We avoid turning away from it when its message is bearish, as it was in October. Now, entering December the Commitments of Traders show Commercial and Large Spec data are as good as they get. Silver by the way, continues to improve but to nowhere near the degree gold has.

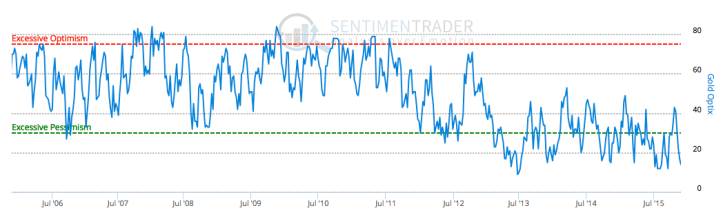

Last weekend in NFTRH, we reviewed Sentimentrader‘s gold Optix (optimism index) and found it to be as over bearish (contrarian bullish) as it has gotten throughout the bear market.

What does it mean? It means gold has been likely to bounce amid more and more people becoming very bearish (hello Fed rate hike just around the bend). I wonder whether the bounce is starting now or will wait until the Fed (likely) hikes the Funds rate.

Either way, gold is in a major bear market and that will not be reversed until the right combination of macro fundamentals and technicals say it is reversed. But the elements for a bounce are in place.

Leave A Comment