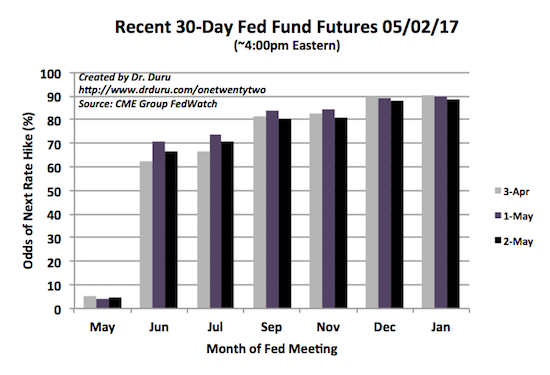

Market expectations for a June rate hike remain as solid as ever. However, expectations for two more rate hikes in 2017 have wavered. A day ahead of the release of the next decision on monetary policy from the U.S. Federal Reserve, Fed Fund futures pricing in two rate hikes by December (assuming 25 basis point hikes) have finally dipped below 50% by the smallest of margins.

Source: CME FedWatch Tool

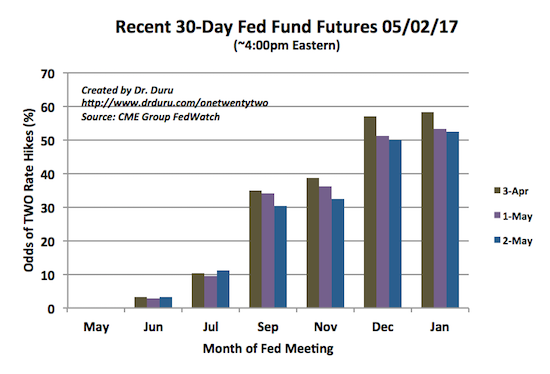

The slow erosion of expectations for two more rate hikes in 2017 extends into January, 2018 where the odds of two rate hikes by then are only 52.3%. The increased uncertainty can be seen in financial stocks where the Financial Select Sector SPDR ETF (XLF) has stalled out over the past month as part of a larger trading range extending back to December, 2016.

Source: FreeStockCharts.com

The U.S. dollar index (DXY0) also reflects the uncertainty in the rate outlook as it teeters on major support at its 200-day moving average (DMA).

Interestingly, in mid-April gold STOPPED benefiting from the increased uncertainty. The SPDR Gold Shares (GLD) now sits at an important juncture as it tests 200DMA support with 50DMA support directly below.

The picture is even worse for silver. For 12 straight trading days, the iShares Silver Trust (SLV) has closed with a daily loss. This losing streak is SLV’s longest ever since its inception in 2006. The next longest losing streak ended at 10 trading days on November 11, 2015 (data from Yahoo Finance). That sell-off was part of a bottoming process that ended with the Fed’s first rate hike the following month.

This losing streak happened to come immediately after I declared silver speculators vindicated for running up futures contracts to maximum bullishness. Silver speculators remain stubbornly bullish as net long contracts just pulled away ever so slightly from the historic high last week. So I am left wondering whether SLV is well overdue for a substantial relief rally.

Leave A Comment