDX could become a double bottom pattern.

Double bottom patterns create substantial fear amongst investors, more so than any other technical market pattern. For a double bottom pattern to be valid, volume needs to be less on the second bottom, and so far that’s the case with GDX.

Leave A Comment