Gold’s resistance, which prevented any monthly close above $1,995, was breached, with a close at $2,035 on Thursday, November 30:  The next day, Friday, December 1, those who had logically positioned themselves “short” at this resistance level, bought back their positions, causing the price to climb to $2,071, the historic high for gold touched 3 times intraday during the last three years, but which the bullion banks had until then successfully defended. Logically, all speculators loaded into “short” positions at this level before Wall Street closed.In Shanghai, the price of gold is permanently higher than in New York or London. Normally, this premium is around 0.3%, but since July it has been 1.9%. The monthly resistance of gold in Shanghai was therefore broken and Chinese speculators found themselves in a short squeeze. They bought back their short positions in a hurry, sending the price up to $2,148 in just 20 minutes at the opening of the Asian market.Gold has set a new all-time high across all currencies.After that, the usual culprits, JP Morgan & Co, went back to work and sold paper-gold to bring the price down to Friday’s closing level on Wall Street. In all chart logic, they should even bring it back to $1,995, the old monthly resistance. What we call a pull-back. This would allow us to check if the old resistance has become “support”, if so, the price should rebound and return to its highs, and test it again.Most of the central banks, except the US Federal Reserve, have been accumulating as much gold as possible since 2009 because they know it will play a role in the future monetary system. To buy gold, central banks sell dollars and US Treasury bills, which were the core of their monetary reserves since oil had to be purchased in this currency. But this is no longer the case, hence the collapse observed in the market value of US Treasury bonds. Especially since the American government is increasing its debt at a historically unprecedented rate, while no one is buying it anymore.Gold has a bright future ahead of it, while fiat currencies, according to The Economist, will simultaneously lose their purchasing power in 2024, as seen on the cover of November 16 illustrating the outlook for 2024:

The next day, Friday, December 1, those who had logically positioned themselves “short” at this resistance level, bought back their positions, causing the price to climb to $2,071, the historic high for gold touched 3 times intraday during the last three years, but which the bullion banks had until then successfully defended. Logically, all speculators loaded into “short” positions at this level before Wall Street closed.In Shanghai, the price of gold is permanently higher than in New York or London. Normally, this premium is around 0.3%, but since July it has been 1.9%. The monthly resistance of gold in Shanghai was therefore broken and Chinese speculators found themselves in a short squeeze. They bought back their short positions in a hurry, sending the price up to $2,148 in just 20 minutes at the opening of the Asian market.Gold has set a new all-time high across all currencies.After that, the usual culprits, JP Morgan & Co, went back to work and sold paper-gold to bring the price down to Friday’s closing level on Wall Street. In all chart logic, they should even bring it back to $1,995, the old monthly resistance. What we call a pull-back. This would allow us to check if the old resistance has become “support”, if so, the price should rebound and return to its highs, and test it again.Most of the central banks, except the US Federal Reserve, have been accumulating as much gold as possible since 2009 because they know it will play a role in the future monetary system. To buy gold, central banks sell dollars and US Treasury bills, which were the core of their monetary reserves since oil had to be purchased in this currency. But this is no longer the case, hence the collapse observed in the market value of US Treasury bonds. Especially since the American government is increasing its debt at a historically unprecedented rate, while no one is buying it anymore.Gold has a bright future ahead of it, while fiat currencies, according to The Economist, will simultaneously lose their purchasing power in 2024, as seen on the cover of November 16 illustrating the outlook for 2024:  It is interesting to observe what happened after the monthly resistance of 2014-2019 was broken. The price of gold rose from $1,354 to $2,072 in 15 months. An identical rise would take gold to $3,170 in January or February 2025: A terrible drop in fiat currency purchasing power.

It is interesting to observe what happened after the monthly resistance of 2014-2019 was broken. The price of gold rose from $1,354 to $2,072 in 15 months. An identical rise would take gold to $3,170 in January or February 2025: A terrible drop in fiat currency purchasing power.  Taking advantage of the runaway gold price, the price of silver broke the oblique resistance, which has blocked the rise since the high point of 2011, at the monthly close:

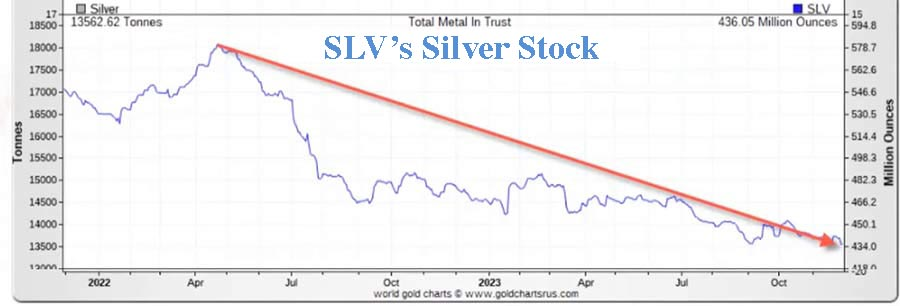

Taking advantage of the runaway gold price, the price of silver broke the oblique resistance, which has blocked the rise since the high point of 2011, at the monthly close:  Note that industrial demand, particularly for photovoltaics, is increasing very sharply in 2023 and that official silver stocks (if they have any physical reality) of the COMEX, LBMA, SLV and Shanghai are declining rapidly. Those in Shanghai are at their lowest since 2016, although stocks have been replenished numerous times this year. China is the world’s third largest producer of silver.

Note that industrial demand, particularly for photovoltaics, is increasing very sharply in 2023 and that official silver stocks (if they have any physical reality) of the COMEX, LBMA, SLV and Shanghai are declining rapidly. Those in Shanghai are at their lowest since 2016, although stocks have been replenished numerous times this year. China is the world’s third largest producer of silver.  These official stocks of iShares Silver Trust (SLV) are mainly used to manipulate silver prices in New York and London.

These official stocks of iShares Silver Trust (SLV) are mainly used to manipulate silver prices in New York and London.  The year 2024 should be extremely satisfying for those who have invested their capital in precious metals to protect themselves from a new banking crisis and currency devaluations.More By This Author:Gold Nears All Time High, Silver Records A Major Breakout

The year 2024 should be extremely satisfying for those who have invested their capital in precious metals to protect themselves from a new banking crisis and currency devaluations.More By This Author:Gold Nears All Time High, Silver Records A Major Breakout

Stalled Real Estate Market: Stone Is No Longer A Safe Haven In The US

Gold Is At Inflection Point, Hard Landing Is Coming

Leave A Comment