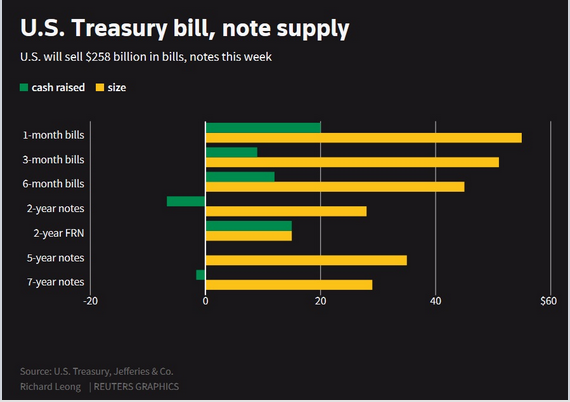

As noted earlier, bonds fell and the dollar rose as Wall Street turned its attention to today’s – and this week’s – record bond supply – which as Goldman explained over the weekend , is just the start as the US set-offs on an “unsustainable” increase in debt, and which this week consists of an unprecedented amount of 4-Week, 3- and 6-Month Bill issuance, as well as 2, 5, 7 and FRN notes to boot.

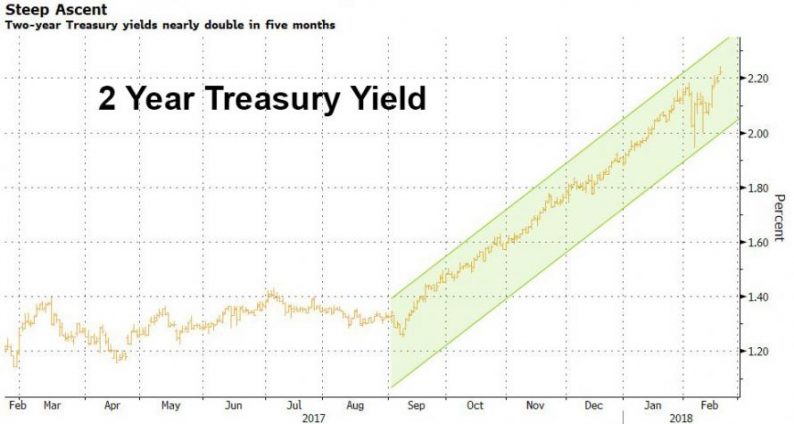

Today’s selloff was driven by 2Y Treasuries which rose as high as 2.2436%, the highest level since just before the Lehman bankruptcy, while the eurodollar curve steepened too. Yields on 10Y bond rose to 2.93% earlier before fading half of the move.

Commenting on the sharp moves in yields, last week Jeff Gundlach noted that “UST 2 yr, 3 yr, 5 yr, 7 yr & now 10 yr yields all rising>200 bp annual rate since 9/7/17. Faster than Fed hiking.”

One-by-one they join in. UST 2 yr, 3 yr, 5 yr, 7 yr & now 10 yr yields all rising >200 bp annual rate since 9/7/17. Faster than Fed hiking.

— Jeffrey Gundlach (@TruthGundlach) February 14, 2018

As explained last night, the Treasury will sell 3-month bills worth $51 billion and 6-month bills for $45 billion, both unprecedented in their size, with a historic total of $179 billion in bills and notes for sale today:

In sum, total issuance this week is expected to hit a record$258 billion.

As Bloomberg observes, the glut in supply follows the passing of a two-year budget deal on Feb. 9 that raises government spending by nearly $300 billion. And, as Goldman and others have warned, investors will now brace themselves for a deluge of issuance over the coming months and years as President Donald Trump’s fiscal stimulus seeks trillions in debt to boost growth; if it fails US deficits are set to soar according to John Davies, a U.S. interest-rate strategist at Standard Chartered Plc.

Leave A Comment